Real Estate Regrets: Betinah's Chaotic lesson on Why Mizigos weren't the Best First Choice of Investment.

Feb 3, 2025

It’s not that we shouldn’t invest in Rental Real Estate, especially for many of us lower middle-income individuals who are fully and gainfully employed. It’s just that when our only incomes are our salaries, it makes no investment sense to put all our savings in Rental Mizigos at this time. The "When" question gets lost.

The story of Betinah, a millennial single and fully and gainfully employed person in her early 30s, is a case in point. I got to know Betinah last December through our Masterclass, and we picked up conversations later to talk finance and align her investment objectives after she started following my crusade of doing the right investment at the right time.

Betinah knew I was a little biased towards capital markets, and she wanted us to review her portfolio fully in her individual capacity and determine what she needed to do to ensure she stays on the right track and also pursue some of her most ambitious projects.

Courtesy photo of Betinah’s 3 amazing and well-planned 2 BR Units in Nakwero.

It was during this 10n 1 financial therapy session that she brought up this big construction project she was undertaking in Nakwero, which was her biggest undertaking.

Like many people who start construction at such an early age, the thrill that it’s been moving and she has been making progress over the years is unbeatable. You could see in her eyes that she was proud and that in a few years, she would be owning her own rental units in her name, becoming a landlord, and supplementing her salary.

From an emotional investment perspective, she was fully covered and happy, but she didn’t notice one important point: the numbers were off.

Betinah bought the land in a good and growing area of Nakwero at the end of 2019 for around 40 million Uganda shillings, with all costs included. Over the last five years, with her income, she has continued to deploy almost 25 million Uganda shillings per year into this project. We ran the numbers, consulted with her engineer, and found that as of December, she had officially injected 144 million Uganda shillings without considering incidentals like her monthly LC costs, travels to the site, and all. We totaled and lumped up the cost to 150 million Uganda shillings.

The project was at a good stage with the 150 million Uganda shillings invested over a full period of five-plus years, but I asked Betinah what the alternative would have looked like.

It was important for me to know the cash flow investments she had been making towards this project and track it down. She had been saving around 2 million Uganda shillings per month earmarked for construction.

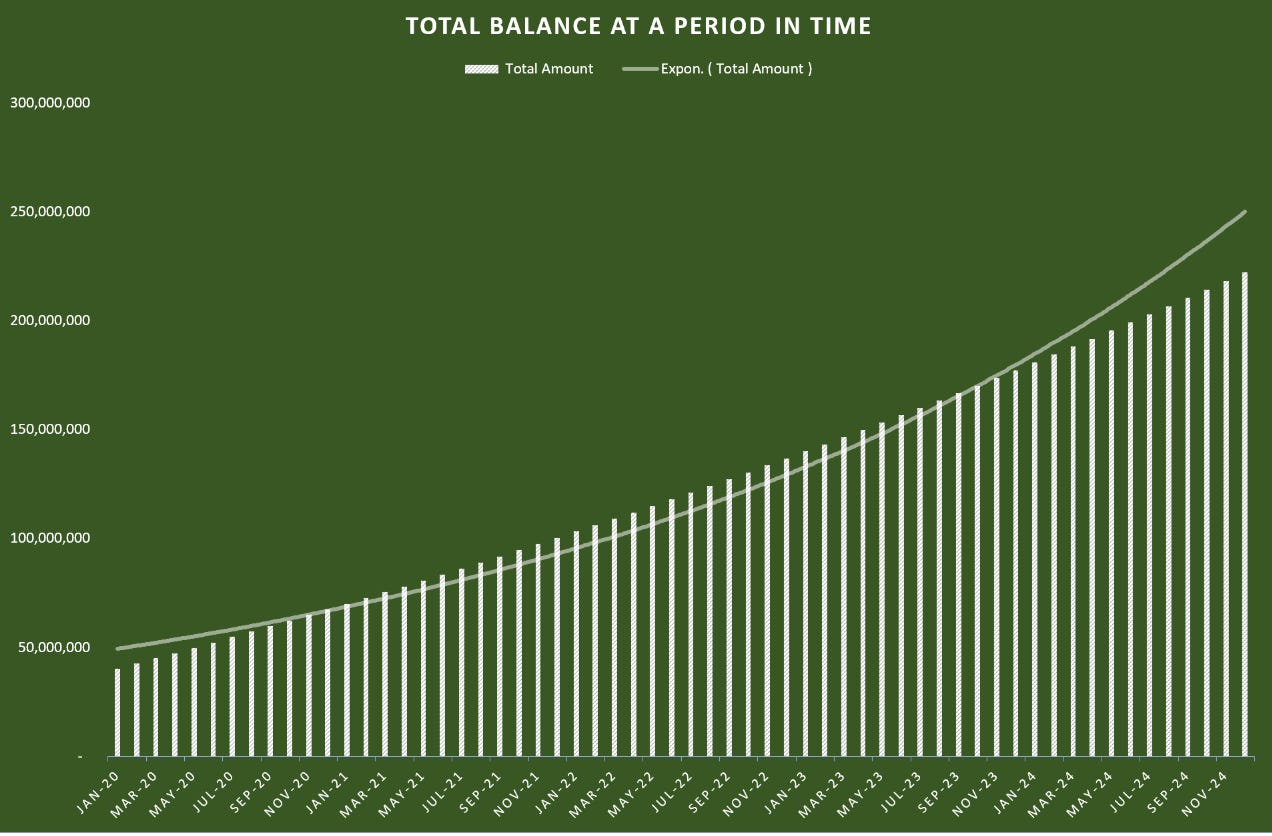

The alternative to this project was, imagine Betinah had put those 40 million Uganda shillings into a Unit Trust and the 2 million Uganda shillings per month as a top-up to a Unit Trust. Between January 2020 and December 2024, Unit Trusts have averaged an interest rate of around 11.5%, but for this conversation, we used a cautious 11%. Had Betinah deployed the money into a Unit Trust, she would have around 220 million Uganda shillings in her total account right now.

The other alternative would have been an investment in treasury bonds. Bonds in the last five years have averaged a net return of 14% after tax. Had Betinah known about bonds in 2019 and invested her 40 million Uganda shillings into a 10-year bond and included and topped up 2 million Uganda shillings per month into accumulating more bonds while reinvesting the coupons, by the end of 2024, she would have a minimum of 246 million Uganda shillings in her total bond portfolio.

To make the comparison fair, at this point, she noticed it wasn’t the right decision to have started her construction, especially at the time she started and funded it with just her salary. So she asked, "What can I do?" Two options were possible: to sell the project as is and move right away into the treasury bond market or to estimate the cost of finishing and finish it up to earn the rentals.

We reached out to a good agent for an estimated cost of what the market can offer right now if she were to sell. After reviewing the land and quality of construction, the price tag was around 170 million Uganda shillings as is. (If you have 170 million Uganda shillings, reach out to me and get yourself this project).

Having invested over 140 million Uganda shillings, her valued property could fetch around 170 million Uganda shillings compared to Unit Trusts of 220 million Uganda shillings or bonds of 245 million Uganda shillings. After looking at all three options, she wished she had done the opposite given her circumstances and invested in a Unit Trust or bonds market.

To get to the final bottom, we requested the estimated number to complete these 3 2 BR units, and we got an estimated future cost of 129 million Uganda shillings required to accomplish this project. I asked Betinah how long she thinks it would take to raise this money so that I can track cash flows, and she said with her improved income, maybe 3-4 years with a dedication of 3.5 million Uganda shillings per month. With 129 million Uganda shillings to go, it was important to ask how much rent such well-built 2-bedroom rentals earn in Nakwero currently. We were told 900,000 Uganda shillings in her location, and in an estimate for the future in three years, maybe 1,20,000 Uganda shillings. So in three years' time, she would start earning around 3.6 million Uganda shillings per month or 36 million Uganda shillings per year, assuming full occupancy and full payments, after sinking in close to 270 million Uganda shillings in the project.

Was it worth it to continue on the journey? Probably not. We came up with a solution: if she could sell right now and get even a minimum of 150 million Uganda shillings and then channel all that into a long-term bond while also contributing her 3 million Uganda shillings per month into a long-term bond, in 10 years she will most likely have a total bond portfolio of close to a billion Uganda shillings. At that point, she might as well withdraw 600 million Uganda shillings and buy any rentals of her choice, and her bond portfolio will continue to grow, giving her close to 10 million Uganda shillings per month.

The point wasn’t to stop her from investing in rentals and being a landlady; the point was to plan better, delay that a little, and first grow her money to the levels that matter. Then she can buy whatever apartments she wants.

Are you like Betinah?

Such a great read.

Alex, i personally do not agree with the Idea of Selling the project. Since she already has invested money, time, resources and emotions into the project. I advise let her retain the ownership of the land and project. It can wait and be completed later, even with all the money invested. Let her save money for as long as she wants and once she hits her financial targets, she can come back to the project later, and wiser. When complete, two sources of income. Unit Trusts and the Rentals will be hers to enjoy.