“It’s a long read, take time to read to the end”

I woke up to a screaming article in the Daily Monitor from an interview with Livingstone Mukasa, titled “Without Shs 100 million, avoid Bonds.” For a moment, I thought maybe the writer and the interviewee (who are well known to me) missed the point, but reading the whole interview made me realize that this is the view being pushed, and it is extremely wrong and alarming.

The point to avoid get-rich-quick schemes and instead aim for steady income sources

Investing in any type of product, whether it is equity stock markets, businesses, or real estate, is a long-term game that requires patience and building capital. The same applies to investing in Treasury bonds and unit trusts (a pathway to investing in bonds). None of these legitimate products are get-rich-quick schemes, and if anyone promises you this, they are deliberately misleading you. This forms the basis of the misleading article that suggests you need serious money to invest in bonds for you to see tangible and quick results.

For far too long I have said, Investing in Treasury bonds, will require time, patience to grow your wealth and incomes and for Ugandan context, at 16%, this is something Treasury bonds are beating many other ventures including Real Estate

The Power of Compounding while Investing in Treasury Bonds and Unit Trusts

In finance, we talk about compounding as the 8th wonder of the world, and Treasury bonds and unit trusts are some of the best ways to invest and allow yourself to compound.

What the writer and the interviewee miss is that in trying to explain why those with more money get more money when they invest in Treasury bonds, they missed the point that in Treasury bonds and unit trusts, it’s all about the power of a percentage that allows you to compound.

The person who has Shs 100 million will get 15-16%, the person with Shs 10 million will get 15-16%, and the person with Shs 1 million will get 15-16%. From an absolute number, the person with more money will get more profits, but that doesn’t mean you with less money will get any less profit. You are getting the same percentage and have the chance to level the ground and get the same profits for the amount you have invested. So, it’s not about who has more money to get more money.

The question becomes, what is the alternative for you to invest in with your Shs 1 million right now in Kampala? What is the alternative for you to invest in with your Shs 5 million that can guarantee you a profit of 10% or more that would outcompete the Treasury bonds at a mass scale? I’m waiting for Answers for this.

Then Why Treasury Bonds and Unit Trusts? Because they are for all, Poor or rich, small or large sums

At one point, you must start somewhere. Let’s talk about my brother, whom I am encouraging every single month to continually put Shs 100,000 in a Treasury bond. He is 27 years old, and we have worked out the numbers.

All he needs to do is put and continue on the journey of Shs 100,000 in a Treasury bond and buy a 20-year bond. By the time they matures, he will be 47-48 years old. If he consistently puts in Shs 100,000-150,000, he will be getting 15%, just like me, who is putting in Shs 1 million.

So, do not listen to someone who says those who have more money are the ones who benefit from bonds. With the little you have, it compounds, we are all getting an average return of 15% and our money is compounding and growing, and the earlier you start the better.

So, how can someone like my brother take advantage of Treasury bonds and Unit trusts? I’m going to do a simulation with the assumption that the average interest rate he will get is 12%. If he dedicatedly puts Shs 100,000 in a 20-year Treasury bond every single month, by the time he is 45 years old, he will have close to Shs 100 million.

What if you have 500,000 Shs per month and dedicatively put it down for 15 years, by the time its 2039 and you are 45, you will have a portfolio of over 250 million and earning over 3 million per month. Now why would you wait to have 100 million to start? No start now.

That is the power of compounding. He needs to start now; he doesn’t need to wait until he has Shs 100 million. He doesn’t need to put that money in a savings account to earn 2-3%. No, he has to invest right now and few things right now are out competing and outperforming Treasury bonds and the Unit trusts.

My brother is not alone; many people are like him. I have a client I talked to two weeks ago, an amazing lady referred to me by a good friend. She had Shs 500,000 in her savings account and said she could only manage Shs 100,000 every single month. I told her it’s okay; buy your bonds. By the time you are 60, you will have Shs 300 million to retire with while earning over 3 million plus per month.

If you do not start now, you will retire with almost nothing. That is the power of compounding. The 15% you are getting will help you grow. It doesn’t matter whether you are starting with Shs 1 million or Shs 2 million; the most important thing is to start. The earlier you start, the better.

If you are like my brother who can only afford Shs 100,000, that’s your earning capacity right now. I implore you to start investing, whether in unit trusts or Treasury bonds. Start now. If you are 23, the better. You still have 40 years to compound your money. By the time you are 50, you will have hundreds of millions from just a Shs 100,000 commitment now.

You do not need to wait until you are 40 or 50 to have more. Start with the little you have and take advantage of compounding your investments, allowing your money to grow.

You might be reading this article and be one of the many people in Kampala who are just starting. You have just graduated, and your salary is still Shs 600,000 to Shs 1 million. All you can afford to save and invest is Shs 200,000. Do not despair. Buy that Treasury bond every single month. Do not buy short-term Treasury bonds; buy long-term Treasury bonds.

With your UGX 200,000 per month, at 23 years, in 15 years from now when you are 38 years, you will have over 100 million and growing, from just putting aside 200k per month. Thats the power of compounding.

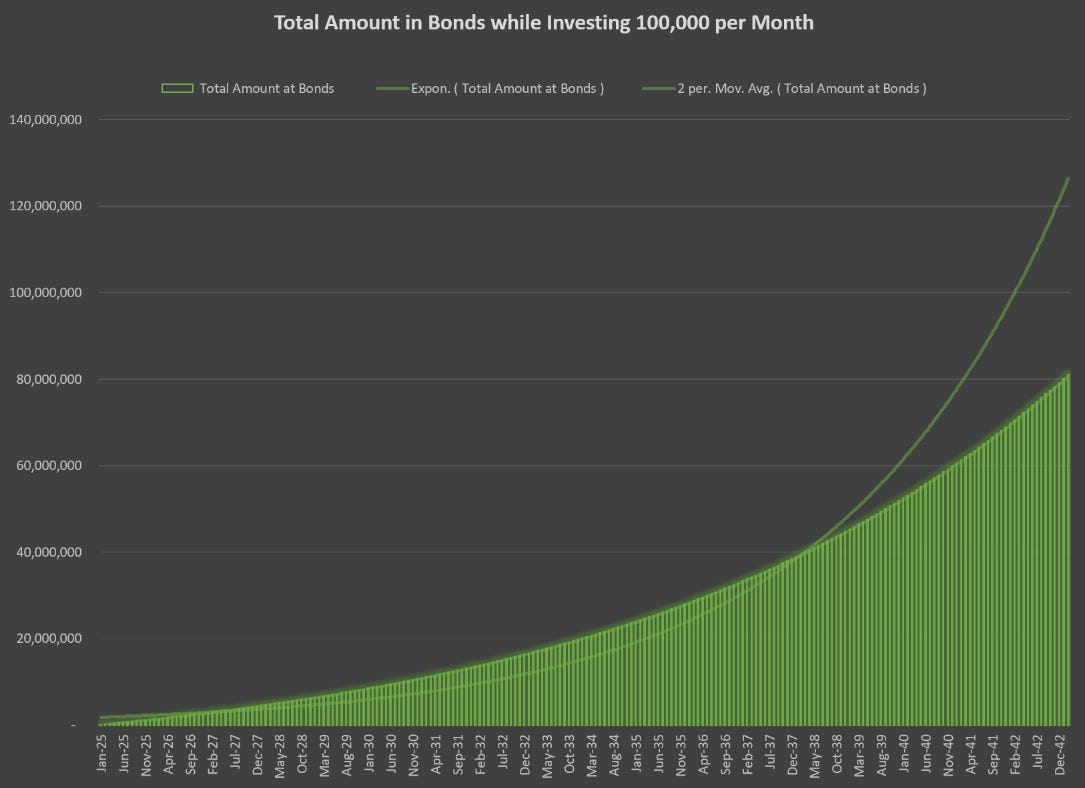

At worst, put that money in a unit trust every single month or every single day you have money. Your money will grow. As you can see in the graph, if he follows this plan, with just Shs 100,000 per month and buys a bond that guarantees him a 13% interest per month, in 20 years, he will have over Shs 100 million. He will be 40-plus years old.

He doesn’t need to wait until he is 40 to start. He can start now and allow his money to compound to a level where he will be earning almost Shs 1 million per month in just interest income, yet he has only been investing Shs 100,000. So, it’s not true that you need Shs 100 million to invest in Treasury bonds. The minimum you need is Shs 100,000.

Of course, those with more money will make more money; that’s how capitalism works. But with your Shs 2 million every single month, for 20 years, you will be on your way to having a billion in Investments while making over 10 million per month.

Patience, patience.

What else can you do? Many of us will be fully and gainfully employed. We are not going to be creators of the most amazing companies, but we can be amazing investors if we follow the rule of playing the long-term game.

Then there is a second category of people, those of us who are 40-45 years old, married, and as a family, we can maybe afford a Shs 5,000,000 investment per month. I implore you not to listen to the message that you need more money to start. With your Shs 5,000,000, you can invest in Treasury bonds. If you do it at 35, you still have 20-25 years to go before you retire. That Investment for your family would grow to over 3 billion in a 15-20 year period, with just a dedicated 5 million from you and family, Why then should you first get 100 million to invest?

You still have 20 years to go before your earning capacity starts to reduce. What do you do with your Shs 5,000,000? You can buy a bond every single month or every single time you have that money. With the power of compounding, someone who invests Shs 5,000,000 every single month, by the time they are 60, will have almost Shs 3 billion in their total capacity.

But even if you dedicate every single time as a family to put Shs 500,000 in a Treasury bond, allow that money to grow and compound, then by the time you are 50, in 20 years, you will be earning Shs 4-5 million per month as a family. Do you need Shs 100 million to start? No, you can start with the little you have. Yes, those with more money will make more money, but we are demonstrating that with your Shs 500,000, you will make more money.

The writer talks about real estate being the most common investment in Uganda.

Of course, it is the most common; it’s what our fathers and forefathers did, and it has made enormous amounts of money. We are not saying we should abandon real estate, but we cannot keep quiet about the obvious situation where it is pricing out people. We cannot keep quiet anymore.

If you are earning Shs 500,000 or Shs 1 million, it will take you almost five years to save to buy a plot of land, and it will take you almost 10 years to construct a decent house. What do you do in that period? Do not keep that money in a bank account.

Do not borrow expensively to put a roof over your head. Invest. This is why these products have come in to promote the capital markets. I wish I could promote cryptocurrencies and stock markets, but there is a product that is easier to understand.

Put your money in a unit trust for those five to ten years. You will have more money to buy your own property. At the end of the day, we are not going to sleep in trees. Real estate is the past, present, and future, but not for all of us right now. We are trying to maximize our earning capacity. We are trying to ensure our earnings grow. Do not buy a plot of land deep in the village where it won’t double your money. Instead, invest that money in a Treasury bond. In five years, your money will have doubled. In ten years, you will have Shs 200 million. At that point, you can do much more.

It’s not about competing; it’s about giving people alternatives to investing in products that matter and make money.

The writer and the interviewee talk about real estate, forgetting that it is one of the most capital-intensive assets you can invest in. To construct good apartments or rentals that make money, you need a minimum of Shs 200 million. You can contribute it over time, but it will only give you Shs 2 million per month, sometimes even less. That is a return of 6-7%.

These units costs over 200 million and you earn just 1.5 million per month before any expenses. Same amount in a bond earns 3 million per month

In what world is this acceptable? With the same Shs 200 million, you can make over Shs 30 million a year at a 14% return without struggling or chasing anyone. This is about numbers.

We looked at the idea last week that the net present value of Shs 200 million in real estate is less than the net present value of a Treasury bond over ten years. It has nothing to do with not trying to give you alternatives. We are just saying real estate is pricing out so many people, and we want that to be controlled.

To understand what it means to invest, especially for Ugandans, we must have the psychology of money and earnings from a Ugandan perspective, not from the UK or the US. The majority of people in Uganda are still in the category of the poor and lower-middle-income, saving just Shs 300,000 a month or less than Shs 1 million a month. What better way for them to build patient capital and wealth over time than Treasury bonds, which currently offer 17% plus returns? Of course, there will be outliers who start a business and succeed, but we always emphasize starting a business, knowing that 95% of businesses fail in Uganda.

How do you know that statistic and still want everyone to start a business?

At least with Treasury bonds, you are assured of over a 13% return every year, no matter how much you invest.

Those who invest in unit trusts and money market funds are assured of over a 11% return, and it has been consistent for the past ten years. Hopefully, it will continue for the next ten years. How do we build patient capital and wealth? Investments in Treasury bonds are long-term. We need to encourage people to start when they are 18 if they have some earnings, or at 20 when they start making Shs 50,000. Put it in a unit trust to allow that money to grow. Start at 25, and you have a higher chance to make more money.

The writer talks about the risks of investing in Treasury bonds. What risks are we talking about? Treasury bonds are considered the safest, lowest-risk investment globally, even in Uganda. For over 50 years of issuing Treasury bonds in Uganda, the Government has never defaulted, not even once. So what risk are we talking about that is higher than other investments?

Even with political risks, the extremes are a coup or military dictatorship. Why do you think your business will survive under a military dictatorship? We have seen in Uganda and other countries that even under military dictatorship, business people have fled. At least with Treasury bonds, in countries like Niger, when a military dictatorship came, they postponed payments for six months and then resumed.

You cannot compare risks and say bonds are riskier. Bonds are the lowest-risk investment you can have. Yes, they crowd out private capital, but that is a macro-level issue. As an investor, you have one thing to worry about: where to make money and how to make money. If you are making money from unit trusts, invest in them. If you are making money from Treasury bonds, invest in them. Your money will grow.

Businesses fail 95% of the time, but everyone investing in Treasury bonds and unit trusts is making money. What risk are we talking about? Spread the risk? What risk are they spreading? Globally, everyone will tell you that Treasury bonds are the safest investment. In Kampala, the majority of people who have tried businesses have failed. We almost know everyone who has tried a business and failed. But we also know many who have succeeded. I can tell you about 100 people who have started with Treasury bonds and succeeded. Where do you want people to go? I want people to invest in Treasury bonds and unit trusts. They are easy, simple, and you can invest as little as you can and have a chance to succeed. This success is not short-term; it is long-term. It is not a get-rich-quick scheme. It is patient. You don’t need to be 40 to start. You need to have something little to start.

While I do not disagree with what you say, I would like to make a clarification. Treasury bonds do not compound and accumulate your money to pay it back at the end of term, say 20 years, with original investment plus compound interest earned over those 20 years. Instead, you are paid the interest accumulated I.e coupon payment every end of quarter. There’s currently no mechanism I know of that allows to leave it in the treasury. At the end of the term of the loan, you only earn the original investment whichever way calculated.

I think this clarification helps to bring clarity to those wishing to invest in this product to earn the huge lump sums you mention in your article at the end of term. And it probably is the real reason why some investors think it makes more tangible sense when the amount invested is substantial, as the quarterly coupon payment can then be used to solve cash flow issues or be invested elsewhere. When it’s say 15% of shs.100,000- posted to your account, it’s hard to figure out what next. Thanks

Nice.

Thank you for this