Investment decisions are crucial for financial growth, and Unit Trusts right now in Uganda are a central part of the Capital Markets Investments.

In this comprehensive review, we analyze the performances of five selected Unit Trust Managers in Uganda: UAP Old Mutual, ICEA Asset Managers, BRITAM Asset Managers, Sanlam Managers, and XENO Uganda. These are evaluated across different fund categories: Money Market Fund, Umbrella Fund, and Balanced Fund and their performance in the last one year as per the shared Fund Fact sheets.

As of September 2023, CMA quarterly Report, the total Unit Trust market is now around UGX 2.2 trillion with over 70,000 Account holders. I personally believe this is still small compared to the potential and opportunities the Unit Trust model pose.

In the same report, UAP Old Mutual holds the largest share of the unit trust market in Uganda, with an AUM of over 1.4 trillion Ugandan Shillings as of September 2023 (Per December 2023 Fund Fact sheet, they are almost UGX 1.7 trillion strong). This figure indicates a positive confidence level among investors for UAP Old Mutual’s return on Investment, brand and being one of the oldest Unit Trust Managers. This is then followed by ICEA with an admirable AUM of UGX 302 billion.

So, if you want to make an investment decision based on where the majority of investors might be, the table below might be a guiding principle.

Then how did each Unit Trust Manager perform in the last 1 year? (All information is based on the published fund Fact Sheet)

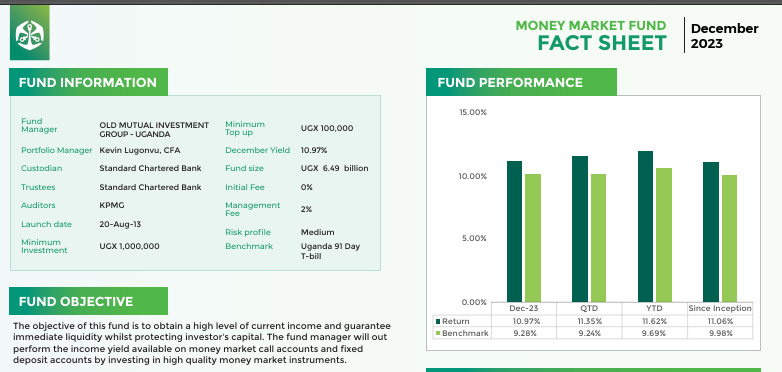

Money Market Fund. (For those with conservative risk and want to invest for a period of 12 Months of below)

Sanlam Managers outperform competitors in the Money Market Fund (even when compared with Umbrella Category only outsmarted by Xeno & ICEA in that category). They boast the highest rate of return at 12.31%. Per Sanlam Communication, “the 12.31% Yield is net off of fees and any applicable tax” which makes this a truly resounding performance by the fund in the last 1 year.

XENO Uganda follows closely with a return rate of 12.03%. UAP Old Mutual and ICEA Asset Managers offer competitive rates of 11.62% and 11.60% respectively. However, BRITAM Asset Managers provide the lowest return rate in this category, at 9.00%, which is significantly less attractive compared to its rivals.

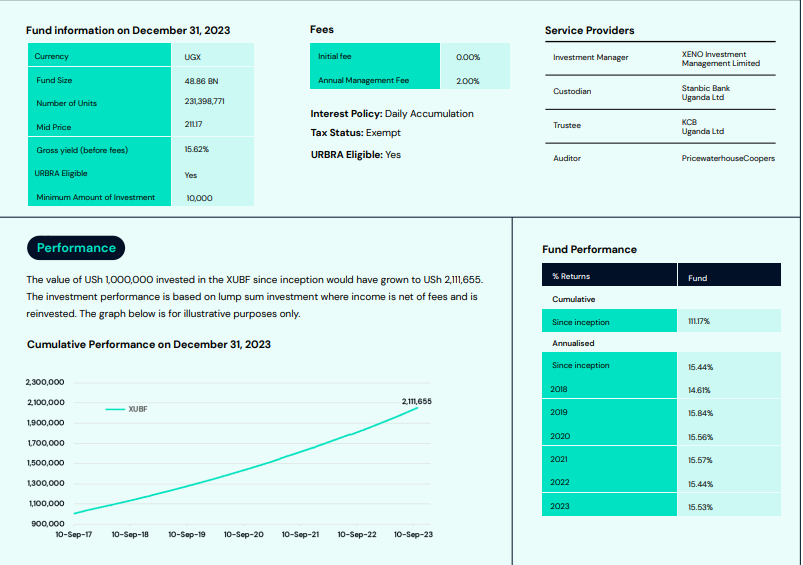

In the Umbrella Fund category, which carries a medium level of risk (For which the Benchmark of Investment here are Treasury bonds), XENO Uganda delivers an impressive return rate of 15.53% followed by ICEA Asset Managers at 12.70%, and UAP Old Mutual at 11.76%. Unfortunately, BRITAM Asset Managers lag behind their counterparts, offering a return rate of merely 10.09%.

It’s important to note that XENO Uganda is a goals-based platform, where currently you can’t just choose and invest in the Bond Fund alone, you would have to answer some questions that assess your goal and risk and then allocate your funds correctly among their four Unit trusts.

Lastly, while the Balanced Fund strategy also carries a medium level of risk and with exposure to Mark to Market risks, the return rates significantly vary among managers. UAP Old Mutual shines with an 11.03% return rate, a stark contrast to ICEA Asset Managers' and BRITAM Asset Managers' mediocre rates of 3.80% and 1.34% respectively. For XENO Uganda’s Mark to Market Equity Based funds, the Local Domestic Equity Fund registered an impressive 17.4% annualized performance only for the Regional one to come out with a -37% return for the year.

It's worth noting that the majority of these funds’ Assets, approximately 70%, are invested in government treasury bonds. These are generally considered a safer Investment and they illustrate the fund managers' risk management strategies to protect their investors' Assets.

Happy Friday.

Alex Kakande

Thanks a lot Alex. I'm wondering what has less risks ou better said under what conditions does one utilise a money market fund or a unit trust. They seem to only minimally differentiate themselves from one another

thanks for this surgical analysis