Understanding Loan Repayment Schedules.

Take Control of Your Loans Using Early Repayment Strategy

Long Worthy read

When entering into a loan agreement with a financial institution, it's crucial to understand some key attributes to not just effectively manage your repayments, but also potentially reduce the overall cost of the loan. Doing so can completely change the way you perceive and handle your financial obligations, and it starts with scrutinizing three important components of your loan agreement.

The first is the loan repayment schedule. Every lender will provide a detailed document outlining exactly when payments are due, usually on a monthly basis. In the document, three components will dictate your loan management strategy which are very important to understand: the principal loan amount outstanding at any point in time, the interest charged at each interval, and whether these interest charges are determined by a reducing balance method or a fixed rate.

The principal outstanding refers to the amount of money you owe, which will be at its highest on day one of your loan. This is what you must focus on reducing as quickly as possible. The interest expense tied to this principal is either computed on a reducing balance - meaning it will decrease as your outstanding principal decreases - or at a fixed rate, where the rate stays the same regardless.

It is advised to negotiate for an interest calculation on a reducing balance. This way, every time you repay more than the minimum required amount, the extra is applied to reducing the principal amount. This, in turn, reduces your future interest payments and lowers your running costs. To ensure this happens, it's important to notify your bank in advance when planning to make any additional repayments so that a new, tailored repayment schedule can be generated.

During each repayment period, the total amount due will be a combination of the principal plus interest. The interest component can be controlled by allocating any extra payments towards reducing the principal. This results in an automatic reduction of future interest costs and can mean needing less cash available for each payment going forward.

Since last year, early repayment of your loan generally won't attract any penalties, which is particularly helpful for those with more expensive loans. Utilizing any financial windfalls to pay against the principal will reduce the burden of interest and improve future cash flow positions. Again, it's imperative to inform the bank that any overpayments should be applied against the principal to take full advantage of this.

However, this benefit of reducing balances is not available with fixed-rate borrowings, which can be tricky and often cost more overall.

The second attribute of your loan agreement to pay attention to is the obligatory fees, which will need to be paid from the outset. These typically include insurance premiums, loan processing fees, and CRB fees.

Example.

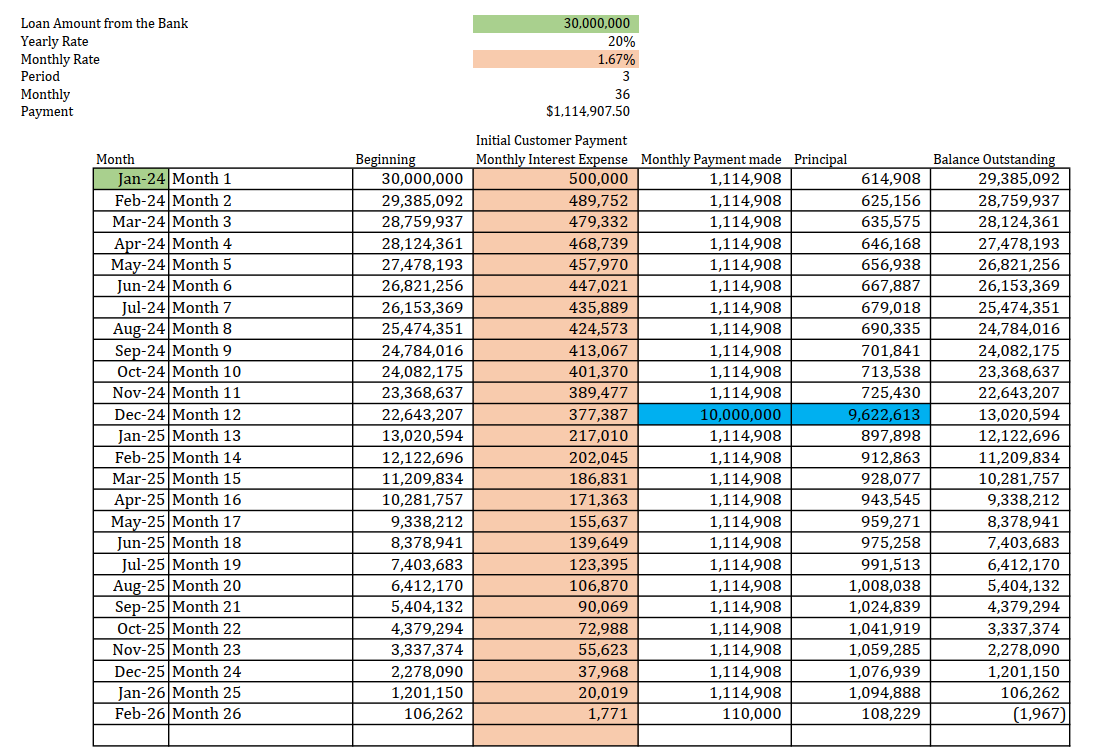

The Example above gives a clear example of how a reducing balance loan works. In this case, the loan amount is UGX 30,000,000 with a yearly interest rate of 20%, which translates to a monthly rate of 1.67%. The loan term is 3 years, or 36 months, and the monthly payment is UGX 1,114,907.

Let's break down the first few months to illustrate how the principal and interest are calculated:

In the first month (January), the beginning balance is the full loan amount of UGX 30,000,000. The monthly interest expense is calculated as 1.67% of this amount, which comes to UGX 500,000. The monthly payment made is UGX 1,114,907. After subtracting the interest expense from the payment, the remaining UGX 614,908 goes towards reducing the principal. This leaves an outstanding balance of UGX 29,385,092.

In the second month (February), the beginning balance is the outstanding amount from the previous month, 29,385,092. The interest expense for this month is 1.67% of this amount, which comes to 489,752. After making the monthly payment of 1,114,907, the remaining 625,156 (after subtracting the interest expense) goes towards reducing the principal, leaving an outstanding balance of 28,759,937.

This process continues for each subsequent month. As the outstanding principal decreases, the interest expense also decreases, meaning a larger portion of the monthly payment goes towards reducing the principal. For example, by the third month (March), the interest expense has reduced to 479,332, and the amount going towards the principal has increased to 635,575.

This example clearly demonstrates how a reducing balance loan works. The interest expense decreases over time as the outstanding balance reduces, which in turn allows more of the monthly payment to be applied to the principal. This is why it's beneficial to choose a loan with a reducing balance interest calculation, as it can result in lower overall costs compared to a fixed rate loan.

Early repayment of some of the Loan in December 2024.

In the given example, a significant change occurs in December 2024 when a large payment of UGX 10 million is made. This substantial payment drastically reduces the outstanding principal balance from 23,368,637 to 13,020,594. This action has a profound impact on the dynamics of the loan repayment. Starting from 2025, the interest payments drop significantly due to the reduced principal balance. This not only decreases the overall cost of the loan but also shortens the loan period, allowing the loan to be paid off a year earlier than initially planned.

By making a substantial payment of 10 million in December 2024, you can completely change the dynamics of your loan. This payment, of which UGX 9.6 million is applied to the principal, reduces the outstanding balance from what would have been approximately 22 million to around 13 million. This single payment significantly minimizes the interest expenses starting in 2025 and also saves a considerable amount of money that you would have otherwise paid to the Bank in interest.

When comparing the numbers, the impact of this significant payment is clearly shown. Using the original payment term, the monthly interest expenses would have been averaging around 320K in 2025. However, with the payment of UGX 10 million in December 2024, the interest expense drops to around 200K at the beginning of the year and continues to decrease to 180K by the end of the year. This dramatic reduction in interest is due to the significant reduction in the principal amount as a result of the early lump-sum payment made.

Furthermore, this approach allows an individual to end their loan agreement earlier than initially planned. If they maintain the same monthly payment of UGX 1.1 million, the loan, which was originally supposed to end in 2026, would be finished off 12 months earlier, by the end of 2025. This not only saves on interest costs but also frees up future finances sooner.

This scenario illustrates the power of making larger payments towards the principal when possible. By doing so, more of the monthly payment goes towards reducing the principal, which in turn decreases the interest expense on the loan. This strategy accelerates the repayment process, leading to a quicker reduction in the outstanding loan balance. It's a practical demonstration of the benefits of a reducing balance loan, where the interest is calculated on the outstanding balance, which decreases with each payment.

However, it's important to note that this strategy requires careful planning. Before making a large payment, it's crucial to inform the bank so that a new repayment schedule can be generated. This ensures that the extra payment is applied correctly to reduce the principal and not just the interest.

Happy Sunday Everyone.

Thank you Alex for continuously bringing us these invaluable insights into Financial Literacy.

This is knowledge we've long needed but not had access to within our Ugandan setting / context.

You're definitely going to help our people evolve at a previously unprecedented rate 🤝🏾🥂

This is superb. You’ve simplified it in such a way that anyone who will read this article will understand it.