Uganda's Treasury Bond Switch on October 18, 2023: What You Need to Know

Investing in Treasury Bonds. October 17, 2023.

Dear Friends,

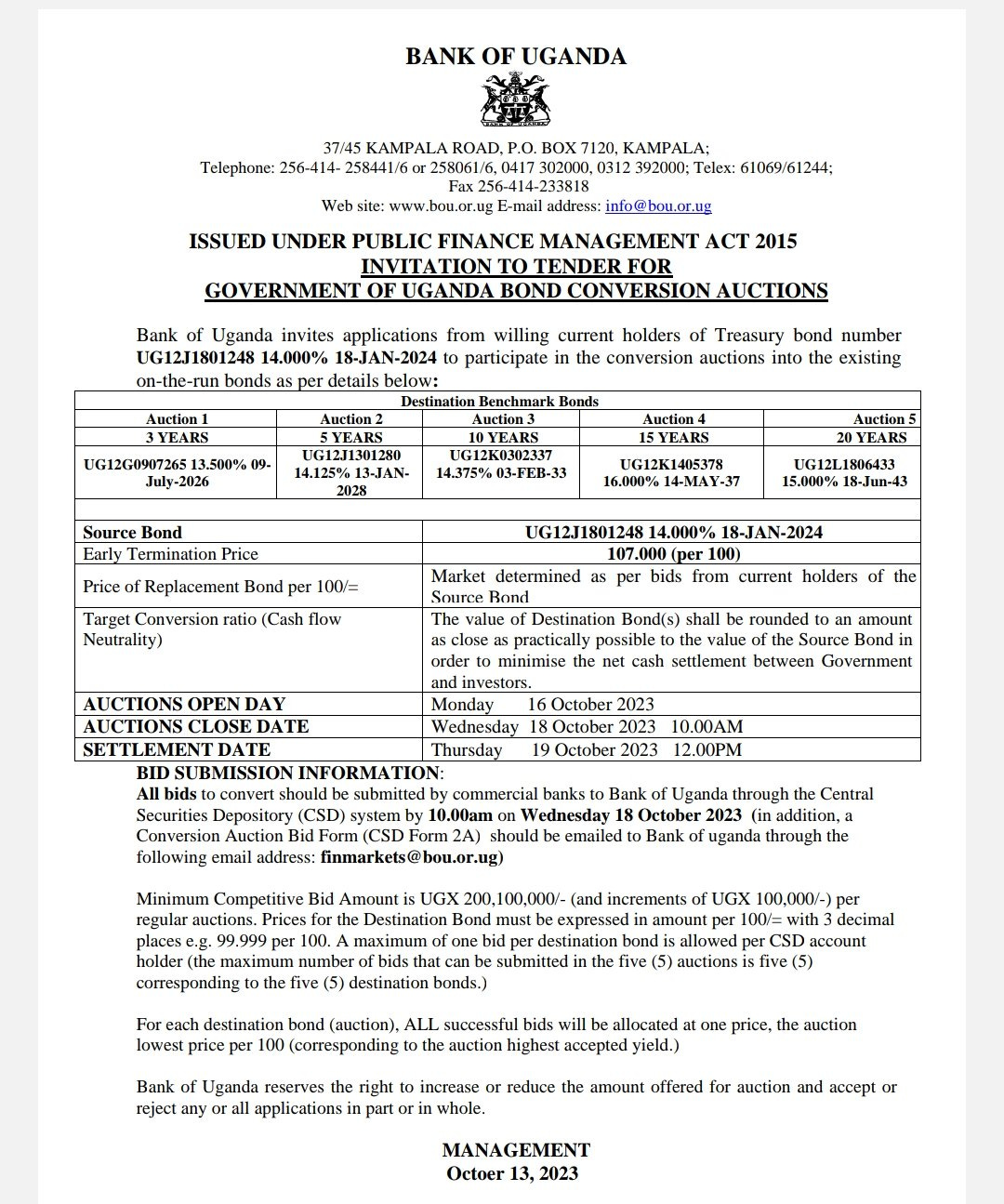

On October 16, 2023, the Bank of Uganda (BoU) issued a Call for Treasury Bond Switch scheduled for October 18, 2023. The affected Treasury bond is maturing in January 2024 and has a value of around UGX 1.2 trillion outstanding.

Image below shows the Bank of Uganda communications on Bond Switch.

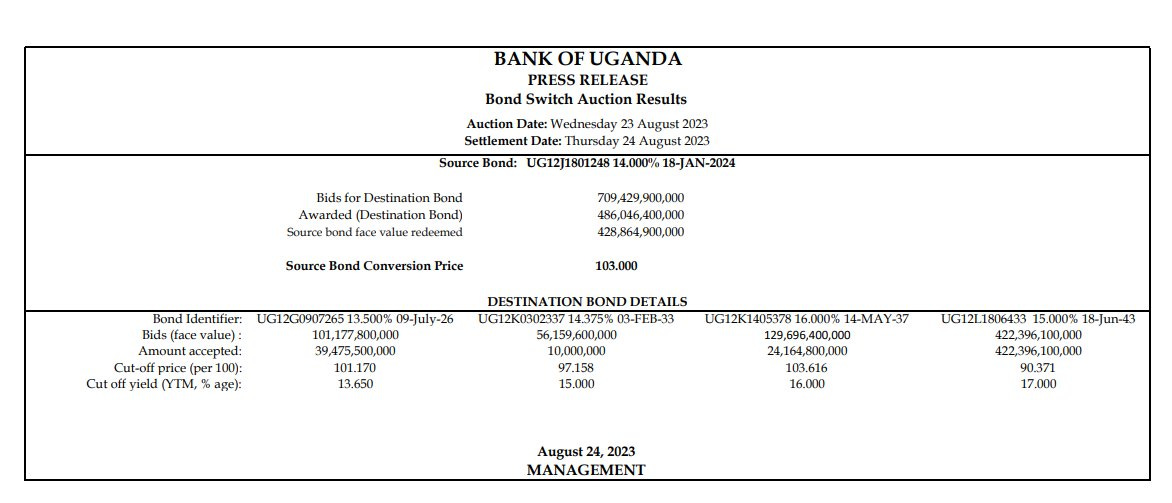

It was worth around UGX 1.6 trillion in August, but this is the second bond switch for this particular type of bond. In August, the BoU realized a total of UGX 480 billion in that switch. So they are bringing this to the market.

See below.

Image below shows the total results of the Bond Switch on August 23, 2023 where majority of bond holders switched to a 20 Year Bond on Market.

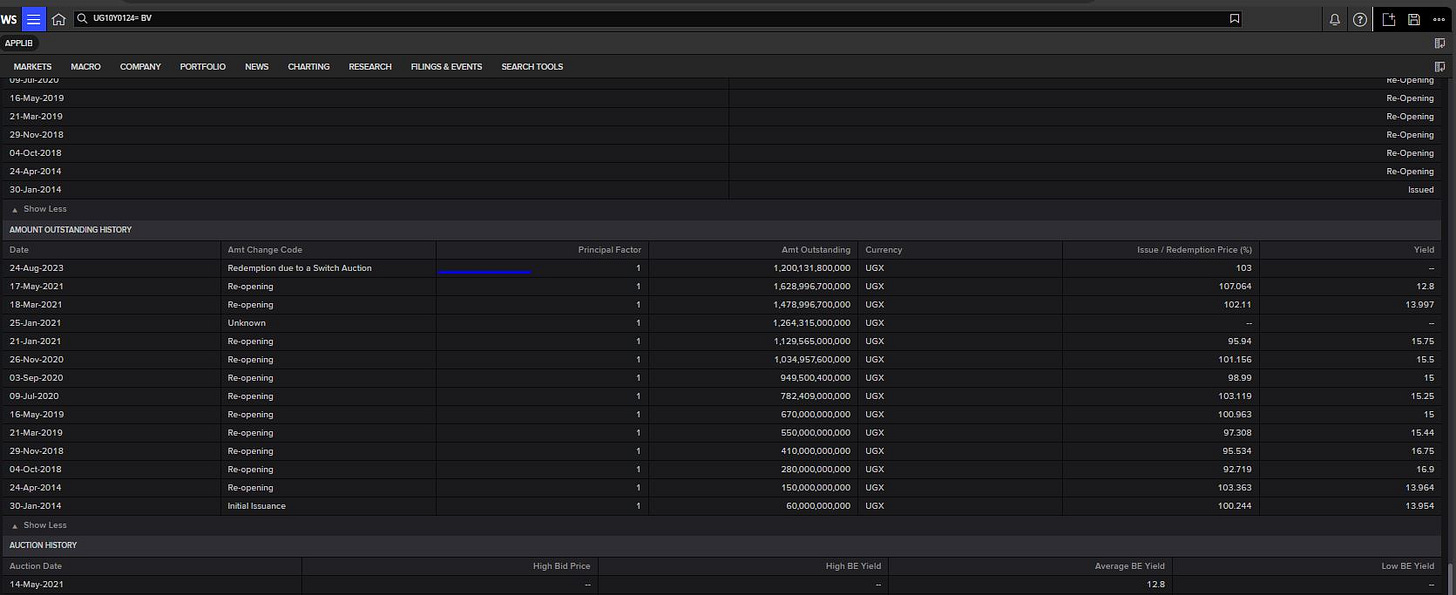

Graph showing the Impacted Bond, showing the outstanding value before the Bond Switch in August 2023 and After the Bond Switch.

What is a Treasury Bond Switch?

A Treasury bond switch is a strategy that involves selling one Treasury bond and buying another Treasury bond with different characteristics without exchanging cash. It is not a new concept, and central banks around the world use this type of strategy to ensure market objectives. It is voluntary.

In Uganda's case, this bond switch was pre-planned by the team at the Ministry of Finance and the BoU and scheduled into the calendar for FY23/24.

Only those who hold the bond UG12J1801248 are eligible to switch their position to any other type of bond available on the market.

Below is the current yield of the Impacted Treasury Bond which is lower than the current Treasury bonds on the market.

Why does the BoU use the bond switch methodology?

One of the most common reasons to switch Treasury bonds is to adjust the duration of a bond portfolio in the market. The bond being impacted had close to UGX 1.6 trillion due for payment in January 2024. By adopting a bond switch, the BoU allows holders to invest in other bonds on more favorable terms without necessarily paying out cash at maturity.

This is noticeable as Bond holders investing in 20-year Treasury bond had a cut off price of 90 Shillings verses to Bond buyers on October 4, 2023, who had a cut off price of 100 Shillings for the same 20-year-old bond.

How does a bond switch work?

When a bond comes closer to maturity, the BoU would ideally get money from the government and pay back the bond holders or issue other bonds to pay off the current expiring bond. However, what most central banks globally are doing now is switching the bonds from the upcoming maturing period to longer dated tenor bonds.

For those holding the bond in effect, they will then be allowed to switch their position to bonds which mature at later dates, say 2 years, 5 years, 10 or 20 years. Effectively, the government buys back the maturing bonds and issues more longer-term bonds to the bond holders, but without necessarily exchanging money.

It is an effective liquidity tool used in financial markets. Bond switching replaces the maturing debt with more debt just at a later maturity. This reduces near-term liquidity issues for the government, but it is also an effective monetary tool.

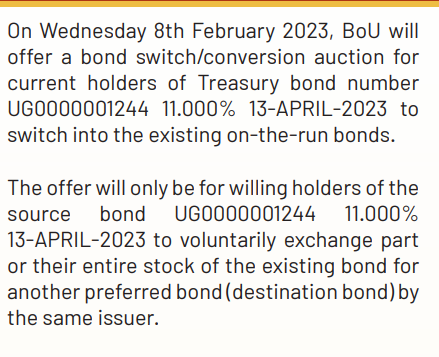

Bond switches are not new; we had one in February 2023 in Uganda. The bond holders switched from a 11% bond to more high coupon bonds in February, which meant that the investor who accepted the switch got a better bond with a higher coupon rate.

In simple terms, instead of the government having to pay the bond holders on January 18, 2024, and then issue another bond, it just goes into an arrangement to give them another bond expiring at a later date.

If you enjoyed this letter, please consider sharing it with your friends and families,

I hope you have a great week and potentially invest in Uganda’s Capital Markets.