Uganda's Debt Surpasses Ugx 110 Trillion and Interest Payments are 30% of URA Revenue.

Challenges and Projections for the Upcoming Budget

Friends,

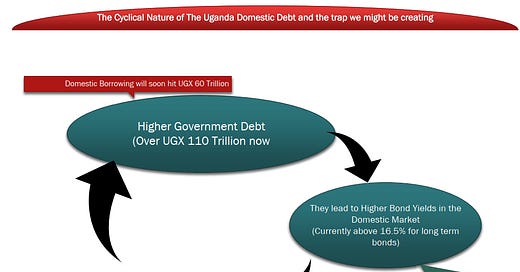

By Friday this week, the total government debt is projected to surpass 110 trillion Ugandan shillings, comprising nearly 55 trillion in external debt and over 58 trillion in domestic debt through treasury bonds and treasury bills.

The situation becomes particularly intriguing when considering the upcoming budget that is set to be presented to the Parliament of Uganda for approval, especially in comparison to the previous 2024-2025 budget that was approved last year.

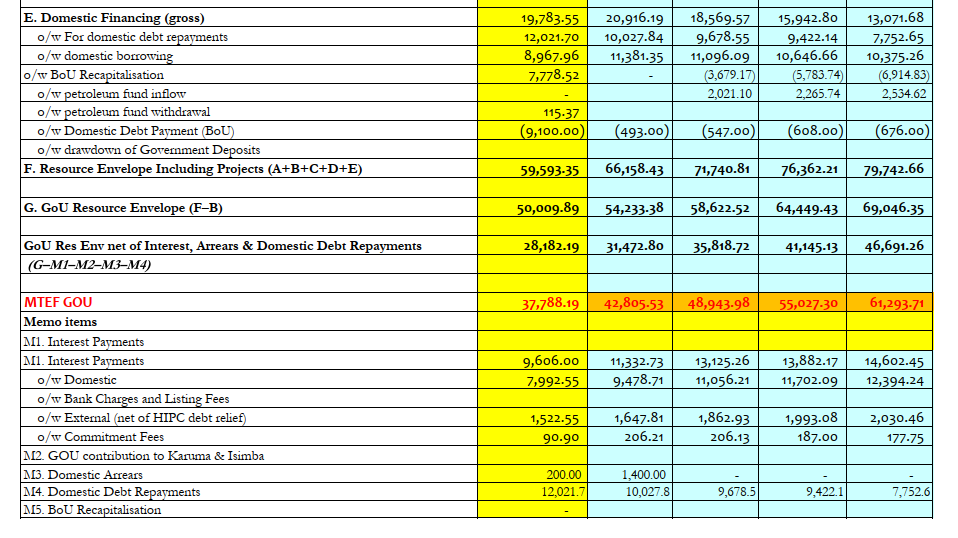

This narrative takes a compelling turn when we examine the approved budget from the prior financial year, which allocated a total of 19 trillion for domestic financing through treasury bonds and treasury bills. Notably, there was a specific line item that required 7.8 trillion for the Bank of Uganda's recapitalization payment, which is absent this year.

As of May 27, 2025, the government has borrowed over 21 trillion from the public. This week alone, we anticipate the government will raise over Ugx 2 trillion through a private placement to primary dealers. Additionally, in June, the government is expected to raise at least 1 trillion through public auctions of treasury bills and bonds.

(By End of this week, Government would have borrowed from the Domestic Market in this financial year alone to the tune of over UGX 23 Trillion)

This means that, despite budgeting to borrow a maximum of 19 trillion for both new debt and debt repayments, by the end of the financial year, the government could have raised over 24 trillion from the domestic market, which is exceedingly high.

This situation leads to the fact that, of the total budget for the upcoming year, nearly 11 trillion will be allocated for interest payments—both for domestic treasury bonds and bills, which amount to around 90 trillion, and for external debt, which is 1.6 trillion.

There appears to be no sign of slowing down. Even when examining the budget forecasts for the next three to four financial years, it is evident that interest payments are projected to rise each year, despite expectations of increased revenue from taxes and oil.

We are approaching a point where debt payments and servicing, particularly through interest payments to the domestic market, are nearing a critical level. This raises the question of whether treasury bonds might become the most lucrative business for the government in Uganda—not because we desire it to be, but simply because it is the reality we face. This presents a risk that must be carefully considered.

What makes this situation even more compelling is the pressure it will exert on the economy due to increasing debt payments and servicing, especially concerning domestic debt. If taxable revenues do not rise as anticipated, the government may need to borrow more, particularly at a time when international grants and loans have significantly decreased—dropping by almost 80% over the past three years. This trend suggests continued upward pressure on interest rates and yields, making government borrowing from the domestic market increasingly expensive.

Currently, the 20 year Uganda Treasury Bond has an Ask yield of over 18% by the Primary dealers when they are buying in the secondary market, (something projected to be seen in the upcoming private auction)

Ultimately, this scenario will force the government to borrow at higher costs, resulting in a larger portion of future budgets being allocated to interest payments on loans, particularly in the domestic market, rather than being directed toward more productive ventures for the country. From a macroeconomic perspective, this is concerning.

The trajectory of interest payments and our national debt—both domestic and foreign—has reached a level where we must begin asking difficult questions as a country. However, we remain hopeful that as revenue begins to flow in, as projected for 2027, this will lead to a reduction in borrowing pressures and a greater focus on revenue generation in other areas.

The government is over borrowing and much of the borrowed money seems to be going into expenditures and not investments. Should this be a point of concern for the bonds holders?

At this rate we are hanging in the balance. I fear a day is coming where the standard of living will become so high that we as ordinary Ugandans. Can't live comfortable lives. An increased borrowing rate always results in increased taxation and interest rates.