Treasury Bonds vs. Unit Trusts: A Comparative Analysis of Returns

June 12, 2025

Yesterday's auction yielded some of the best results we have seen in recent times regarding treasury bond auctions in Uganda. This comes at a moment when the desire among many individuals to invest in treasury bonds is at an all-time high. Almost every single day, there is a growing number of people expressing interest in investing not only in treasury bonds but also in money market funds and unit trust funds.

We are witnessing a significant shift as more people begin to appreciate capital market products. They are learning about stocks, money market funds, and treasury bonds, and engaging with various questions that arise. More individuals are stepping forward to share their insights, which is essential for ensuring that we all learn about financial investments, prudent financial management, better investment strategies, and how to make money in capital market products.

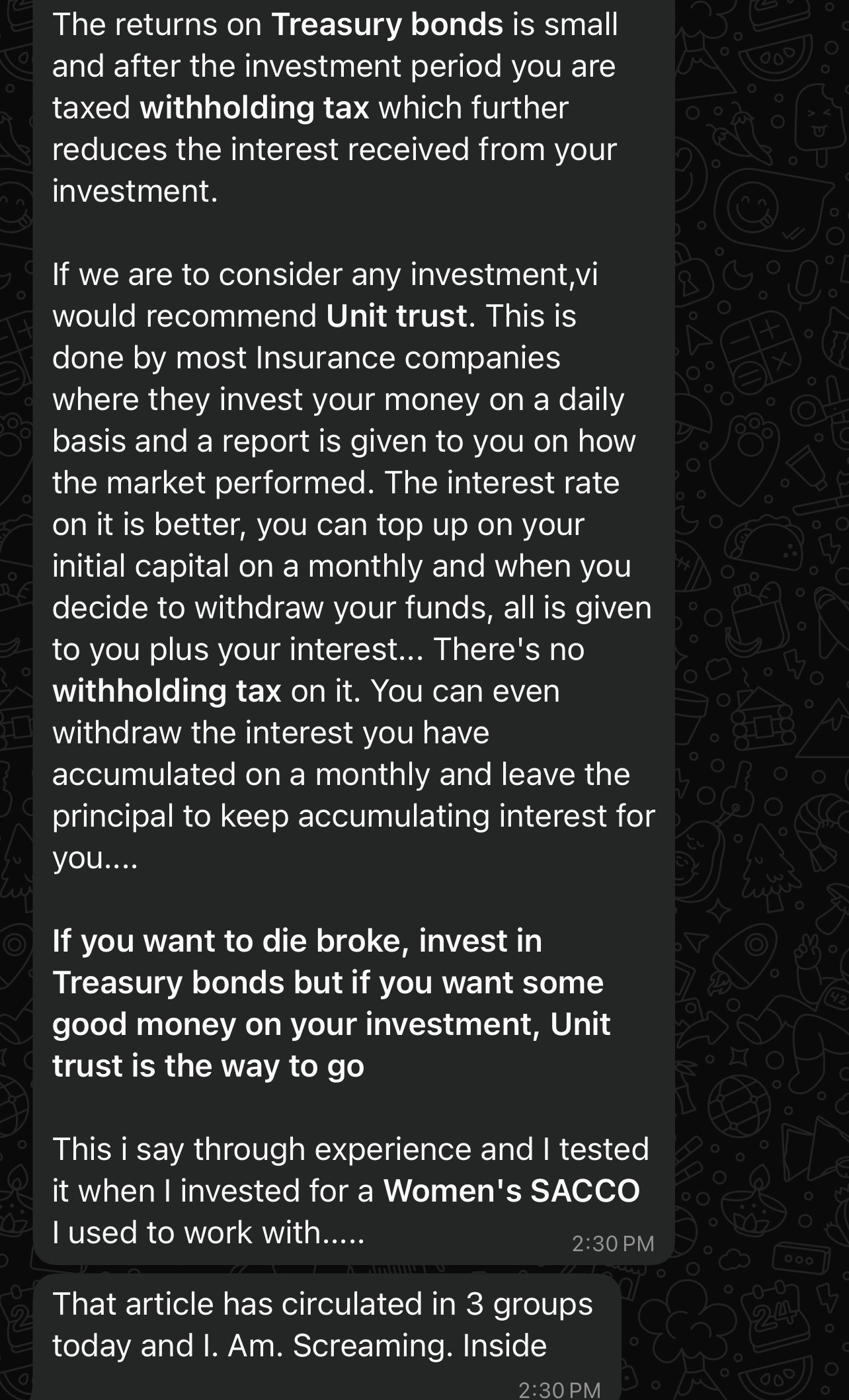

However, I was recently made aware of this message by a good reknown financial coach who is advocating more for Unit Trusts than Bonds.

It was interesting to observe that, at a time when more people are seeking answers, it is unfortunate that the responses they receive may not always be entirely correct. While they might not be outright wrong, they may lack accuracy.

Capital market products, such as treasury bonds and unit trusts, work hand in hand; they are akin to cousins. Depending on one's perspective, they serve different purposes, and many of us need and utilize them. I intend to focus on what I believe are incorrect statements and will write two or three articles to substantiate this claim.

I am a strong advocate for both unit trusts and treasury bond investments. Yes, you can earn more money from treasury bonds than from unit trusts.

Let's consider an example: Two individuals each have 10,000,000 Ugandan shillings. One invests in a money market fund, specifically in one of the best unit trusts, which currently offers a competitive annual return averaging 13%. To be generous, let's say it provides a 14% return. This means that a person investing 10,000,000 shillings today would earn approximately 1.4 million by the end of one year. By July 2026, they would have made around 1.56 million in total income, resulting in an average return of 16% after management fees over 13 months.

In contrast, if the second individual invests 10 million Ugandan shillings in a 5-year or 10-year bond with an interest rate of around 16.5%, they would receive a bond worth 10.5 million (500K discount). This bond would yield approximately 670,000 shillings in July ( 1 month from now).

If they reinvest that 670,000 in the same bond in July 2025, by Jan 2026, the bond would bring in an extra Ugx 740,000 bringing the total Ugx 12 million in 7 months. This bond would then pay them another coupon of close to Ugx 790,000 shillings by July 2026. This represents a return of 23% over the same period, while the unit trust would have returned only a maximum of 16%.

Numbers do not lie; strategies may. Our financial coach may understand that unit trusts compound, and she might be concerned about taxes since unit trusts do not tax the income you earn, but they do have management fees. This is equivalent to the tax on the coupons earned from treasury bonds.

What our financial coach may not realize is that management fees are calculated on your total investment income and principal, whereas tax is only paid on the coupons from treasury bonds.

Indeed, we need both of these products. I advocate that anyone considering investing in a treasury bond, especially if they are just starting, should first invest in a unit trust if they have reservations about treasury bonds due to perceived risks. Some fund managers are doing an incredible job, and they themselves invest heavily in treasury bonds and treasury bills—80% of their investments are in these instruments.

If we focus solely on numbers, as discussed here, I have illustrated how someone can easily achieve a 20% return in the next 12 to 13 months with a Ugx 10-million investment, compared to the maximum 16% return from a unit trust. In my next article, I will write more about these strategies and explore how you can deploy them, whether you are contributing monthly, weekly, or annually, to demonstrate the power of treasury bonds, especially given the current interest rates.

1. But the fund management fee of unit trusts is on interest made not principle.

2. Reinvest in bonds is Manual and basing on an assumption that you'll get that same bond same conditions which is more theoretical than practical

Kakande alex needs to clarify this issue. I do not think you can re_invest the cash flows payments from the Tbonds into the Same Tbond. The T_bond is more like a fixed deposit amount, which you cant not add on. If we would be adding money to the already purchased T-bonds, then one wouldnt necessirily need to purchase another T_bond.

On the other hand, one can put the cash flow payments accruing from the T-bond into the Unit trust/MMFs, which can then build up for buying a new T_bond.