Friends,

Welcome back from what has been one of the best weeks for treasury bonds. We just wrapped up a remarkable week for treasury bond investors, and for those of you who took maximum advantage on the various activities, we match on.

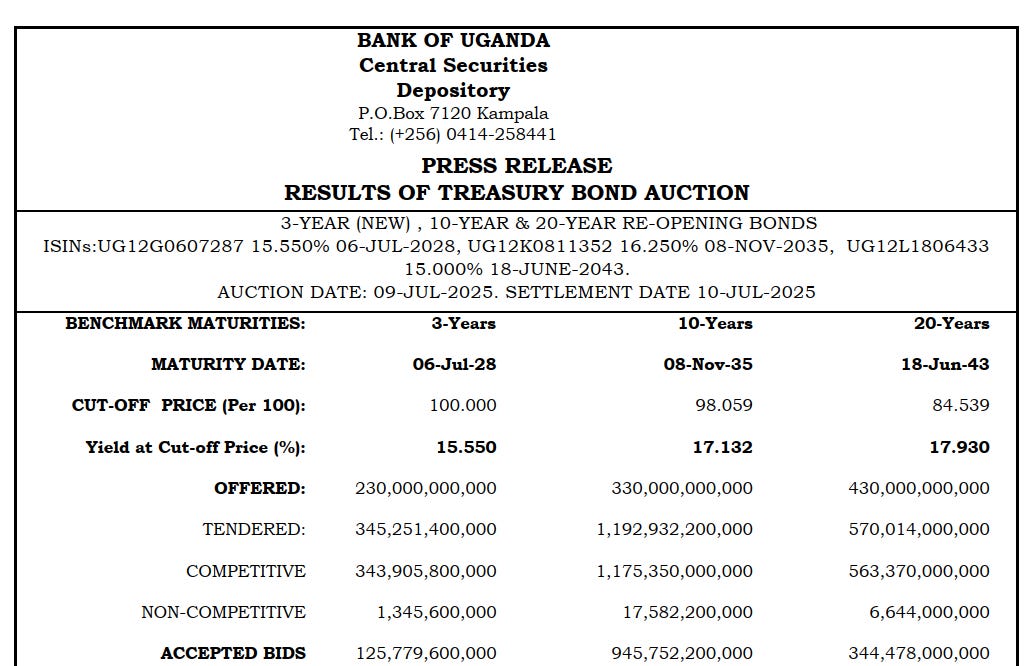

First, there was an auction for the newly issued three-year bond, which will mature in 2028. It came out with a yield of 15.5%, matching its coupon rate. Additionally, there was a reissuance of the 10-year treasury bond maturing in 2035, boasting a coupon rate of 16.25% and a yield rate of 17%. This bond pays out in November and May, and many investors were particularly drawn to it this time around due to its attractive yield, especially since it is the highest coupon-rated bond among medium-term options. This bond is replacing a previous 34-year bond that had a coupon rate of 14.125% and Government managed to raise over 900 billion through the re-issuance of the 10 year bond.

When the Bank of Uganda announced the reopening of the 2035 bond, which has 10 years remaining, with a coupon rate of 16.25%, it quickly became appealing to many investors and this was fully evidenced in the results of the Auctions as it outperformed even its close relative, the 20 year bond.

Furthermore, the 20-year bond that was reissued had a yield of 17.9%, which aligns with what many investors are currently seeking in longer term treasury bonds. which brought it an over 15% actual discount rate to investors.

In the same week, we also saw the payment of coupons on July 10th for two highly sought-after bonds in the past 5-6 months especially for new first time investors:

The 15-year bond maturing in 2039 and the 20-year bond maturing in 2043 for which the Bank of Uganda paid out over 600 billion to Treasury Investors last week just owning these two amazing bonds.

Many investors received their first coupon payments for these bonds, particularly since there has been a noticeable increase in demand for treasury bonds since February. Congratulations to those who benefited from this!

Spotlight on the Upcoming 25-Year Bond

As August approaches, it promises to be another significant month for treasury bond investments and issuances. For the first time, the Bank of Uganda, in partnership with the government, will issue a 25-year bond, which is expected to steepen Uganda's yield curve.

This issuance comes at a time when interest rates, especially for 10-year bonds and longer, are experiencing upward pressure, with yields at 17.0% and above for bonds on the primary market in the last few months for bonds that are 10 years and longer.

The anticipation is that this new 25-year bond, maturing in 2050, could push the yield curve to cross the 18% mark, which would then become its coupon rate. (Means every Investor who might invest on the primary Market might have a chance to lock in a really good coupon rate for the fore-seeable future)

For those of you who have been eager to invest in treasury bonds with yields of at least 18%, this is an exciting opportunity that is not guaranteed but at least its potentially has a chance to hit it.

The 20-year bond, which has nearly 17 years remaining until maturity, had a yield of 17.9% as of July 9th. If a bond with 17.5 years to go can yield 17.9%, it stands to reason that a bond with an additional 7 years could potentially exceed previous yield rates, possibly reaching 18.5% or more.

The highest coupon-rated bond currently available is a previous 20-year bond issued in 2022, which initially had a coupon rate of 18.5% before the government discontinued it due to high interest rates. All eyes are now on the upcoming 25-year bond and its anticipated performance, as well as the pressure it may exert on yields.

Interestingly, this bond issuance marks the first time Uganda will offer a 25-year bond, while neighboring countries like Kenya have had them since 2018. This is a promising moment, and the bond's coupon payments will be scheduled for August and February.

This timing makes it an excellent option for investors looking to ladder their treasury bond investments. If you already own a 15-year bond maturing in 2039 or a 20-year bond maturing in 2043, this new bond can seamlessly complement your portfolio by covering additional months, particularly since those existing bonds pay out in July and January.

What are the implications of government discontinuing a bond?

Kindly advise I participated in the 20year bond expecting to get a coupon on 10th July but it never came through. I am only told that it will be paid in January 2026. Could it have been misappropriated?