Article 150

Friends,

Many of you have inquired about the various treasury bonds available for investment, particularly individuals in the Diaspora or those with access to diverse markets. The article below aims to provide insightful information about the different investment opportunities, along with their respective coupon rates and yields, using a benchmark of the 10-year Treasury Bonds.

In this discussion, I have included not only treasury bonds from global superpowers such as the USA, Canada, the UK, and Germany but have also incorporated options from our immediate neighbors like Kenya and Tanzania for a broader perspective.

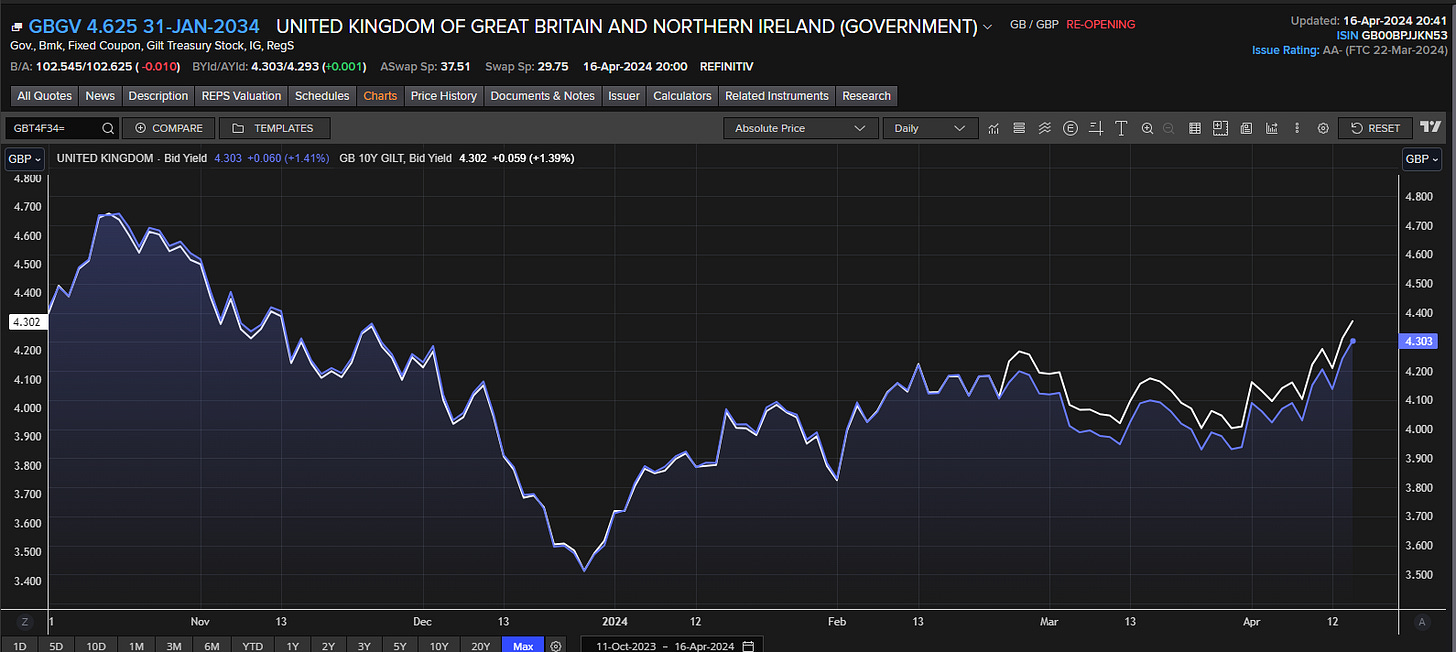

United Kingdom.

United Kingdom 10 Year Gilt. With an Annual Coupon rate of 4.625% with the current yield of 4.29%. If you invested GBP 10,000 in the 10 Year bond (Cost would be around GBP (10,343), you would earn an average of 462 Pounds gross per year.

United States of America.

The United States Treasury bonds are considered one of the safest investments globally due to the full backing of the US government.

US 10 Year Treasury Note currently offers a Coupon rate 4% with YTM of 4.668%.

With a USD 10,000 (cost would be $9,544) investment, you would get $400 Dollars per year.

Kenya

The Kenya 10 Year Treasury Bond offers Coupon rate of 12% and yield of 17.4%. So if you are to buy a KES 1 Million Kenyan Bond right now on the market, you would pay around KES 780K for the bond, a whooping discount of over KES 200K and be slated to earn around KES 120K per year gross level.

Tanzania

The Tanzania 10 Year Treasury Bond offers Coupon rate of 11.4% and yield of 14%. So if you are to buy a Tshs 1 Million Tanzanian Bond right now on the market, you would pay around Tshs 880K for the bond, a good discount of over Tshs 120K and be slated to earn around Tshs 114K per year gross level.

Sweden

Sweden 10 year Treasury note with coupon rate of 1.75% and yield of 2.53%. An Investment of Swedish Krona 100K would yield you around 1,750 per year at gross level.

Germany

Germany 10 year Treasury note with a coupon rate of 2% and yield of 2.48%

Canada

Canada 10 year Treasury Bond with a coupon rate of 3% and yield of 3.72%.

If you are to invest around CAD 10,000 in the Canadian Bond, you would be earning around CAD 300 per year at gross level.

For those who want a little exposure to other markets especially those living in these more developed markets and want to invest in the Treasury Bonds, I hope this assessment helps you on your guiding path.

Happy Investing Everyone

There's is an error with the cost of the UK bond. Also please advise people that they can also buy bonds through their USE brokers and not only commercial banks