The Bank of Uganda plans to auction a 10-year treasury bond next week Wednesday April 17, 2024, for the Bond maturing in February 2033. This bond offers a good opportunity for individuals seeking to invest in medium-to-long-term bonds.

Specially, those who seek a bond that is subject to the lowest possible WHT rate, which for this bond, is at 10 percent withholding tax while at the same time does not lock in their capital for a long period of time.

With the bank’s recent 25 basis point increase in the Central Bank Rate (CBR), expectations are that the bond will be sold at a discounted price compared to its previous sales. Consequently, it’s anticipated that the bond will yield higher returns than previously seen; at the moment, the bond’s bid-to-ask price ranges from roughly 15.5% to 16% depending on the amount of money you plan to invest.

This bond presents an opportunity for investors looking to maintain low tax withholding, but also desiring possible high returns on their investments. Importantly, the bond offers the flexibility of not having funds locked in for an extended period. With a coupon rate of 14.375%, and maturity in February 2023, many may find this a worthwhile investment.

If you want to invest in this bond, its time to go to your commercial bank and fill up the CDs form 2 tomorrow and Friday.

Please be advised that the upcoming event is a primary auction; it would be advisable not to divert to the secondary bond market unless it presents a yield close to 15.5 or above.

Numbers.

For instance, if you invested UGX 100 million in this bond, you would receive 12.9 million per year, after tax. This equates to a yield of nearly 13% post-tax on a bond with a face value of UGX 100 million.

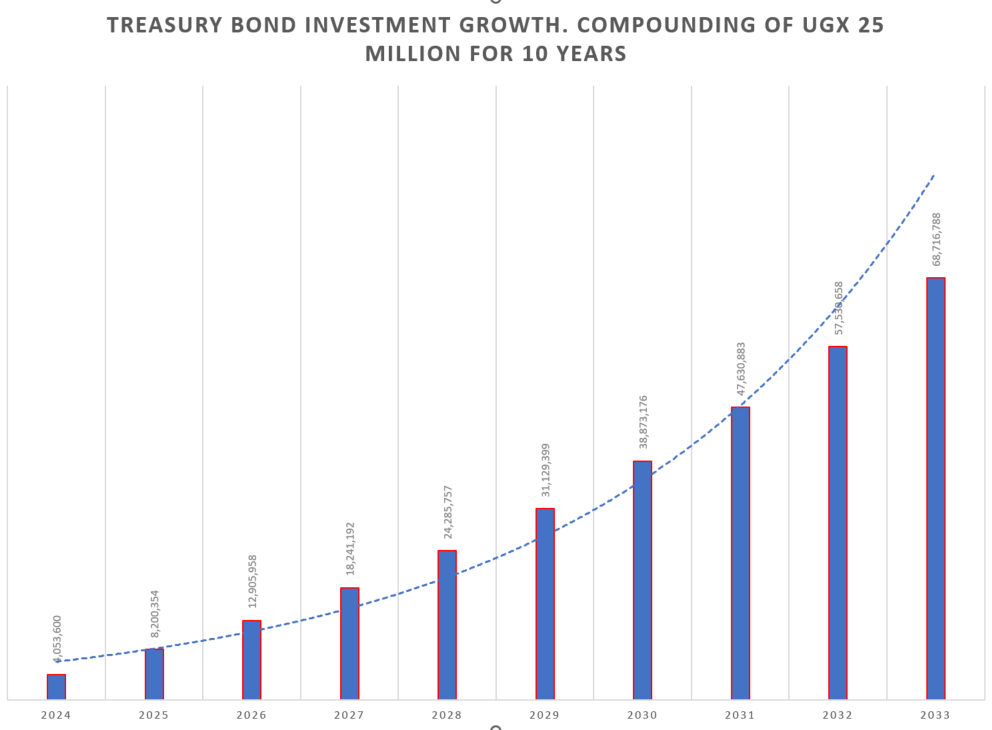

Furthermore, by continually reinvesting the interest earned back into the treasury bond, which averages a 13% net yield, the returns by 2033 could grow to approximately UGX 330 million.

A lower investment of, say UGX 10 million, could still generate really good returns, providing around UGX 1.2 million per annum.

Do these investments have a mimimum amount required ?

If so, what is this amount?

Always come across the term secondary market, in what ways can a "beginner" like me access it

Hi Alex, thanks for this advice.

My question is: How do I 'continually reinvest the earned interest back into the bond' yet it's supposedly paid to my back account every 6 months? Does that mean buying on the secondary market whenever am paid?