But they are all part of the Treasury Securities offered by Bank of Uganda.

Friends,

From the recent discussions, many people might have picked interest to invest in Treasury Bonds and like some of my clients who went to commercial banks requesting for bid forms for the Treasury bonds for this week’s auction only to be told there is another Auction next week that they can participate in.

What the banks didn’t tell them is the Auction next week is for the Treasury Bills not Treasury bonds.

Know this difference and make a better decision. Treasury bills, also known as T-bills, are short-term debt securities issued by the Ugandan government. They are sold every two weeks by the Bank of Uganda, and Treasury Bonds are sold once a month.

In this article we will focus on the Treasury Bills and give a high-level comparative review to Unit Trusts.

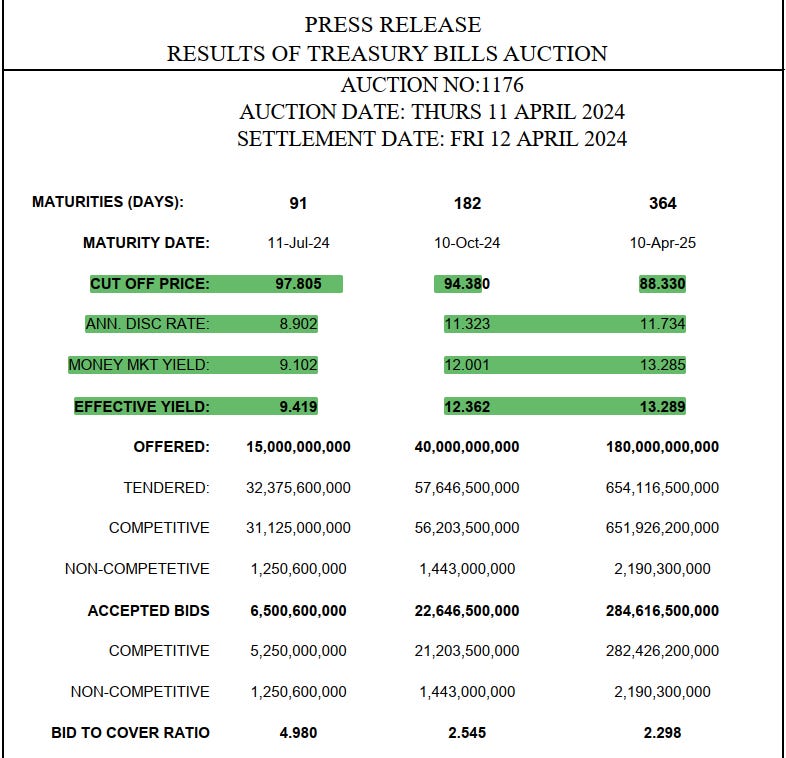

The Bank of Uganda auctions Treasury bills with maturities of 91 days, 182 days, and 364 days every two weeks at discounted prices. For instance, the 364-day Treasury bill rate was 11.734% in the last Auction on April 11, 2024.

As an investor, you can purchase a Treasury bill with a face value of UGX 10,000,000. However, you will not pay the face value; instead, you will pay a discounted price, let's say UGX 8,833,000 in the last Auction for the 364 Treasury Bill.

At the end of the maturity period (364 days), the government will pay back the UGX 10,000,000. The difference between the discounted price you paid (UGX 8,833,000) and the amount you receive back at maturity (UGX 10,000,000), UGX 1,167,000, represents your interest or profit. Results of the recently concluded Treasury bill Auction last week

The Tax element

Treasury bills are subject to a 20% withholding tax (WHT) on the profits you earn. For example, in the scenario above, with a profit of UGX 1,167,000, you would pay 20% WHT, amounting to UGX 233,400, leaving you with net earnings of UGX 933,600. Based on this calculation, the 364-day Treasury bill would yield a net return after tax of just over 10.5%. The total amount you will receive on your account would be UGX 9,766,600.

Comparision of Treasury Bills to Unit Trusts like the Old Mutual Investment Group Unit Trusts.

Unit trusts like The Umbrella Trust Fund by Old Mutual Investment Group (OMIG), on the other hand, offer an average net return of 11% per annum across the market. Sometimes even as high as 11.88% as noted in the graph above that in 1 year ending 31 December 2023 the fund offered a yield return of around 11.5% net to it’s investors.

Additionally, the Umbrella Trust Fund by (OMIG) provide open-ended liquidity, allowing you to access your funds whenever needed. For example, if someone invested UGX 8,833,00 in a unit trust of their choice for 364 days, at a minimum compounded return of 11.5%, they would make a profit of UGX 1,015,795 net of management fees with total balance at UGX 9,848,795.

This means that the person who invested in the Old Mutual Investment Group Umbrella Trust fund would make more than the person who invested in the Treasury bills.

Kindly note. The comparative above is for Treasury Bills (Not Treasury bonds) vs Old Mutual Investment Group Umbrella Trust Fund’s average Yield to investors. Some Unit Trust funds might yield less return than the Treasury bills thus its prudent for an investor to make research and compare all possible scenarios for investments before making the final decision.

Alex Kakande

+256 771 404 377

Alex, thank you for the detailed comparison between Treasury Bills and the Old Mutual Investment Group's Umbrella Trust Fund. Could you clarify if there was any specific reason for exclusively comparing these investment options to Old Mutual's products? Are there other unit trust providers you considered including in your analysis that could also offer competitive returns? Understanding the scope of your comparison would help us evaluate our investment options more comprehensively.

Alex thanks for the education regarding the comparisons between T bills and T bonds as well as the roi comparisons between the t bills and the unit trust.It has given me a broader understanding of the products and makes me a better financial advisor.