Friends,

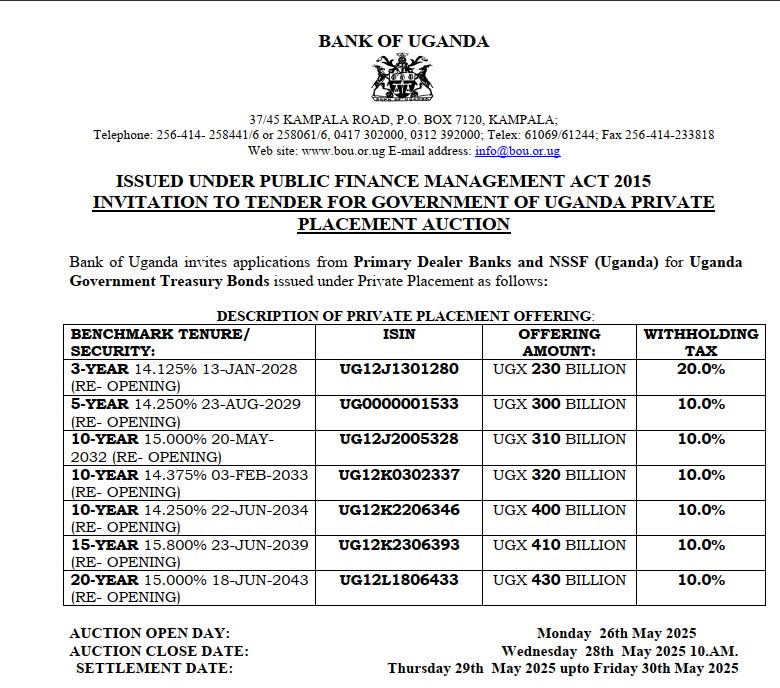

The Bank of Uganda has finally announced the private placement offer that we have been waiting for over the last few weeks. This offering is specifically intended for the primary dealer banks and NSSF Uganda only.

It will open on Monday, May 26, 2025, with the settlement day scheduled for Thursday. Therefore, the auction is set for next week.

This is a private offering, meaning it is exclusively for the primary dealer banks in Uganda. There are only eight licensed primary dealer banks, which means that retail investors are not invited to participate in this Bond offering.

The only way retail investors can take part is if they bank with a primary dealer bank and ask them to bid on their behalf and allocate to them later. However, this typically occurs only if the investor has a significant amount of money, as these banks tend to target clients with substantial funds

Interestingly, instead of the usual practice where the government or the Bank of Uganda invites private placements for just two or three bonds, this time it has invited private offerings for seven treasury bonds. The plan is to raise close to 2.4 trillion UGX in this private placement, with a minimum bid of 1 billion UGX a Red Indicator that this government is currently in need of substantial funds, especially as they prepare for the upcoming elections.

Raising 2.4 trillion UGX from the economy through a private placement, just two weeks before a public bond auction, raises concerns. This is a significant amount of money being withdrawn from the economy at a time when we are nearing the end of the financial year, before the budget is approved, and before the remaining Calendar Auctions are taken.

One must consider how much money the government is planning to raise in the coming weeks and months. With only one month left before the financial year ends, if the private placement raises close to 2.5 trillion UGX, the auction the following week but one might also raise as much as 600 billion UGX. This means that within a single month, the government could have raised close to 3 trillion UGX or more from the economy through treasury bonds. Additionally, considering treasury bills—both those sold this week and those scheduled for sale in two weeks—this could lead to the government raising over 3.8 trillion UGX in total from the economy. This is a substantial amount, especially considering it would occur within a span of just 40 to 45 days.

For retail investors, even though we do not have the opportunity to participate in this private placement, the results of these placements will impact how subsequent public auctions will yield especially in June and July.

One possibility is that the primary dealer banks, as market makers, may raise interest rates high enough that the next auction could break the rate ceiling. This would lead to significantly higher interest rates, particularly as we are entering an election cycle.

Currently, the banks are buying the 20-year bond at 18.2% plus on the secondary market.

Alternatively, the government might raise a considerable amount of money in this private placement, resulting in upcoming public auctions being priced low enough that interest rates return to a lower level, which would not significantly impact yields in the next two to three months. This is something to keep an eye on.

As mentioned, only those who bank with primary dealers may have a chance to participate in this private placement. This is contingent upon engaging with your bank and having a significant amount of money, allowing your bid to be included as part of their overall bid. The primary dealer banks include DFCU Bank, Absa Bank, Centenary Bank, Housing Finance Bank, Stanbic Bank, Equity Bank, and Citibank Uganda.

Happy Investing

Alex Kakande

Thank you for this post. Isn't Stanchart part of the primary dealer banks?

I am curious what the yield results are going to be for this private auction and if they will be made public. Please share with us that information when you get access to it.