“Bond Investors are eating Big this 2025.

Retail investors in this week’s Auction have eaten big, with the latest 17.5% yield of the 15-year treasury bond and a 16.75% on the 5 year bond”

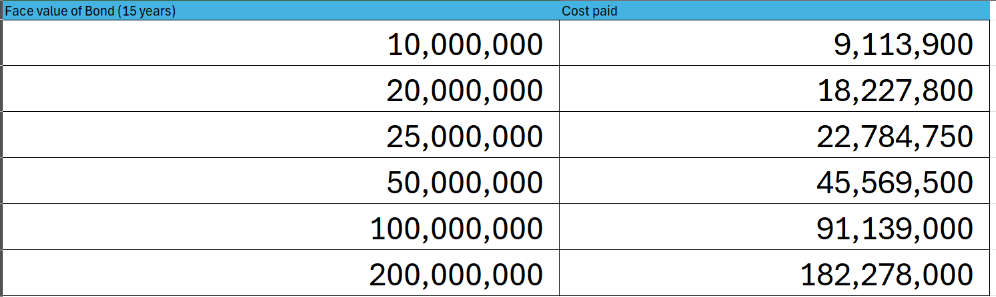

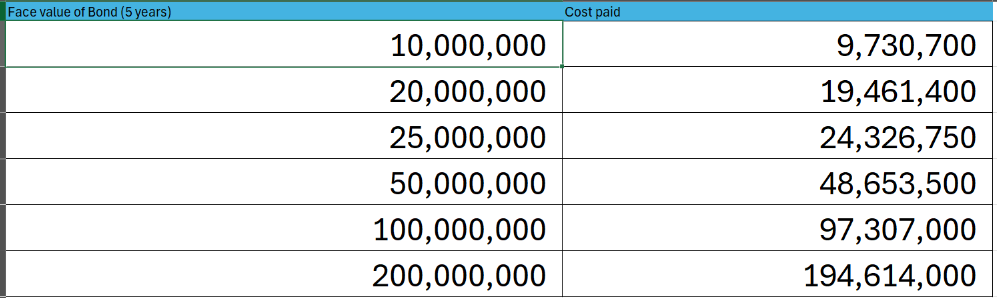

To demonstrate how this auction panned out, see below.

Face value vs Cost paid for the 15-year Treasury bond (Investors enjoying an almost 10% discount)

Face value vs Cost paid for the 5-year Treasury bond (Investors enjoying an almost 4% discount but with coupon income coming in next month)

Friends

The latest Treasury Bond Auction results from the Bank of Uganda (BoU) have been released, with particularly strong interest in the 15-year Treasury Bond and the 5 year treasury bond.

In a notable and interesting development, for the first time in 18 months, the yield on Uganda's long-term 15-year treasury bond has surpassed the 17% mark, a level last observed in the 2022/2023 Auction and matching it with the 20-year treasury bond which brought in a 17.5% in November.

This comes at a time when tomorrow, January 9, 2025 and Jan 10, 2025, the Treasury department is to pay out close to UGX 350 billion in coupon incomes related to 2 bonds (The 20-year treasury bond and 15-year treasury bond) and a maturing treasury bill.

Significantly, the government tendered a total of 990 billion UGX, attracting bids exceeding 1 trillion UGX. However, only 791 billion UGX was accepted in this auction. This raises the question of whether the government is exercising caution in its borrowing strategy as we gear up for what promises to be an amazing 2025 year.

Financial Year to date, the government has so far raised a total of UGX 14 Trillion from the Treasury bond and treasury bill market.