Friends,

Inspired by a recent conversation with a client, this article digs into the financial challenges that are faced by seemingly rich families who find themselves cash-strapped due to very poor financial planning. Wealthy in the sense that they have mega-Home houses, drive descent cars with 80% of their NetWorth tied into their family home and cars but seemingly every single day struggle to meet basic needs of life, that has now pushed him to put all his most important assets on sale.

(Read on and see how one unplanned event is pushing a client to a sale of their whole investment to replan their life and manage the challenges ahead and if you are interested to buy, reach out)

Courtesy house in Jomayi Estate Nabusungwe seating on 50*100 plot - Asking price 400 million

The Poor financial planner conundrum of the 40-year-old who was working was working with a USAID project and now their funding is almost on hold and their net steps are almost close to none.

My client, a 40-year-old man, married with children, was earning a substantial monthly net income of approximately UGX 4.5 to 5 million before the Executive Order which has seen his Organization cut his salary to jus $500 per month till things are settled. (Something he is grateful for at least not all hope is lost for now, though the problem starts here)

Thanks to the old, dated way of planning and investing early all the income in real estate, he managed when things were still good to build and set up a secondary income from rental properties, which he wisely invested in eight years ago, bringing in another 3 million per month but for which it’s seems with the Job God income wholistically reduced, and his responsibilities are just growing, his only option is liquidate some of these assets to rebalance life)

The Apartments are in Mbalwa and you would think they would be bringing in more money than this but unfortunately not, and he is contemplating selling them now (If interested asking price is 400 million seating on a 85*100 plot of land)

Even before the Hard news of January hit him, even with a combined monthly income of UGX 7 to 8 million, he finds himself in a challenging position where his entire income is exhausted on expenses such as school fees, home maintenance, Edusave insurance policies, bills, and the cultural obligation of 'black tax.' Consequently, he is left waiting for the next paycheck and rental income that at this point, it seems its no longer enough and wish he could replan and strategize his life around.

During our discussion, it became evident that his financial outgoings, including loan repayments, credit policies, and everyday living costs, left him with nothing to save when he was still fully and gainfully employed, and now with his salary income almost gone and with no realistic job ahead and having to rely only on Rental income, he is left with some serious expenses to cover that he needs to come up with a solution asap .

I posed a critical question: In the event of a 20 million crisis right now, could he raise the funds within 72 hours without borrowing or struggling? His answer was a resounding no, reflecting a common scenario among millennial families who have made financial commitments without considering emergency funds.

This is a client who is driving a car of above UGX 30 million cost but would struggle to raise funding for an emergency of around UGX 15 - 20 million without borrowing or having to sell some plots of land at a very low value in such a short time.

Despite owning a family house and other investments, totaling a net worth of 500 to 700 million, my client could not liquidate 20 million quickly due to the illiquid nature of his assets. At 40, facing an emergency without accessible funds is not just inconvenient; it's a poor financial strategy. The obsession with investing in illiquid assets is a trap many fall into and when something that requires cash, comes knocking, its only then they realize their investments or expenses have been a terrible deal.

The solution is straightforward: before making any investments, create an emergency fund—money that can be accessed within 48 hours if needed. For my client, How he wished he had created a minimum of 15 -50 million, representing 5-15% of his net worth, to be readily available. This doesn't mean hoarding cash in a bank account but rather investing in money market accounts that offer liquidity and some return.

Now we are left with a time to scramble with selling some of the illiquid real estate assets to raise the funds that might stabilize his situation, manage to pay fees and take care of his family.

To him, it’s a must to open up a Unit Trust account like yesterday and start funding it every single month no matter what with a plan to save around UGX 200,000 no matter what to the Unit trust Account. He has to cut his expenses by half right now until a solution comes up. He is already scared, being a career NGO person, it might be hard to secure another job if the funding cut offs continues having seen his friends who lost jobs during DGF who haven’t recovered yet.

But at least to him, for now Rental income is still coming in but not enough especially if the property is valued at more than 350 million only to bring in 2.5 million per month.

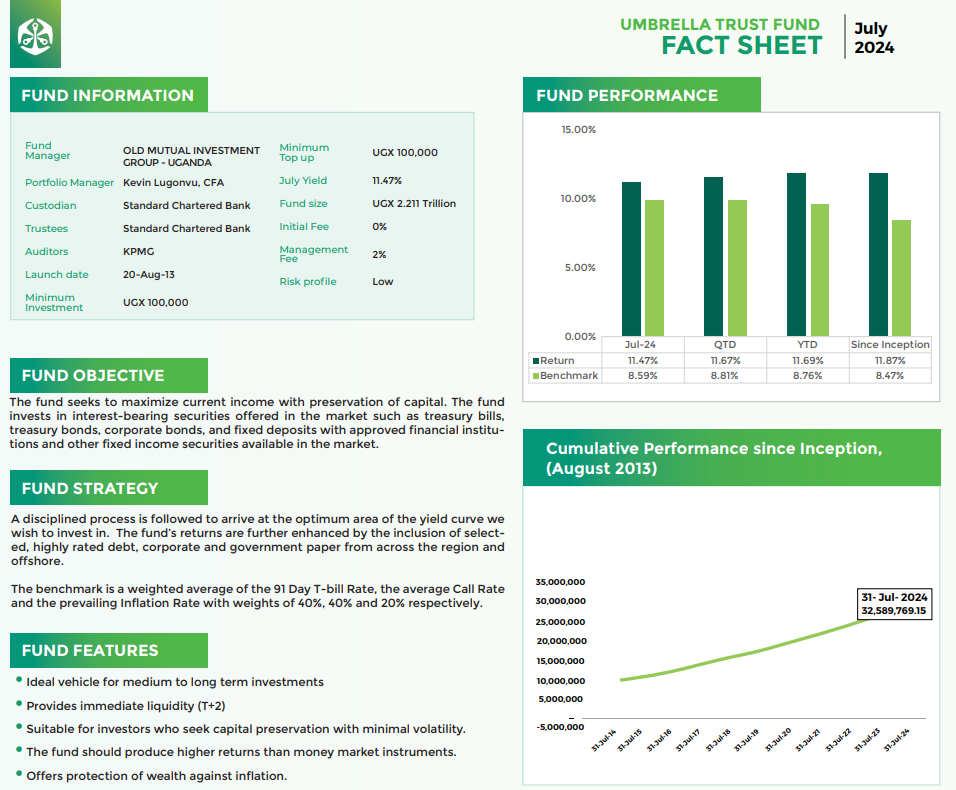

It would take him around 36 Months if he is to invest with a company like Old Mutual Investment Group Umbrella Fund which has averaged over 11% annualized return per month, to reach his target of UGX 15 million but still grow that before he thinks of investing in anything else. This, for a 40-year-old family person is a must have, the Emergency fund in our economy is a must have.

Emergencies are a fact of life, and financial planning for such events is crucial. Many people invest heavily in illiquid assets like real estate, which can lead to difficult situations when immediate cash is needed. It's a matter of life in our economies to diversify investments and include assets that can be quickly converted to cash.

My client and I agreed that building an emergency fund was a priority. By setting aside a portion of his income each month, he could accumulate a significant emergency reserve within a year. This approach is not only about preparing for the worst but also about creating a financial buffer that can provide peace of mind but also as we explore the options of selling off one of his Assets to replan and re-strategize on income generation that is for the future.

The takeaway from this experience is the importance of establishing an emergency fund before making any other investments. Such a fund acts as insurance, protecting your capital while allowing for growth. It ensures liquidity for unforeseen needs without the desperation of liquidating long-term investments at a loss.

Don’t be like many of those we have seen, plan better, talk to advisors, and make better investments which not only seeking profit maximization but also ensuring that your investments can support you during emergencies.

And nothing beats liquid investments like Unit Trust funds and treasury bonds and including these into your portfolio, you can achieve a balance between growth and liquidity, allowing you to handle life's unexpected turns without financial distress.

Thank you Alex for bringing to us such experiences to learn from. If I were him, I wouldn't think about liquidating the real estate assets now but rather would consider downgrading the expenses to what can fit in the prevailing income.

Thank you Alex for sharing this practical insight.

He can liquidate the home, let him shift to one of the rentals he owns. If his vehicle is a high maintenance-let him reconsider a downgrade and also revise his expenditure and direct it to basics.