The Magic of Compounding: How Treasury Bonds are Transforming Maureen's Future to a 1 Billion portfolio.

November 28, 2024

All she had was just 50 million in cash, which she intended to use to buy a plot of land. She was confident that she could easily save and invest 1,000,000 per month with a strategic plan.

At 36, with a young family, her goal was to retire with at least UGX 1 billion in investments or, at a minimum, earn UGX 100 million in passive investment income per year.

This is when we crossed path and I became her Investment advisor and we decided to come up with a plan to help her achieve this goal using the power of treasury bonds with a Mix of Unit trusts and, most importantly, the power of compounding investments. Ever since we started in February, here is how it's going.

Welcome to the journey of Maureen and what she is doing, which I plan to update you on going forward to show you the power of treasury bond investments and to inspire more of you to take similar actions to ensure you can replicate and benefit from them.

In February of this year, she reached out, wanting to enter the treasury bond market and understand how it works and how to make money from treasury bond investments. At the time, she had around 50 million, and the goal was to grow this into a portfolio that generates income. The objective was to compound this investment to ensure it at least doubled, with a target of around 1 billion by 2040, using just the 50 million she had. This is where the journey began, learning how to compound investments made in treasury bonds.

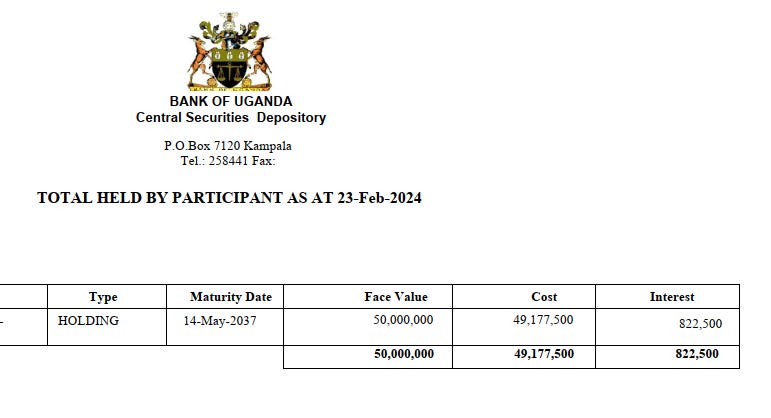

First purchase holding report in February 2024

The first purchase was the 50 million on a 15-year bond, which first paid a coupon on May 30, 2024. She received around 3.6 million just three months after buying the bond. From the 3.6 million coupon received, she topped up an extra 6 million, making it 9.6 million. We went to her custodian bank, where she bought the same exact bond on the secondary market in June. After that transaction, she now had a face value bond of 60 million, no longer just UGX 50 million.

Today, she is receiving her second coupon from this exact bond from Bank of Uganda and she is excited, and this time, six months later since her initial coupon, it is UGX 4.32 million, which is an increase of around UGX 730K over what she received in June. This increase is due to the initial investment still providing 3.6 million, but the reinvested 3.6 million plus the additional 6 million is bringing in an extra 730K. Now, she is getting more money from it.

Part of this article is to highlight the conversations I've been having with her this whole week as we prepare for the coupon coming in today. In the last few months, she has been using her unit trust account to gather some money, and now she has around 6 million to top up, which will bring the total amount to around 10 million by next week to reinvest and buy a bond. We plan to go back to the secondary market, look for this exact bond she originally purchased, and buy it to top up the original bond.

With the planned 10 million to be invested next week, she will again be paid a coupon in May 2025. At that point, the estimate is that she will be earning a coupon of 5 million, which will be 1.4 million more than what she earned initially when she first invested in the 50 million bond as her total Bond Portfolio would have grown to a face value of around 70 million.

By June 2025, Her total bond portfolio will be around 75 million, comprising 70 million in total face value bonds and around 5 million in coupons to be received in May 2025. The plan is to save more (1 million per month) and increase the investment so that when the coupon comes, there will be more cash flows to top up and increase the bond, which is the best strategic way possible.

This shows that in one single year, by May 2025, we anticipate having a total bond of around 80 million, bringing in around 6 million per coupon just from the initial 50 million investment she started with. After reaching the 6 million per coupon, the plan is to start buying other strategic bonds to begin bond laddering.

The compounding power of treasury bonds is evident in this example. For this particular client, who started with 50 million just nine months ago, in a span of one year and three months, she would have increased her bond position to around 80 million, earning from as low as 3.6 million per coupon in May 2024 to almost doubling it to 6 million by May 2025. If she continues on the same track, by the end of 2025, she could reach a coupon income of close to 7 million or 7.5 million per coupon, making it close to 13 million to 14 million per year with projections in 2025.

If you have just started your treasury bond investment, the best way to make money is to compound your investments. Unlike money market funds, it is not automatic. You must track when the cash flows are coming and be proactive in reinvesting that money, especially if you do not have other uses for it.

The discipline that comes with reinvesting that money gives you an opportunity to see your initial investment double in almost 3-4 years, as we are seeing with this particular client.

There are many others like her, where we started with a small amount of money every single month, used the unit trust to accumulate, and then reinvested that money every time a coupon was paid. We buy more bonds, moving from a 3.6 million per coupon to close to 10 million per coupon.

Thank you for this article, Alex. I have finally learnt how to achieve compounding with treasury bonds. Thank you for your endeavor to support financial literacy for the masses. May God reward you

Thanks for sharing. Is it ok if you shared the figures in tabular form to paint this picture. I would like to appreciate the earnings from the original Tbond and the additional savings. The info will inform me on the next course of action. I look forward to it.