“The relationship between a person & a bank is unequal but favorable to the latter. You have a profit maximization entity on one hand & a person trying to better their chances in life through these transactions”.

All she wanted was a 30 million loan for 5 years to facilitate her further Master's education. She had never borrowed from the bank, even with over 10 years of working with one of the best employers, a Government MDA, which came with job security.

The bank knew this, and that’s why it had started camping at their workplace to convince many of them to take on unsecured loans with lower interest rates than what was being offered on the market.

But was the interest rate really low? As she would later find out, with insurance costs, management fees, and loan facilitation fees included in the payment, the rates were nowhere near what was promised to her. Nor did the loan officer take the time to explain to her all that she was signing up for, but yet she signed up for the loan anyway. It was her first chance at getting some good money and even planning to invest in Treasury bonds, as the loan officer advised her to.

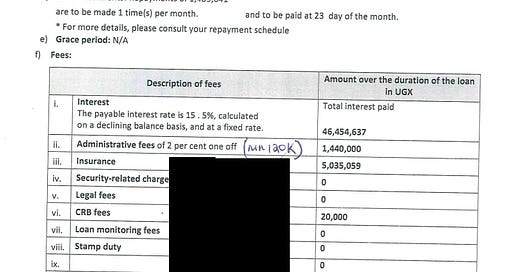

Loan Terms.

Three weeks ago, she reached out to me to understand how best she could invest in the treasury bond. But like I always do, we sat down and first understood her financial situation, plans, and goals, and came up with a realistic plan forward. It was at this point that I found out that the money she wanted to invest was from a loan she obtained in August from one of the leading banks. Agatha, from her explanation, only needed just 30 million from the bank to pay for her Master's Degree in Germany.

Payment Schedule.

Only UGX 30 million. The loan officer, after seeing her monthly paycheck of UGX 3 million, convinced her to take a loan of UGX 72 million and even wore the financial advisory hat of advising Agatha to pay for her Master's and invest UGX 40 million in the treasury bonds to make her money. To Agatha, the loan officer told her this would allow her to grow her financial investment while just paying UGX 1.5 million per month.

The loan came out at a 15.5% interest rate, but due to it being unsecured, the insurance and management fee costs were higher than expected, and the effective interest rate for the loan ended up being 18%, way above any interest rate she could get from a treasury bond. This was supposed to be the first red flag, but Agatha didn’t know. All she knew was the number of the loan officer who was advising her to take a UGX 72 million loan instead of the UGX 30 million she truly needed and for which she ended up taking the loans.

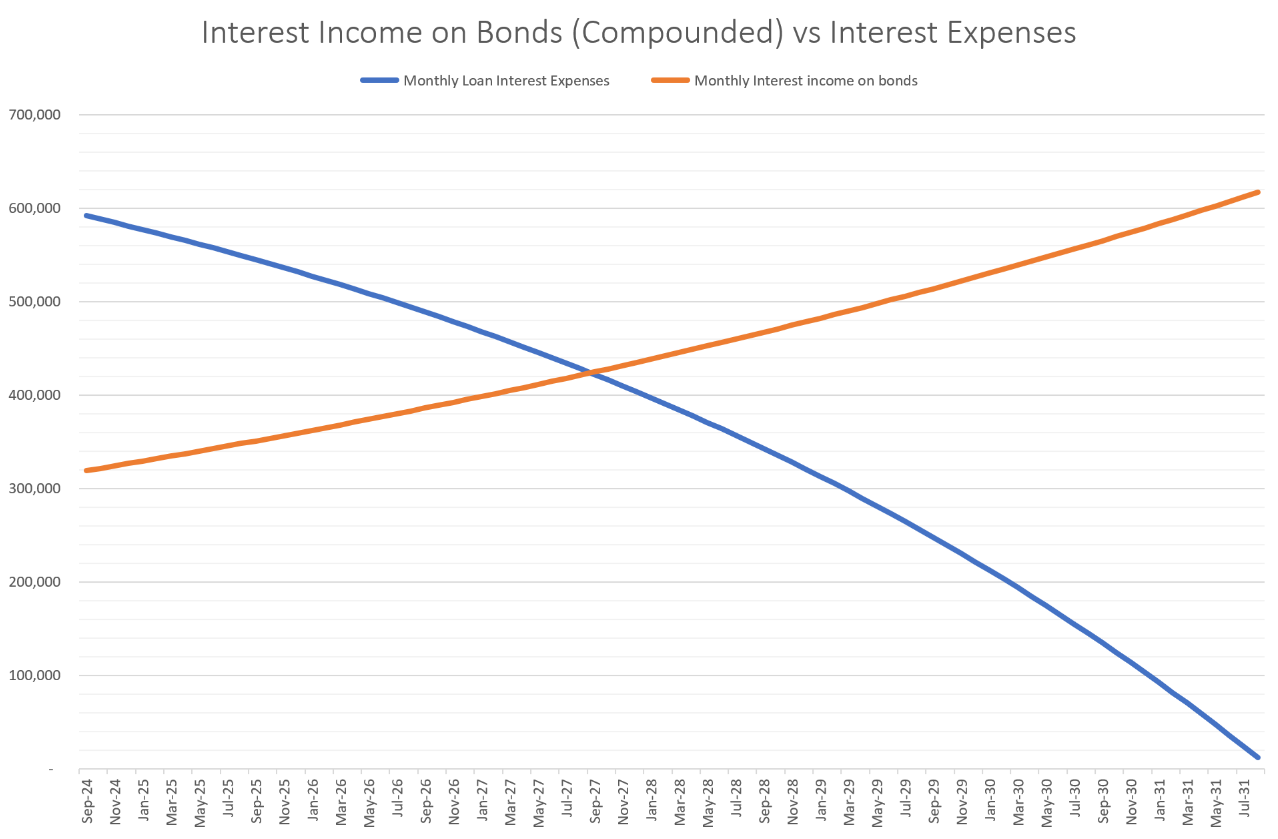

Agatha couldn’t believe what she was finding out from this impasse. To advise her to invest the remaining UGX 40 million in a treasury bond with an average net yield of 14.5% would have meant she was making a loss of 3.5%. It was not a viable option, and she should never have taken the extra money if she didn’t need it.

To put it into perspective with that UGX 40 Million extra, here is the comparative between the loan expenses on UGX 40 Million and UGX 40 Million on bonds compounded.

She wondered how they could have tricked her into signing for more money than she needed. It was at this point she realized the old saying, "Ignorance is no defense," and to the loan officer, their job was to distribute as many loans as possible to willing takers, whether they could pay them or not. At least for Agatha, she could pay for it as long as her job was secure, but it was about to create a financial hole she hadn’t planned for.

Quickly realizing the situation and the explanation of early redemption of loans rule by the Bank of Uganda, I advised Agatha to go back to the bank and readjust her loan, pay back the UGX 40 million in principle, and be given a new repayment schedule going forward. Lost for words but with no other option, she did exactly that and the next day reached out to the loan officer in question.

However, this guy might be one of the shrewdest persons for this bank. First, he told Agatha that no, she couldn’t pay back the money in a lump sum (which isn’t true; you are allowed to repay as much as you can early on). But after pressing hard, the gentleman still insisted that even after repaying the UGX 40 million, Agatha would still have to pay UGX 1.5 million per month for a shorter period until the full loan was paid off, effectively raising her interest rate to 21%.

Agatha’s loan terms were terrible, yet she had signed them, and every passing day, she seemed to have no way out of this growing ordeal. What could she do? I advised her to go to another bank and try to get her loan bought off and renegotiate new terms. She reached out to her second bank, which also has a good working relationship with her employer, and in one day, she was quickly connected to another loan officer who sympathized with her and even told her, yes, they could buy off the loan and adjust everything to her needs. She was excited; there was some glimmer of hope finally, and so we waited for the loan terms. This time, I told her not to sign anything without me looking at it or interpreting it for her.

It didn’t take long, and Bank 2 came back with a proposal of an effective 19.5% interest rate and a top-up amount of UGX 33 million on the loan to make it UGX 105 million. Far worse terms than what we were trying to get out of. I asked Agatha, what is it about her that makes people want to give her more money than she needs? Because even Bank 2 was topping up as if she had asked for the money. The issue was her salary; each bank wants to maximize her 60% payment capability, even when it’s leaving her in a hole with money she doesn’t need.

After two weeks of back and forth, with no hope of how best to get out of this ordeal, Agatha accepted that she was tricked by the loan officer. We agreed to invest the UGX 40 million (or what was remaining into her purse) in the 15-year bond.

She is going to be making losses in the coming 3-4 years as she pays the loan she never needed. Her salary is cut in half by a person who needed to hit their loan disbursement target, yet the price Agatha has paid for not knowing is high. It’s not all bad; Agatha will have to pay, she can pay, but her tight budget and everything for the next four years make this hard. Had she known better, she would not have signed that 72 million loan rather than the 30 million she needed.

Kakande thank you for bringing this out in the open. It is an open secret in the banking corridors. I feel for Agatha!

Finance world is a jungle with banks atop.of the food chain, one has to go there literally armed to the teeth with knowledge, ignorance ain't bliss.

Out those banks so we know about them so they deal with their foot soldiers.

On debt also called leverage I will share a quote I hold dear in this regard:

“My partner Charlie says there is only three ways a smart person can go broke: liquor, ladies, and leverage. Now the truth is, the first two he just added because they started with ‘L’ – It’s leverage.” Warren Buffett

This is why we always have to be very wary of loan officers, and also only sign for the amount of money you need, not what is being offered! Loan officers are always acting friendly, like your saviour, yet they just want to hit their targets and leave you in a terrible condition. You ask for a 10m loan, the guy sees your payslip, and starts stories of how they can get you 30m, and you invest the balance elsewhere. That is always a bad trap. If you wanted a loan of 10m sign for 10m and go back for a top up when you need it.