Friends,

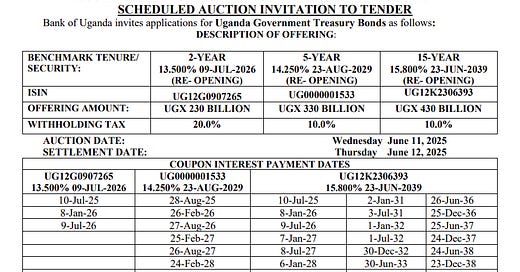

The Bank of Uganda will be auction off the 3 treasury bonds on June 11, 2025.

The Breakdown

UG12G0907265: 2-Year Treasury bond with a coupon rate of 13.5% and WHT of 20% Maturing in July 2026.

UG0000001533: 5-Year Treasury bond with a coupon rate of 14.25% and WHT of 10% maturing in August 2029.

Yes, this 5-year bond has a withholding tax of 10% because it’s a reopened bond which was first issued in 2014 as a 15-year bond, and the Treasury re-opened it as a 5-year bond in this calendar year.

UG12K2306393: 15-Year Treasury bond with a coupon rate of 15.8% and WHT of 10% maturing in June 2039.

This Auction marks the final treasury bond auction in the financial year 2024-2025, and on the FY 2024-2025 Bond Calendar.

This auction comes at a pivotal time, following the recent release of the 2025-2026 fiscal budget for which we know now that the Government plans to Borrowing over Ugx 20 trillion from the Domestic Market to fund the budget.

It also comes at the time when the last auction of the 20-year treasury bond yielded an interest rate of 17.945%, while the recent 15-year auction in April 2025 yielded an interest rate of 17.1% indicating the potential for significant investment opportunities

Graph below shows Institutional Investors are pricing the Bond at a bid rate of 17.4% already.

Investors with a focus on cash flow can anticipate the upcoming bond auction as an opportunity to secure a discounted investment that will soon pay a coupon. With the auction scheduled just days before the next coupon payment on July 10th, investors can expect their initial coupon payment shortly after the investment date. Moreover, this auction serves as the last chance to invest before the release of the next bond calendar, which may bring changes in interest rates for the financial year 2025-2026.

Table below showing the Coupon payment schedule from July 10, 2025 (30 days after the Auction of the Bond)

Opportunities and timing

For those considering whether to invest now or wait, it is worth noting that the previous auction for the 15-year treasury bond yielded an interest rate of 17.1%. This suggests that the upcoming auction could offer yields in the range of 17% or higher. Current trends in the secondary market also support this projection, with secure investments yielding around 17% for retail investors on the secondary market right now.

While it is uncertain whether the yield will surpass the previous best of 17.5% or even reach 17.8% as Bided by institutional investors currently, there is a possibility for those willing to take on the associated risks. The results of this auction will provide insights into the government's direction regarding interest rates, which will be valuable for all investors, whether they participate in this auction or consider future ones in July, August, and September.

Thanks for this info Alex. Please advise whether an individual investor needs to file income tax returns on bonds purchased -- either the coupon or the bond at maturity; or only when selling before maturity.