Friends,

One of the most common questions I receive from individuals looking to invest in treasury bonds, especially for the long term, is how they can purchase different bonds to ladder their portfolio.

This strategy allows investors to receive varying cash flows throughout the year, which is one of the best approaches to investing in treasury bonds. Instead of relying on a single treasury bond, laddering enables you to hold multiple bonds that pay out at different times.

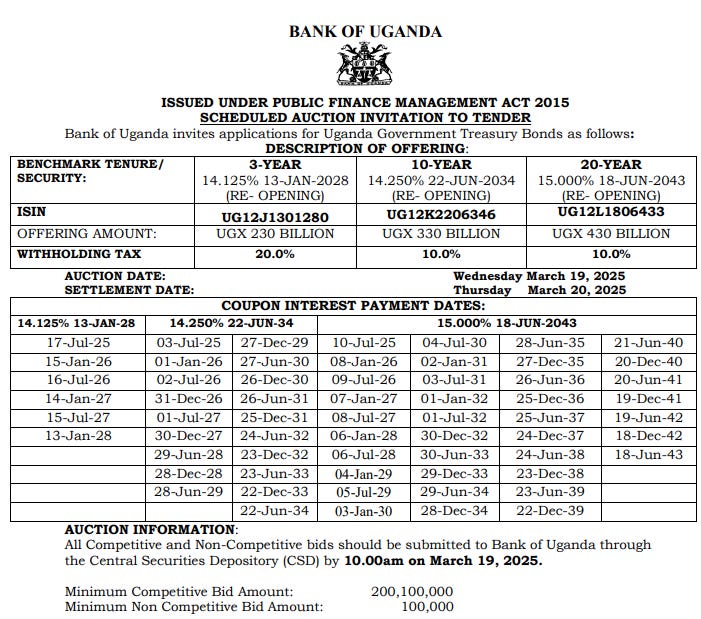

I always advise that this is an effective strategy, but it’s essential to invest in a way that allows you to follow a timeline and calendar, helping you avoid paying a premium while still achieving your investment goals. The upcoming auction on March 19, 2025, presents an excellent opportunity for those who have been seeking ways to ladder their treasury bonds, particularly the 10-year treasury bond.

The 10-year treasury bond pays coupons in December and June. We haven’t seen a bond in the primary market that pays out in both December and June for some time. For anyone, especially those who already hold the 20-year and 15-year treasury bonds (which pay out in July and January), this bond will help cover the cash flow for the June and December months in your calendar.

For those entering the treasury bond market and looking to average their bond ratings while covering different months, the 10-year bond is one you should target in the upcoming auction due to its June and December payouts.

However, it’s important to note that opting for the 10-year bond may mean leaving some yield on the table. In the upcoming auction, the 20-year bond is expected to offer a higher yield than the 10-year bond. This means that those purchasing the 20-year bond will likely pay less than you would for the 10-year bond.

That said, your investment strategies may differ. If your goal is to maximize returns and pay the lowest amount possible for the best discount, I would recommend the 20-year bond. However, if your objective is to spread your investments across different months—particularly if you already own the current 20-year bond that pays in July and Jan—then the 10-year bond is your best option.

Some of my clients, particularly those in the diaspora, often express the need to earn money each year, especially in December, when they are in Kampala. They prefer to spend the coupon payments rather than using their dollars. For these clients, the 10-year bond may be the ideal strategy, as it pays out in December, aligning with their spending needs during that time.

For those of you who already hold the 20-year and current 15-year bonds and wish to diversify your cash flow across different months, the 10-year bond is the best choice for you, especially considering its 10% withholding tax Bond too.

Thank you Alex for these tips. I am in the diaspora and ready to dip my toes in the Ugandan bond markets. How do I go about identifying the best bank to carry out my instructions? Any leads will be truly helpful.