He said,

"Alex, I had the money. I had just executed some good businesses post Covid recovery that at the time I had close to 500 million accumulated, and I always envied some of our neighbors every time we went back to the village, seeing the palatial bungalows they came back to while we returned to a tiny village house.

Courtesy photo.

The post-COVID period was good for my business, and without a good financial plan, I elected to construct this palatial home, it was a dream, and I truly believed I deserved it and yes I had to go for it.

Almost every single month now, with a few adjusted priorities, I ask myself why I put a shell of a house that I barely stay in for even 30 days a year, that we only use for Christmas periods.

It was a very reflective moment in his financial and investment journey and the decisions he had made, he is around 41 married and with 3 beautiful kids with wife and 1 outside of marriage. A man who enjoys a good beer and Ipsum and a man who has hustled in his medical entrepreneurship business.

As I listened to him continue to speak his mind, he touched on something, 'What truly makes this investment a bad investment is that it can't even bring in a bare minimum income.

I have tried to put it on Airbnb, but since it’s in the village where the majority of our neighborhood in Sheema have their own palatial houses, for most of the year, no one will even dare to rent it out. The only time people reach out is in December when I also want to use it, so it doesn't bring in money and just sits there.

I can't sell it because it’s on big family land, and in our district, we don’t sell; you can maybe sell to your brother or cousin. So, in reality, there is no way to extract value out of this beautiful but useful once-a-year country home, especially now that I might need the money or would have done it better to construct this house differently.'

Mbarara and western Uganda people, the principle of not selling your ancestral land is a good preserve, I have talked to many and they believe this is one untouchable thing. I love it . Back to story.

This is the story of a client of mine. We are recently trying to structure their asset portfolio, and among the many assets they held, this one captured my attention, especially in the festive season when culturally we go back to our villages.

We have tended to raise significant palatial homes in villages that are very costly to construct, but the only return they bring back is a feel-good factor and December accommodation.

As you go back to the village, and if you own one, maybe reflect on the actual return from that particular house.

Don’t get me wrong, many of us construct these for our parents, and if this is the case, then by all means, that’s an investment I sign off on any day, any time. They deserve the best.

But for those of us who do it just to fit in because our cousin did it, or everyone is doing it, rethink the strategy. Maybe rethink that whole investment strategy and ask yourself what that money you are about to put into that palatial home can do for you.

Even if you are to sit back and say, 'Where will I stay every time I go to the village?' hotels are there, and your family will be wholly accommodated. Or at best, invest the money wisely and use the proceeds over time to construct the country home. That way, you hit two birds with one stone.

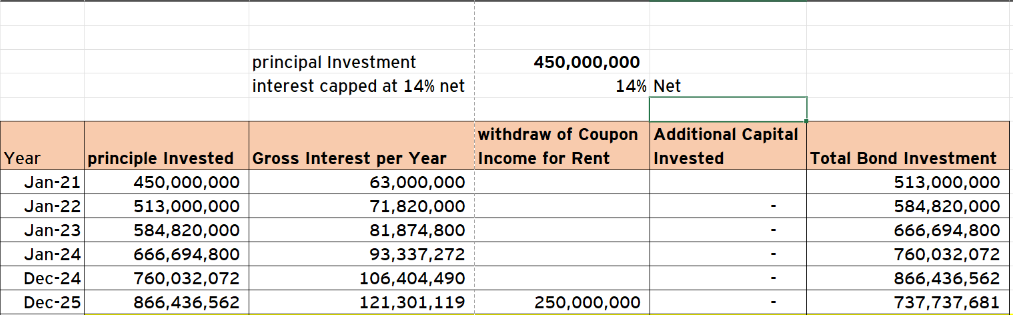

For my client, he deployed close to 450 million in this amazing country home in Sheema in early 2021, and construction was done before Christmas of 2021.

Had he, with more information and guidance, invested that money in a good treasury bond (2021 5-10 year treasury bonds were offering close to a 16% return), he would have earned close to 70 million per year for the last four years.

That alone would have grown his portfolio to over 800 million by December 2024, and he would have had enough money that even if at this point he took off just 200 million to construct a decent home, he would still have over 600 million invested and still bringing in more money than needed. Investment is most times about strategy, timing, and vision channeling.

I love reading your articles on investment.

And for once would like to differ with this one by asking,

What is the essence of money then?

Am agreeable to investing, but what do you use the money for once it has accumulated? Invest it again? Some peoples dreams are to own palatial homes in their villages.

we only go wrong where we compete with village mates who have already accumulated alot and can spare to build such.

After all isnt money supposed to enable us

achieve our dreams?

This is the same challenge diaspora people face or fall into. Put up an expensive house in Uganda, if your lucky you come to it for 2weeks once a year or every other year. On top of that you have to get family members to live in it while you pay for every bill while they ruin the house