Friends,

SBG Securities, a subsidiary Investment arm of Stanbic Uganda Holdings Ltd (SUHL), the publicly listed entity on the Ugandan Stock Exchange, launched its collective investment Unit Trust Fund named Stanbic Unit Trust last Friday. This fund positions SBG Securities as the sixth fund manager in a growing industry, coinciding with a period when awareness of investments in alternative channels, such as money market funds, is gaining momentum in our country and the total Collective Investments Assets Under Management have surpassed UGX 2.8 Trillion.

The Brand

SBG Securities is renowned for its strong presence on the Ugandan Stock Exchange as one of the leading Stockbroker, having been the sponsoring Broker for the public listing of MTN Uganda in 2021 and successfully executed the secondary listing of the 7% outstanding shares of MTN Uganda last month. The firm has been involved in numerous other public listings as a broker, including that of Airtel Uganda.

The leadership of the Fund Manager

The leadership of SBG Securities, under the guidance of a seasoned Finance executive Grace Ssemakula, CFA with over 15 years of working experience from African Alliance firm to NSSF Uganda where he rose to Portfolio Manager to UMEME Ltd and now SBG Securities. Mr. Ssemakula is working with a dedicated team that’s is highly competent, ensuring all operations are conducted with utmost clarity and professionalism to seeing that Investors funds are deployed in the most optimal way. Supervising the Management Team are the Board of Directors, chaired by the distinguished Agnes Konde Asimwe—many will recall her tenure at NTV Uganda—is another reason to place trust in the company's vision for building a successful Fund Manager. (On the Board of SBG securities is Francis Karuhanga and Mona Muguma Ssebuliba who both Graced the launch of the Unit Trust)

Collective Investments have some of the top pillar Governance structure and the Stanbic Unit Trust is no exception. The trustees of the Stanbic Unit Trust are KCB Bank Uganda, with Stanbic Bank Uganda serving as the custodian. As the leading commercial bank in Uganda, Stanbic Bank Uganda is a related party to SBG Securities. Both Stanbic and SBG are subsidiaries of Stanbic Uganda Holdings Ltd, the company listed on the USE.

Stanbic Unit Trust offerings and Innovation.

On the innovation front, the CEO of SBG Securities revealed on Friday that they are introducing critical solutions to the market. For instance, Stanbic Bank Uganda customers who invest in the Stanbic Unit Trust could experience withdrawal times as low as 4 hours, which is significantly faster than the typical T+1 turnaround time currently in the market. This revolutionary approach is particularly appealing for those who need quick access to their funds and already have an account with Stanbic Bank Uganda.

SBG Securities offers three-unit trusts: the Money Market Fund for short-term investors, the Standard Bond Fund for those looking to invest for two to five years, and the Stanbic Balanced Fund for long-term investors seeking exposure to the equities market. The Balanced Fund is ideal for those aiming for high dividends and capital gains from investing in stocks and shares.

All you need is a minimum of UGX 100,000 to start Investing with any of the Stanbic Unit Trust.

Conversations with executives and the CEO's speech at the launch indicate that their primary goal is to seek the highest yields for their clients, which currently lie in treasury bonds. They also aim to invest in top companies on the USE to provide returns for their investors.

Another notable innovation by SBG Securities is the introduction of the Junior Account within the Stanbic Unit Trust, allowing parents to invest for their children's long-term success. This industry-first allows parents to open an account in their child's name, with restrictions that promote growth over an extended period. The launch of this account is a game-changer for parents and future parents who wish to secure their children's financial future.

Management Fees

However, like other industry players, the Stanbic Unit Trust charges a management fee of 2%, which somehow has become the standard rate in Uganda by the different Fund Managers yet higher than the average 1.5% rate charged by the different players in other Regions like Kenya or even global rates of as low as 1%. While a higher management fee is understandable when assets under management are low, and the company has expenses, it is hoped that fees will become more affordable as yields improve, thereby offering higher returns to clients. The industry will be watching to see if the net performance justifies the current fee structure.

By the Numbers.

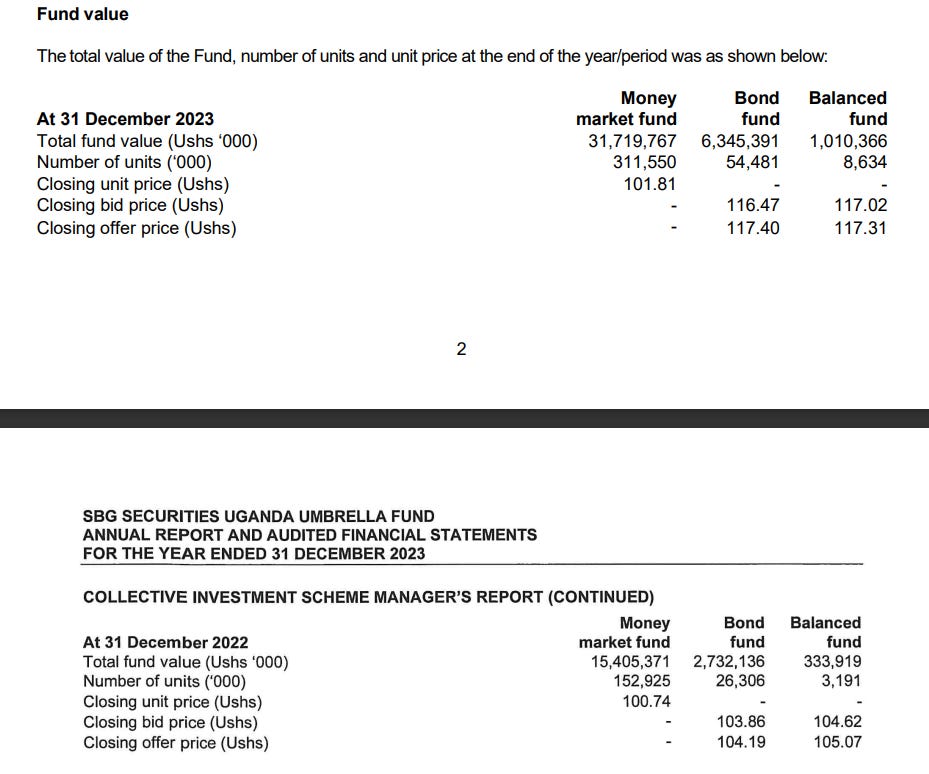

By December 31, 2023, the Stanbic Unit Trust had over UGX 39 billions Assets under Management.

The Unit Trust made a total income of around UGX 4.1 billion with an operating expenses of 782 million leading to around 72% of Gross Margin. As the Fund Manager’s Assets continue to grow, the anticipation is Gross margin made by the funds will continue to grow to industry averages of around 75% and above which would lead to Investors in the Stanbic Unit Trust earning more through their annual yields.