Friends,

One of the Salient questions today on X when we talk about Treasury Bonds and comparing them with Real Estate is whether it is advisable to finance the purchase and investment in Treasury Bonds with borrowed money (Taking a loan to buy a Treasury Bond). This question, however puzzling, largely depends on the buyer's personal circumstances and financial discipline and the kind of loan they can access (terms and rates).

This article seeks to analyze different situations concerning this topic, taking into account a central assumption of investing—the power of compounding. This is the long-term reinvestment of received coupon interest—gained every six months—into the another bond.

But first, “Personal finance and investment comprise 10% calculation and 90% behavior” said Nikita. This truthful sentiment is relevant when considering a 5 to 10-year investment in Treasury bonds, during which one faithfully re-invests their received coupons without withdrawals.

The specific focus in this case study will be the 10 Year Treasury Bond retuning to the primary market on April 17 2024 offering a 14.375% annual coupon, with a 10% withholding tax. This situation presents an investor with about 12.94% of the net coupon income that we will use when comparing with Loans. The bond matures in Feb 2033, offering roughly nine years of coupon reinvestment every six months for the investment value to compound.

For instance, if you invest UGX 50 million in this bond in April 2024 and consistently reinvest all the coupons received into the bond by 2033, your bond portfolio will stand a whopping UGX 168 million.

And if you increment UGX 3 million every six months on this initial amount, your portfolio could skyrocket to over UGX 300 million by 2033.

However, most people might not possess UGX 50 million in lump sum cash, and so we broach today's subject: Is it advisable to borrow to invest in a bond? Your answer should consider these factors.

The interest rate of your loan. Many can access low-interest loans at their workplaces, typically around 14% per annum.

Your other income sources. Can they finance the full loan term without withdrawing a single coin from the Treasury Bond? Salaried people are best suited here.

The willingness to re-invest all coupons fully back into the bond. Behavioral Aspect very key.

Whether your loan interest rate is a fixed rate on a reducing balance, as this allows the interest to diminish monthly as you make payments.

The loan period, Used five years.

To illustrate, consider a salaried person with a job guarantee for the next 5 to 10 years, and access to loans at 14-15% per annum. If you borrow UGX 50 million at a 15% fixed rate reducing balance for five years, your monthly payment to the lender will be approximately UGX 1.16 million. Over time, your bond portfolio increases and you handle your loan entirely from other income sources, the total amount repaid at a 15% rate by December 2028 will have been UGX 70 million. However, your bond portfolio would be valued at UGX 91 million—growing to approximately UGX 168 million by 2033—if left to mature. This venture will yield an impressive profit of over UGX 90 million by 2033 or just UGX 21 Million by 2028

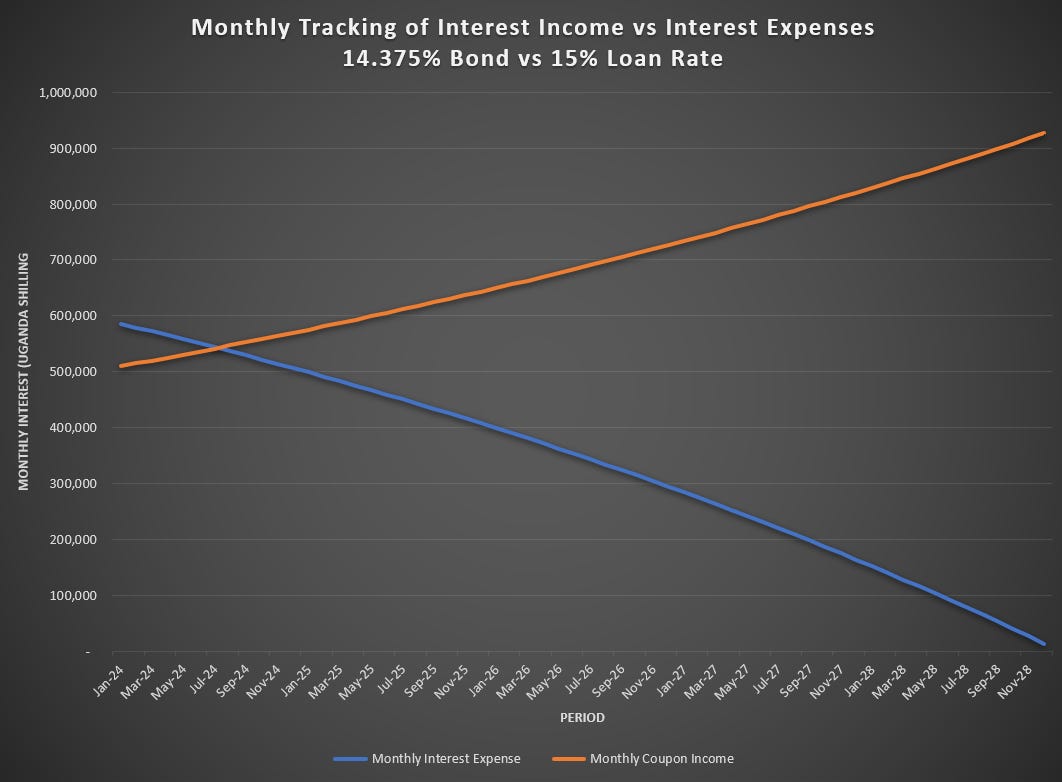

With such a low interest rate on loan, you would break even in 7 months and your monthly coupon interests (Investment Revenue) would surpass your monthly interest expense (Investment Expense).

The second illustration is based on a loan from a commercial bank at an approximate 19%-21% per annum reducing balance rate. Repaying UGX 1.3 million monthly over five years for a UGX 50 million loan equates to UGX 78 million by December 2028. Despite the higher repayment amount, your bond portfolio could still grow to UGX 168 million—yielding potential profit of approximately UGX 80 million by 2033 or just UGX 11 Million by 2028.

With such a high interest rate on loan, you would break even after 2 years and your monthly coupon interests (Investment Revenue) would surpass your monthly interest expense (Investment Expense).

These calculations should provide some insight into the prospects of borrowing to finance bond investments. However, caution is advised. Thoroughly discuss your specific circumstances with a financial advisor before proceeding.

To happy investments Everyone.

How does one 'consistently reinvest all the coupons received into the bond'? How does work? Like instruct the bank to do it or what?

Whenever working on a UGX denominated asset, you have to factor in the USD:UGX exchange rate. A devalued UGX wipes away the gain from the asset.