Friends,

For some of us, we desire and would love to plan for our kids to study outside countries especially for university, giving them one of the best chance to a future, but the biggest limitation has always been financing these expensive dollar demand opportunities.

Plan for your child’s future Education. If the education dreams for your child go beyond Uganda, it might be prudent to invest in a stronger currency like the Dollar, and the Old Mutual Investment Group Dollar Unit Trust fund is currently one of the best long-term options we have in the country.

In light of this, I want to pivot this conversation towards a strategic investment path. Many of you, with these strategic plans for the children could you use the current Dollar denominated Investment to build a portfolio for their Kids, especially using the Old Mutual Dollar Umbrella Fund. (This will help you earn income/interest in the dollar, hedge your investments against any heightened Uganda Shilling inflation or systematic loss of value of the Uganda shilling over a long period of time)

And some of the best investments are made by imagining the impossible, thinking long term and planning ahead before everything else. Like planning a tree.

In 20 years, what will that child's starting point be? Even more so is the question of how you have planned for your child's education 20 years from now. But starting early and having a compounded investment plan in a stronger currency might be all that you need that maybe in 15 to 20 years when the time comes for your child to go for that high education anywhere in the world, their education fund is strong and built up to a sustainable level.

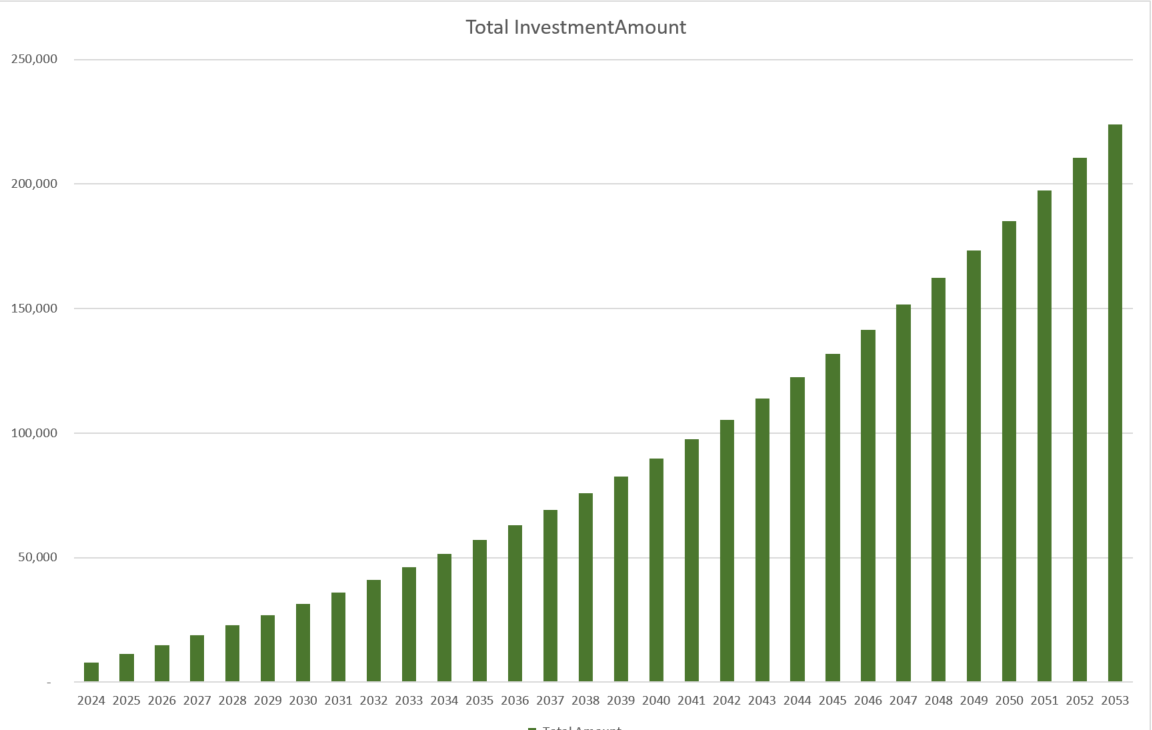

let's say you start with an opening balance of USD 5,000 and top it up monthly with USD 250 per month, how would that fund grow? Assuming that the return per year on that fund is sustained to around 5% per year for the time of the fund.

In just 5 years, your investment would grow USD 31,000 and in 10 years the compounding would lead to the investment grow to close to USD 50,000.

In 15 years, when you are thinking of the child going to University, that investment would have grown too close to USD 80,000 and a good starting position for a child’s education. (Imagine that, just starting with around USD 5,000 and add around USD 200-250 Per month or USD 2,000 per year, might help secure that child’s long term education plans in or outside Uganda)

If you start with USD 10,000 and add just an extra USD 200 per month into your Unit trust, that investment might grow to over USD 100,000 by the time the child is ready to go to university.

This is one of the ways to use the Capital Markets to plan and strategize and Invest with the goals of the future in mind.

If you enjoyed this letter, please consider sharing it with your friends and families.

I hope you have a great week and potentially invest in Uganda’s Capital Markets

Happy Investing Everyone

Alex Kakande

+256 771 404 377