Review: Uganda’s Housing Deficit – Affordability or Availability?

November 30, 2024

Friends,

The Ugandan dream may vary depending on income levels, financial background, religion, and even the generation people are born into. However, one thing that has remained integral to most people’s lives is land ownership as a sign of wealth. Real estate is one of the viable investments in Uganda, but the attachment to ownership seems to run beyond financial rationality. Given the sentiment about land, one would assume that housing would be a solved issue in Uganda. Alas, the numbers from the most recent surveys indicate a deficit of 2.4 million units. With an estimated population growth rate of 2.9%, the gap is expected to widen.

Housing Demand vs. the current Supply

The puzzle between demand and supply can be explained by the price of housing versus what people are willing to pay. Kampala real estate prices will make you wonder if we are all living in the same Uganda. For example, a 3-bedroom unit sold by one of the prominent real estate companies in Naalya is priced at UGX 315 million.

Unfortunately, this is not on the higher end of the real estate market. The prices in the high-end market are reserved for those earning in dollars. Converting the price of an apartment in Kololo or Naguru will have you questioning life.

The dilemma here is that as developers put these properties on the market, the intended customers are barely earning enough to meet these costs. This has resulted in many empty blocks around Kampala. Beyond the need for housing, there is a bigger need for affordable housing that is currently neglected.

The Housing Financing Dilemma

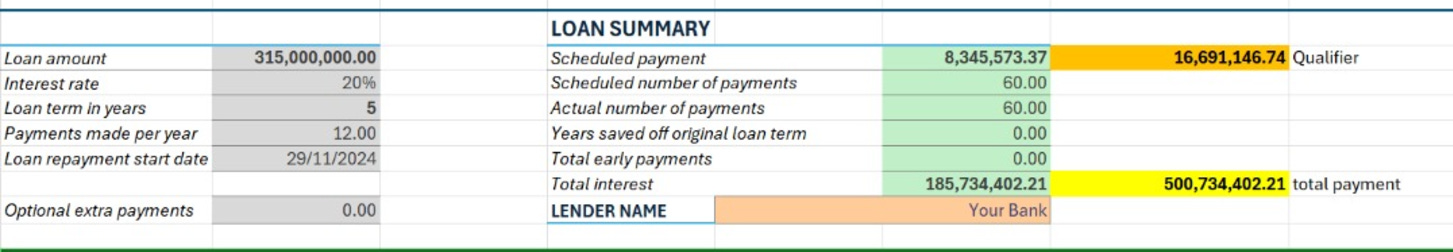

While most of the formal sector can access secured and unsecured loans, they are largely ineligible for the long-term loans required to purchase or construct a house. Even for those eligible, the numbers do not necessarily make financial sense. For the UGX 315 million apartment listed above, this would be the summary computation of the mortgage:

Short Term (5 years)

Interest Payments:

The interest would be UGX 185 million, which is essentially equivalent to the cost of constructing a 3-bedroom unit in an area on the outskirts of the city, say Gayaza (Plot 40 million, constructing 140 million). These are all approximations, but extrapolations can be made.

Eligibility: Most banks offer loans with a repayment amount capped at 50% of net pay, which means the loan amount one can get is restricted. For the case above, you need to be earning 16 million to afford the apartment.

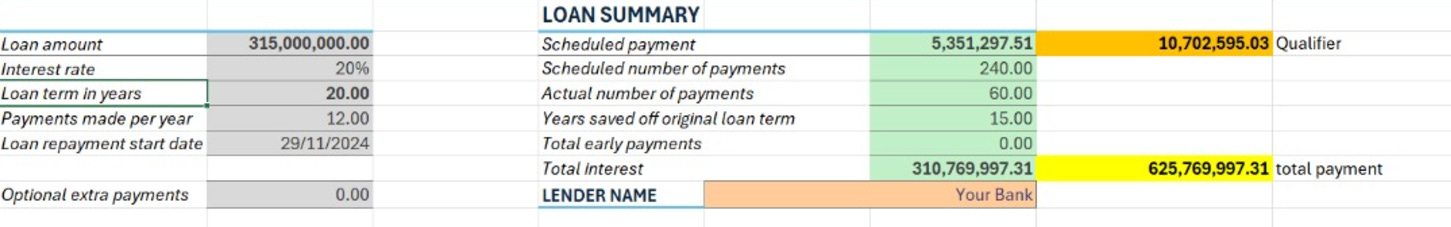

Long Term (20 years)

The 20-year loan might be in closer range for the target market looking to purchase. The interest payments (UGX 310 million) are, however, almost the cost of another house. All this is before taking into account the risk of foreclosure in case of loss of income and insurance costs. With all the above, no wonder there are a lot of idle properties.

Affordable Housing

Next week, I will be analyzing various financing options for constructing similar units. In the meantime, people who are buying these units, kindly share your secret or share your experience with getting a housing loan in the current banking environment.

Happy investing Everyone

I always also keep asking myself how do they make it indeed they should share with us their secret like it doesn't make sense for me to pay 8 million ugx per month on a 3 bedroom apartment. As an investor how can you rent and how much should I charge as rent on 3 bedroom apartment that takes 8 million ugx in debt service a month.

I have spent hours and hours analyzing and underwriting Ugandan properties but they almost not make sense for me even if a property makes 2% rent ratio of it's price it still don't generate cashflow.

Because look, debt service takes 70-80% of the properties income then what about taxes, maintenance and whatsoever, taxes alone takes 7-12% of the properties annual income.

So if 70% of properties income goes to debt service, 35-40% goes to property maintenance, it's already a negative cash flow.

Wait! Am I missing something here?