For many years in Uganda, we've regarded real estate as the absolute go to when it comes to investment opportunities in Uganda. This perception may stem from a lack of exposure to other alternatives products in the country, or simply unexplored data sets. Recently, I received numerous responses from individuals who had invested in real estate and sought a comparison with Treasury Bonds. Our focus will remain as impartial as possible.

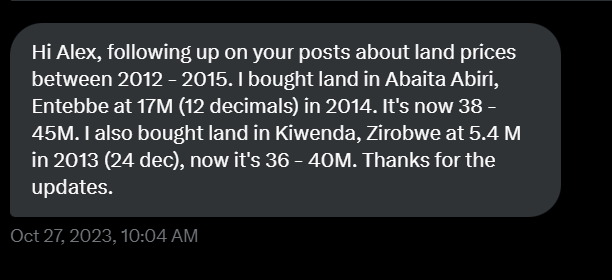

JM, a reader of this mail and an ardent X follower, narrated his investment journey, beginning with a land purchase in Abaita Ababiri back in 2014, where he has maintained ownership for a decade. Purchased at 17 Million UGX, it now commands a price ranging between 38 - 45 Million UGX.

Now, let's draw a parallel with the Treasury Bonds market. Back in 2014, a 10-year Treasury Bond offered around a 15% coupon rate, escalating to about 16% during the election season of 2016 -2017, before stabilizing around 14.5%. If JM had opted for a Treasury Bond instead, he would have amassed approximately 60 Million UGX by the end of 2023 by reinvesting the bond yield. Enough money to buy that same plot of land and or even a bigger plot of land.

Even more strikingly, the projected value of this plot for the next 10 years is 100 Million UGX. In contrast, his Treasury Bond, purchased at 17 Million UGX, would have ballooned to an impressive 213 Million UGX by 2033.

Therefore, those who made similar land investments in Abaita Ababiri over the past decade, or intend to do so over the next 10 years, might find Treasury Bonds to be a more fruitful venture.

However, there's more to the story. JM also purchased a plot in Zirobwe in 2013 for 5.4 Million UGX, currently valued between 36 - 40 Million UGX. Had he elected to invest in Treasury bonds instead, the bond would be worth just 22 Million UGX in 2023. In this case, his real estate investment, now valued at 40 Million UGX, doubles the value of the bond.

JM anticipates his Zirobwe land to appreciate to over 100 Million UGX by 2033, whereas the bond would only grow to around 80 Million UGX, still showcasing real estate as a more lucrative investment for this particular scenario.

In conclusion, it is clear when it comes to investments, there is no ultimate winner. Whether it’s real estate or Treasury Bonds, each has the potential to triumph, depending on the particular circumstances and timing and choosing the right one requires understanding their unique dynamics.

There is no blanket answer to the question of which investment is better. This analysis only underscores the importance of thorough research and informed decision-making when planning your investments.

Alex Kakande

Mr. Alex, thank you very much for the technical guidance you are really giving to the public. My opinion however, on the varying prices of a real state is due to their different locations. For example, the same food can be prepared in different hotels but the prices also vary depending on where it is and yet the same ingredients have been used. This may not necessarily be the same on treasury bonds. Otherwise, I have liked your posts very much. Byamukama Ronald - Bundibugyo.