Old Mutual Investment Group had an incredible 2024, and not even the change in leadership from Simon Mwebaze, who skillfully led the Fund Manager for nearly nine years, could slow down this progress.

The growth across all major funds, including the Ugandan Investment Funds and the Dollar Fund, is truly impressive. Their strong confidence in the market is clear from their outstanding year-end performance.

In an interesting twist however, the Balanced Fund has taken the lead as the highest-performing fund for the first time, surpassing the Umbrella Fund. Those brave enough to invest 5 billion in the Balanced Fund this year enjoyed a fantastic return of about 12.64%, leaving the Umbrella Fund's 11.85% behind. This year's performance is historic and sets Old Mutual on track to reach an incredible UGX 3 trillion in assets under management by the end of 2025.

Umbrella Fund

Balance Fund

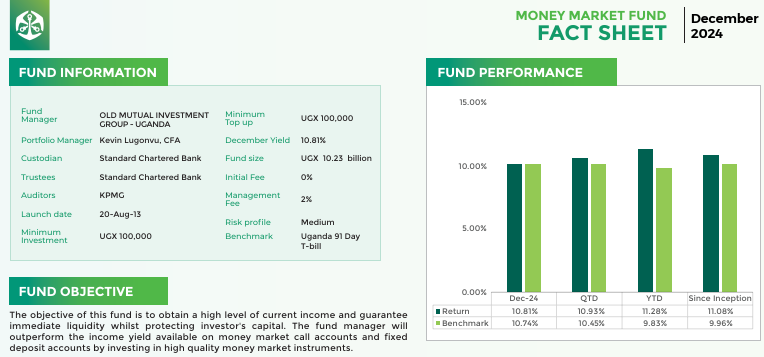

Money Market Fund

Now, let’s take a moment to consider how these funds have performed over the years. If you had invested 10 million at the start of the year, how would your investment have done? And what if you had 20 million? Would you be better off with the Money Market Fund or the Balanced Fund? Looking at this year's interest rates, it’s clear that those who placed their money in the Balanced Fund, with some exposure to the stock market, made a better return of 12.64% compared to the Umbrella Fund's 11.85%, which mainly focuses on treasury bonds and bills.

Regardless, both funds provided profits, showing Old Mutual's leadership in collective investment management while others are trying to catch up.

As shown in the graph for the full 12 months, investors in the Umbrella Fund, where many of us are, averaged around 11.4% in returns each month. Those who took a bolder step into the Balanced Fund, benefiting from access to the stock market, enjoyed an annualized return of 11.9%, nearly 50 basis points above the Umbrella Fund. Meanwhile, the Money Market Fund averaged around 10.89% over the year, trailing almost 100 basis points behind the Balanced Fund, which was the top performer.

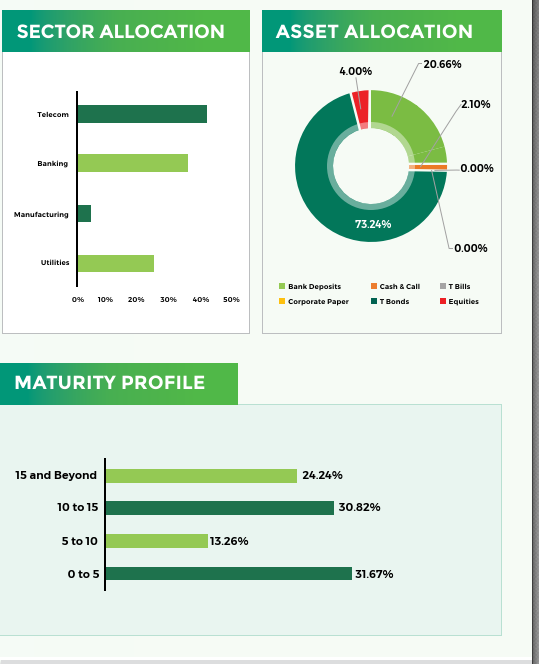

In 2024, the Balanced Fund outperformed all three Ugandan Challenge Funds for the first time in over four years. In the past, the Umbrella Fund always did better than both the Money Market Fund and the Balanced Fund, but this year, the situation has changed. The fund manager's smart decision to invest some funds in the stock market, around 4%, has paid off well. Yet, fundamentally, all three funds share similar characteristics, with significant investments in treasury bonds.

The Umbrella Fund has a 79% allocation in treasury bonds, mostly in 10-year bonds and longer, raising questions about duration risk. About 15% is in treasury bonds with durations of five to ten years, resulting in a notably high duration risk for the Umbrella Fund. However, investors in the Umbrella Fund know that their money is meant for the long term, as a rush to withdraw funds could force the fund to sell off assets.

The Money Market Fund, with 77% invested in treasury bonds, mainly in treasury bills, offers lower duration risk. Investors in the Money Market Fund are typically prepared to keep their funds in for 12 to 16 months, accepting slightly lower profits compared to those in the Umbrella Fund, who are playing a shorter-term game. Even in the Balanced Fund, around 71% of the investments are in treasury bonds.

Ultimately, all the funds have similar features. The choice is yours. If you've been investing in the Money Market Fund for the past four or five years and it has averaged less than 11%, why not consider moving that money to the Balanced Fund or the Umbrella Fund, where returns are more promising?

For those who invested 20 million in the Umbrella Fund at the beginning of the year without adding any additional funds, they would have seen profits of around 2.3 to 2.35 million, bringing their total to about 22.3 million. On the other hand, if the same amount was invested in the Money Market Fund, profits would have been around 2.1 to 2.2 million, which is 400,000 less than the Umbrella Fund. Clearly, the Umbrella Fund outperforms the Money Market Fund.

Even in the Balanced Fund, the majority of the money is in treasury bonds, around 71%.

In an exciting turn of events, the Balanced Fund emerged as the best performer in 2024 for the first time in over four years. An investment of 20 million would have yielded profits of around 2.5 to 2.6 million, nearly 250,000 more than the Umbrella Fund and 400,000 more than the Money Market Fund. While the differences may not be huge, if you're in it for the long haul, the Balanced Fund has proven to be the more profitable option this year. Overall, these funds are similar products, often yielding comparable returns.

Now, what about those who invested in the Dollar Fund? Have they done better this year? The year began with a high foreign exchange rate for the Ugandan shilling against the dollar, but the shilling has since appreciated. Would you have been better off investing in the Dollar Fund compared to the UGX Fund, given the current interest rates? If you had $1,000 at the start of the year and placed it in the Dollar Fund, how much have you made?

The Dollar Fund averaged around 5.0 to 5.4% over the months. For someone who invested $10,000 at the beginning of the year, they would have earned about $550 in interest income. But would they have been better off investing that money in the UGX Fund?

What about those who invested in the Dollar Fund?

Considering the UGX's appreciation in the latter half of the year, let’s analyze. If $10,000 at the beginning of the year was equivalent to around 38 million UGX, and that amount was invested in the Umbrella Fund with an average return of 11.7%, by year-end, they would have approximately 42 million UGX. At the current exchange rate of 3700 UGX per dollar, that would translate to about $11,400—almost $800 more than if they had invested in the Dollar Fund.

UGX Vs USD in 2024 that has seen the UGX appreciate and gain some grounds in the last half of the year.

If $10,000 at the beginning of the year was equivalent to around 38 million UGX, and that 38 million was invested in the Umbrella Fund with an average return of 11.7%, by the end of the year, they would have had around 42 million UGX.

However, the Dollar Fund serves various purposes, especially for those who spend in dollars and wish to avoid exchange rate risks. From a financial standpoint, it seems that investing in the UGX account yielded better returns in 2024 compared to the Dollar investment account.