Friends,

Old Mutual Investment Group continues to assert its formidable presence in Uganda's CIS Fund management sector, with one of its unit trusts surpassing the UGX 2 trillion mark in total assets under management. This umbrella trust fund, denominated in Ugandan shillings, saw its total assets exceed 2 trillion in May 2024, delivering an annualized yield of 11.25% to its investors.

By its total Assets, it would be the 9th biggest bank in Uganda by Asset base

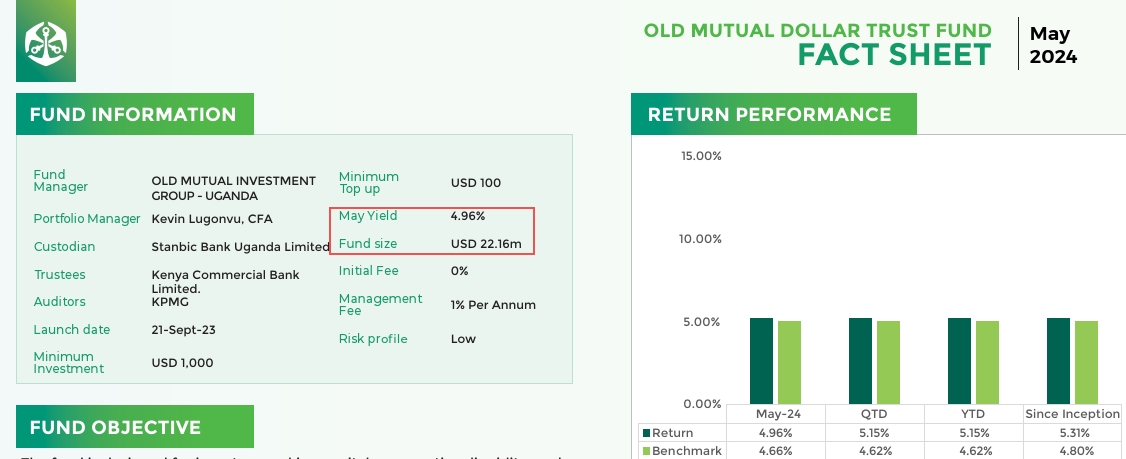

Additionally, the USD-denominated umbrella fund has shown impressive growth, reaching an equivalent of 81 billion UGX, or 22 million USD, with a return of approximately 4.96% in May 2024. This performance outpaces the yield of the U.S. 10-year Treasury bond for the same period, which stood at around 4.4% annualized.

The Old Mutual dollar trust fund offers a more attractive return for investors compared to those who might consider investing in a 10-year U.S. Treasury bond.

For individuals earning in dollars or seeking to diversify their investments into a more stable currency while still earning competitive interest rates, the Old Mutual dollar trust fund presents an excellent opportunity. Its returns are not only competitive in the global market but also comparable to U.S. Treasury bonds, making it a compelling choice for investors.

Following the umbrella trust funds, the money market fund holds a significant position with total assets of 9 billion UGX and an average annualized return of 11% for its investors. The balanced fund, with assets totaling 4.76 billion UGX, offers an average return of 5.5%.

For those interested in investing in stocks and equities without directly purchasing shares on the Ugandan Stock Exchange, the Old Mutual balanced fund could be the ideal entry point. This fund includes stocks and equities in its portfolio, providing a diversified investment option. Instead of dedicating time to understanding and investing in a single company, pooling investments through a balanced fund like Old Mutual's offers exposure to a variety of companies. This approach not only grants exposure to stocks and equities but also includes investments in treasury bills and bonds, catering to investors seeking a blend of asset classes.

Thanks Alex for the informative article! I would also appreciate if you wrote about index funds e.g. S&P 500, whether it is safe to invest in them for a person based in Uganda, how to choose the best index fund and how to start investing etc. It would also be interesting to know how index funds compare with trust funds in UG/the region in terms of profitability from a client perspective.