No Governor? No Prob: How BoU is Thriving Under Dep Governor Michael Atingi-Ego's Stewardship

October 7, 2024

Two and a half years have passed since the former Governor of Uganda's central bank Emmanuel Mutebire passed away on January 23, 2022, in Nairobi Hospital. Despite the position remaining unfilled, the absence seems to have had little impact on the operations of the Central Bank.

Deputy Governor Michael Atingi-Ego has stepped into the role with determination and has successfully turned the Bank of Uganda into one of the nation's most profitable institutions. In the last financial year, the bank reported a net surplus of UGX 1.1 trillion—almost quintupling its earnings from the previous year.

But the question arises: How has the institution, lacking a substantive head, managed to continue hitting targets and reaching new heights? And how has the Deputy Governor managed to steer not only the central bank but the entire financial system of the country in a direction that has resulted in one of the most resilient economies in Subsaharan Africa by many measures in the last three years?

From the operations of the Bank of Uganda, it is noteworthy that the central bank is the primary financier of the Government of Uganda's operations, providing loans to the government.

In FY24, the Bank of Uganda generated a staggering total of 539 billion in interest income from lending to the Government of Uganda. It is no surprise that by June 2024, the loans to the government had soared to over UGX 8 trillion, leaving the Treasury Department with no option but to issue long-term treasury bonds to the Bank of Uganda as a form of repayment instead of cash.

The cozy relationship between the Bank of Uganda and the Government of Uganda continues to yield remarkable profits for the bank in unprecedented ways. Before the government settled its debt with treasury bonds in July, the Bank of Uganda was one of the largest holders of Government of Uganda treasury bonds. Nearly 4 trillion worth of government bonds and bills were held by the Bank of Uganda, an investment that has earned it close to UGX 400 billion in the last year alone.

The Bank of Uganda's investments are not limited to domestic securities. It also invests heavily in treasury bonds issued by the US Government Treasury, the Swedish Treasury, the Chinese Government, the Inter-American Development Bank (IADB), the European Bank for Reconstruction & Development (EBRD), and others. These investments have helped the bank generate significant income totaling over 800 billion, while simultaneously meeting the country's foreign exchange needs with such exposure to strong currencies—a classic case of 'hitting two birds with one stone.'

Yet as everything is going well for the central Bank, it’s also going so well with the Institutions it’s supervising.

The Deputy Governor's tenure at the helm of supervising commercial banks will be remembered as a period when these banks reached unprecedented levels of profitability, driven by growing investments in government treasury bonds and bills rather than loans to the private sector to boost the economy.

For context, For the year ended June 2024, commercial banks' aggregate net after-tax profit (NPAT) amounted to UGX 1,419.6 billion, slightly higher than the UGX 1,399.2 billion reported in the previous year.

Notably, commercial banks' investments in government securities increased by 10% in FY24, compared to a loan growth of 6.8%—a trend that has persisted for the last 4-6 years. Some commentators argue that this trend is crowding out the private sector, as commercial banks prefer lending to the government over the private sector. The situation is exacerbated when one realizes that the growth in loans is not due to new loans being extended to the private sector but rather due to the capitalization of interest.

The Bank of Uganda is concerned about this trend, with projections for growth in loans to the private sector set at around 13%, yet actual figures are only half of that.

Oil Money.

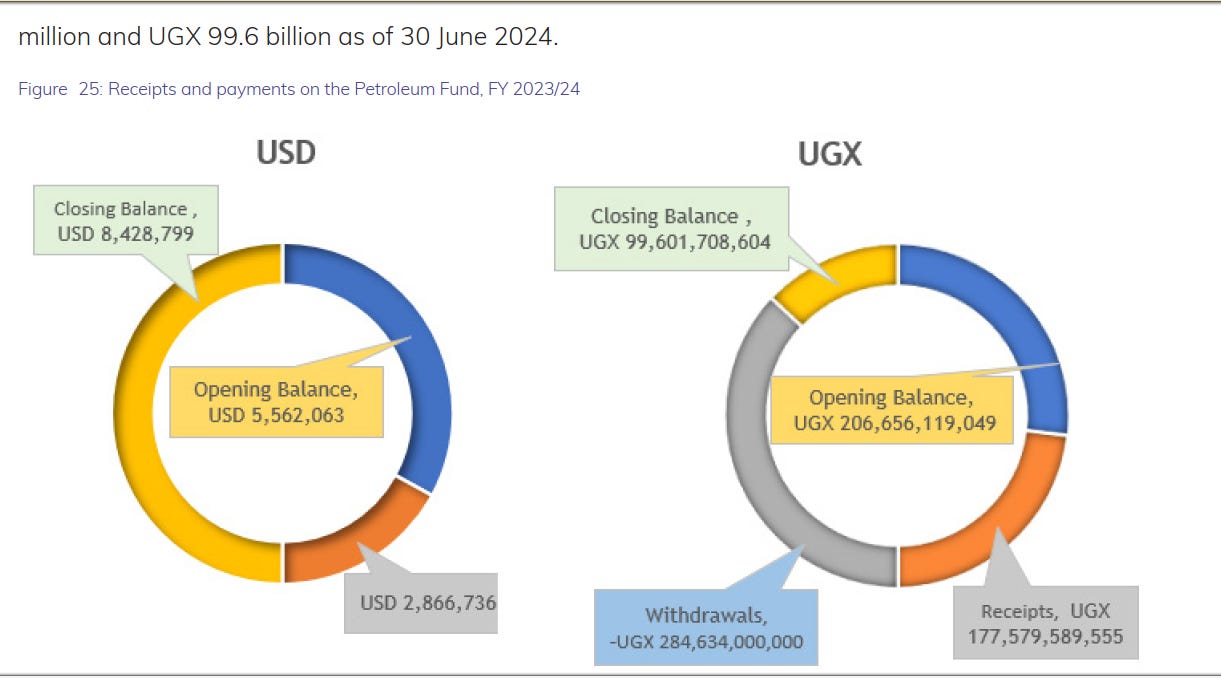

The Petroleum Fund, managed by the Bank of Uganda on behalf of the government, continues to grow, signaling that oil money has begun to flow, at least in terms of the fund's growth over the last year. For now, we can only wait and hope that those managing these critical resources prioritize the country's interests over personal gains.

Haba Group of Companies

However, like every compelling story, the devil is in the details, particularly concerning the money lent to the Government of Uganda by the Bank of Uganda. One notable case involves the Haba Group of Companies. Details are scarce, but the story goes that Haba Group, a private company, sought to borrow money from commercial banks using the Government of Uganda as a guarantor.

Aware of the government's reputation for delayed loan repayments, the Bank of Uganda issued letters of comfort worth UGX 140 billion to commercial banks to lend to Haba Group. Unfortunately, the company failed to repay, and the Bank of Uganda had to step in and cover the obligations, fully impairing the loan with the assumption that it might not be recoverable.

Meanwhile, the country's foreign exchange reserves have dwindled from a high of USD 4.1 billion to around USD 3.2 billion, with our import cover reduced to approximately 3.1 months—a decrease from an average of 3.8 months in the last financial year. The Bank of Uganda's mandate to manage inflation remains a critical aspect of its operations.

From an economic perspective, the steadfast performance of the Bank of Uganda in fulfilling its core responsibilities, such as managing inflation, might lead one to conclude that the presence of a full Governor at the central bank is not a necessity. Alternatively, it raises the question of whether Dr. Michael Atingi-Ego should be appointed as the full, substantive Governor. Given his impressive track record, one might argue that he is already doing an incredible job in the role.

Thriving, but at what cost to the D/Governor.

You may want to understand that the there are non delegatable roles that can only executed by the governor or deputy in the absence of the governor. All these roles now are on shoulders of one single man. When he is for a conference, the BOU remains with a vacuum, and when he returns, he is over worked.

Since last year IMF has been flagging the issue of BOU increasingly lending to the government. There rules on how much BOU should lend to government but it has broken them.

I don’t think issuing long term bonds can be viewed as repayment.