Navigating the Bond Market: Key Insights on September's Treasury Auction

Aug 21, 2025

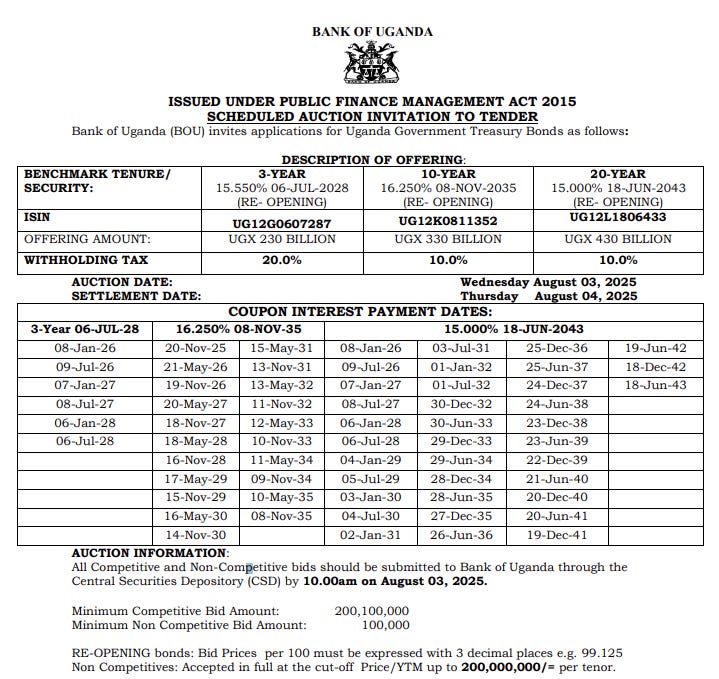

After a somewhat disappointing August auction, especially for the 25-year treasury bond auctioned off this month, Bank of Uganda has released the invitation to tender for the upcoming auction in September. This auction will take place at the beginning of the month on September 3rd, with settlement on September 4th.

UG12L1806433 - UGX 430 billion Offer.

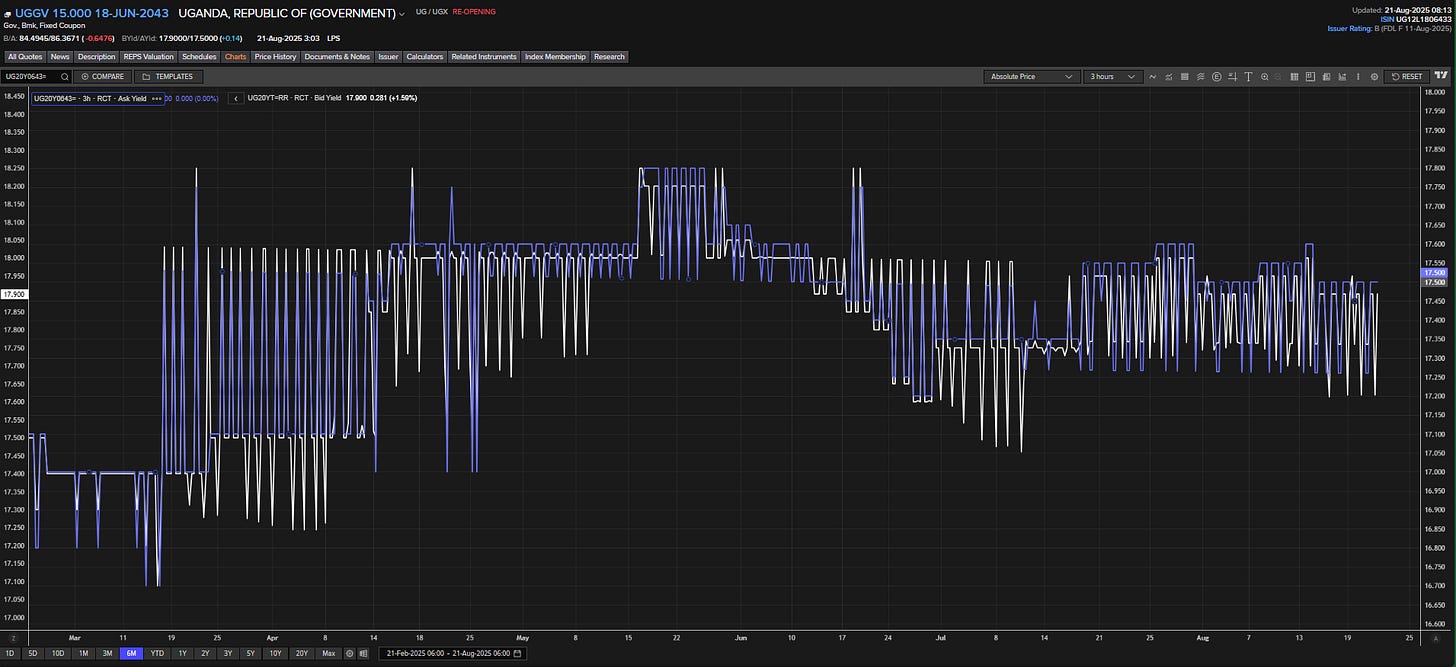

The auction will feature the 20-year treasury bond with a 15% coupon rate that is being reopened, and it remains a favorite among investors. The good thing about this treasury bond is that it pays a coupon in January 2026. The last time it was auctioned in July, it yielded a 17.9% return, providing our investors with around a 15% discount on the bond purchase. By the time it is sold off, it will have accumulated approximately 50 days of accrued interest.

While the discount rate on this bond may not be as high as it was in July, the anticipation is that it might still be available at a discount, as we are seeing trades in the secondary market around 17.3% and 17.4%, depending on the investment amount.

For discount hunters

Investors who always want to pay less, the 20-year bond remains a top choice. It is a must-have, as it will still come at a discount for as long as the yield to maturity is above 17%. It will resume paying a coupon in January 2026. Additionally, those who already hold this bond will receive payments in January and July, which means it does not allow for income laddering.

UG12K0811352- UGX 330 billion Offer.

The second bond will be the 10-year 2035 treasury bond with a coupon rate of 16.25%, the highest coupon rate on the calendar for the financial year 2025-2026. In the July auction, many investors flocked to it. Remember, this is a 10-year bond that matures in 2035. The beauty of this bond is that it pays in November, and May, with the next payment scheduled for November 2025.

If you buy the 10-year bond now, you would have around 80 days before receiving a coupon, which means it has almost 100 days of accrued interest.

For discount hunters,

this bond has a high probability of not being available at a discount due to this fact. In July, when it was issued at a yield of around 17.1%, it brought in just a 2% discount, compared to the 20-year bond that offered a 15% discount.

Therefore, if you are looking for a cheaper bond, this may not be the right choice for you.

Please note that this bond might not be available at a discount; it could actually be at a premium, or if it is discounted, the discount may be very small.

Bond Laddering Opportunity

However, if you already hold a 20-year bond or a 15-year bond that pays in January and July, the 10-year bond might be attractive because it allows you to purchase a bond that pays in May and November, enabling you to ladder your income and receive payments in different months.

UG12G0607287 - Ugx 230 billion offer.

Finally, the last bond will be the three-year bond with a 20% withholding tax. This is a reopened bond that was first sold in July 2025 and will mature in 2028.

Nice, keep them coming and thank you for all the educational content you put up

Great work Mr.Alex