MTN and Airtel Uganda: A Comparative Analysis of Financial Performance and Shareholder Returns.

March 7, 2024

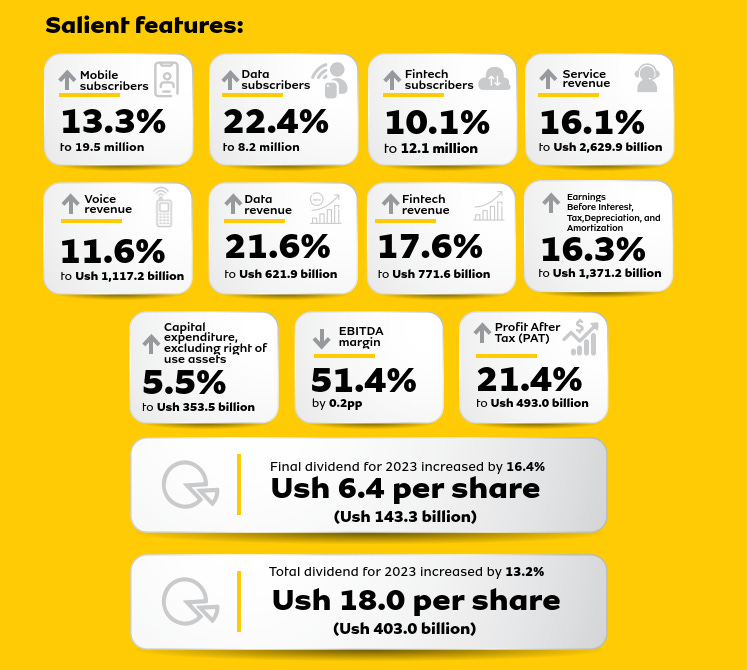

Yesterday, MTN Uganda, the leading Telecom and Mobile Money giant released it’s consolidated financial statements yesterday a summary of which is below.

For Investors.

Now that we have both the financial statements of MTN and Airtel Uganda, we can easily take a closer look at the performance of these two listed entities.

One crucial point to highlight is that the MTN Uganda listed company includes the Mobile Money business within its group which significantly contributes to the overall company's value. On the other hand, Airtel Uganda excluded the Airtel Money business from its listed company.

In the case of MTN Uganda, out of a total revenue of 2.6 trillion, Mobile Money contributed approximately 771 billion, reflecting a 17.6% increase. This contribution greatly boosts value for its shareholders. Given that Airtel Money's size is nearly equivalent to MTN Mobile Money, it is estimated to generate more than 500 Billion in revenue. The exclusion of Airtel Money from Airtel Uganda's listed company denotes a missed revenue opportunity for Airtel Uganda's shareholders. This, coupled with the 200 billion expenses paid to the Airtel Money company, results in a net cost of roughly UGX 700 billion.

This demonstrates that the revenue value derived by MTN shareholders from owning a piece of MTN is comparable to the estimated loss experienced by Airtel shareholders due to Airtel Money's exclusion from the listed entity.

Share price and Company valuation.

In the four months since Airtel Uganda became a publicly-traded company, MTN Uganda's shares have consistently maintained an average price of UGX 170 with an overall valuation of approximately UGX 3.8 trillion (USD 1 billion). Conversely, Airtel Uganda's share price has decreased from the initial highs of UGX 100 or UGX 4 trillion to today's Ushs 87 per share or UGX 3.4 trillion (USD 915 Million).

It’s also worthy noting that when MTN Uganda went public in 2021, it’s price dropped from the highs of Ushs 202 per share to the current stable UGX 170 per share. Where will Airtel price settle in?

Graph below highlights the return on share price for MTN Uganda and Airtel Uganda

MTN Uganda Share Price over time.

Dividends.

MTN has declared a final dividend of 6.4 per share, bringing the total 2023 dividend to Ushs 18 per share for investors, yielding a dividend return of 10.5%. This stands in contrast to Airtel Uganda, where a UGX 8 per share returned a dividend yield of 8%.

It is important to note that for Airtel, half of the dividend in the year was disbursed before the company went public and was claimed by their Main shareholder, Airtel Africa PLC. Thus, this reduces the actual dividend yield of the public company to less than 8%.

Alex Kakande