Maximizing Returns: Key Insights for the Upcoming 10-Year and 20-Year Treasury Bonds Auctions.

June 30, 2025

Investors,

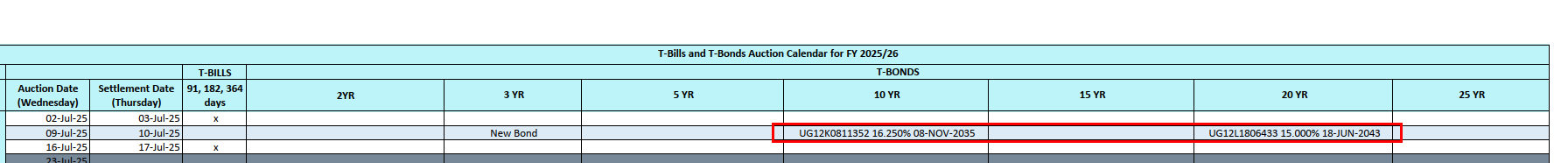

The 25/26 treasury bond calendar is finally out, and it's creating the excitement that we expected, especially for new investors who are looking to invest in some really good treasury bonds, particularly the longer-term treasury bonds that are being brought back to the market, along with the introduction of the new 25-year treasury bond.

However, the biggest question or inquiry has been about the optimization of investment, especially for those long-term investments, such as the 10-year treasury bonds and above. This is my thought process now.

The Excitement in the 10 year Treasury Bonds.

The 10-year treasury bond coming out with a coupon rate of 16.25%. Yes, it has a very high coupon rate, higher than that of the 15-year bond with a 15.8% Coupon rate and higher than that of the 20-year bond on this calendar with its 15% Coupon rate, and this is generating excitement.

This bond is being opened again because it was originally a 15-year bond. So, for those of you who always want to target higher coupon-related bonds, this is a very good bond at 16.25%. It is excellent for cash flows because the net return after tax is almost 14.7% at the coupon rate level, before we factor in the yield to maturity at which you will buy it.

Ask Yield of the 10 Year Bond projected around 16.6%-17% in July

The good thing is that this 10-year bond will be sold off at a time when the 20-year bond, which has a 15% coupon rate (which, after tax, becomes 13.5%), will also be auctioned. As you can see, the 10-year bond, if we are just considering the coupons alone, has a 120 basis points higher rate than the 20-year bond.

So, for those of you who might say, "OK, come July 9, if I'm going to go for the 10-year bond because I'm going to make more money in the 10-year bond than in the 20-year bond," you are not wrong, but not entirely correct.

The Ask yield of the 20 year Bond is projected at 17.2% - 17.5%

Of course, the 10-year bond has a higher coupon rate than the 20-year bond, but because the actual profit or return we make on treasury bonds is always driven by the yield to maturity, you then have to ask yourself: when the auction is finally done, which of these two bonds will have a higher yield to maturity, a higher cutoff yield, or which of these two bonds might be closer to a premium, and which one might have a higher discount to determine the actual profit that you want to make on your investment?

This is simple; I do not need to wait for the results to come out to tell you this: every single time, a longer-term bond will always come out with a higher yield cutoff than a lower or shorter-term bond. This is straightforward. This means that at an actual yield level, the 20-year bond will always come out at a higher yield to maturity or yield cutoff price than the 10-year bond. That is not negotiable.

You are lending to the government until 2043 for the 20-year bond, while for the 10-year bond, you are lending to the government for just 10 years until 2035. Now, the person who is lending to the government for a longer period, which is seven years over and above the 10-year bond, will make more money because of the yield component, as they are taking on a higher risk compared to someone who is lending for just 10 years. But let's also demonstrate it differently.

The 20-year bond, in the last close to two years, has always been sold at a discount. Even when it's about to pay a coupon, someone will buy it at a discount. If you have 100 million right now, you might get a discount of close to 7 or 8 million even on the secondary market.

So, my anticipation is that on the day of the auction, it would have just paid a coupon. The 20-year bond pays a coupon on July 10, which will be the settlement day of its auction. This means that for those of you who are going to buy it, you will be buying it when it has zero accrued interest, so you will get a very good discount right away.

However, you'll have to wait until January 9 to receive a coupon. But that's good because it means that even if it gets sold at 17.2% and above, you are more likely to get a 10% discount on that bond. So, if you have more money, you might end up buying a higher face-valued bond for the same amount of money. This has always been the case in the last year and a half, ever since that bond crossed the 16% yield in late 2023, and in 2024 and now 2025, it has been above 16% for most of the time.

However, the 10-year bond, which has a coupon rate of 16.25%, last paid a coupon in May and is going to pay a coupon again in November. This means that by the time they auction it off, it will have some accrued interest of around 50. By the time they buy it, it will either come off with a smaller discount or at close to par level.

This means if you have 10 million, you are going to get a bond of maybe 10.2 million or just 10 million for your 10-year bond,

Projected face value of the 10 year bond at a projected 17% yield.

while for the 20-year bond, someone who has 10 million might get a bond of 11 million.

Projected Face value of the 20 year bond at 17.3% yield.

You can see the difference: Ugx 11.5 million face value for the 20-year bond versus Ugx 10.2 million for the 10-year bond. That is how it works because the higher yield on the 20-year bond, which will happen at a time when the bond has zero accrued interest, will force them to get a higher face value of the bond compared to what would be a lower yield on the 10-year bond at a time when it also has accrued interest.

For those who are especially starting to invest in treasury bonds, and this is going to be your first time, I will tell you right away: go for the 20-year bond and maximize your return. If it's about the total actual profit, you are going to make more money with the 20-year bond versus the 10-year bond in the upcoming auction.

Treasury Bond Laddering Strategy.

However, the strategy of investing in treasury bonds is not solely about maximizing returns, especially for people who have already invested in other longer-term bonds. In the just concluded treasury bond auction, for example, many of the bonds listed in this calendar year—the 10-year bond maturing in 2034, the 15-year bond maturing in 2039, and the 20-year bond maturing in 2043—all pay a coupon in June and July.

This means if you have already bought any of those three bonds or all three, you have already covered two months on the calendar of June and July for paying a coupon.

Over time, we have always said that bond laddering is one of the best strategies you can deploy in investing in treasury bonds. When you do bond laddering, it allows you to always have cash flows coming in at any point, enabling you to maximize returns over a period of time.

This means if you already have a 20-year bond or a 15-year bond maturing in 2039 and 2043, which pay in January and July, then at that point, buying the 10-year bond maturing in 2035, which pays in May and November, is a strategic decision that I would recommend.

You are buying another bond that is going to pay you in different months—May and November. If you find yourself having just two bonds, the 20-year bond that you already bought in the previous calendar that pays in January and July, now you are going to buy the 10-year bond which pays you in May and November. That’s fine because you will receive your cash flows differently compared to someone who just piles up in one single bond.

For those who had bought the 2037 Bond, you sit back and think about how to approach this, you have to consider: if I already have the 2037 bond and I have it adequately, do I buy the 2035 bond? All of them pay in May and November. But if I do not have the 2037 bond and I already have the 2039 and the 2043 bonds, which all pay in January and July, then it makes strategic sense for me to go for the 2035, the 10-year bond.

However, you should go into this knowing that when the results come out, the people who are going for the 20-year bond will likely have received a higher discount and a better bond investment than you. But that's also okay because you would have gone there not with the sole intention of making more money, but to ensure you're getting paid in a different month and also managing what we call maturity risk, ensuring your bonds mature over different strategic periods for the foreseeable future.

Alex, this is a deep analysis that gives us insights beyond the surface figures like coupon rate. Reading this article has improved my understanding of the influence of the yield to maturity on net returns. I have also now understood what accrued interest is and how it affects the yield to maturity rate (cost of a bond). Thanks a lot!

Thank you Alex