In the last two weeks, you might have noticed significant advertisements, especially by influencers, promoting the LaRose Royal Apartments being constructed in Nakasero, Kampala.

Architectural impression of LaRose Royal Apartments.

When you look at the videos and photos being shared of the different apartments and the various sizes of the condominiums, you are left in awe of the design and the work the Chinese developers are doing. It is an incredibly majestic infrastructure project, targeting those who have money. The pricing suggests it is aimed at the right set of people, but it also raises questions when compared to what is available on the market and the realities of real estate in Kampala.

The truth is, for a long time, we have been saying that real estate in Kampala is extremely overpriced. The premium placed on almost every property listed is unfathomable. As we continue to see new foreign developers undertaking mass-scale developments, where you would expect significant economies of scale to lower the cost of condominiums, the opposite is happening. Prices continue to rise. Even if we focus on LaRose specifically because it is in the center of Kampala, Nakasero, the prices still do not seem justified. You would want to take a step back and ask if the prices are worth it or what the alternatives are for this kind of money.

For those who have seen the final prices, the cheapest condominium at the complex is a two-bedroom apartment going for $388,000, which is around UGX 1.4 billion. The most expensive two-bedroom apartment goes for $458,000, or around UGX 1.7 billion and their 3 Bedroom apartment at the top floor is going for as high as UGX 2 billion.

LaRose is so expensive that it makes Cadenza Apartments seem price-friendly. A top-level two-bedroom apartment at LaRose is more expensive than a three-bedroom apartment at Cadenza.

Architectual impression of Cadenza Residence

There is an argument that maybe the square meters of LaRose are different from Cadenza, and the access, space, and amenities might be better at LaRose compared to Cadenza. However, these are uniquely similar developments. Realizing that a two-bedroom apartment on the top floor is worth the same as a three-bedroom in Cadenza, when both overlook the golf course and the amenities of Kampala, makes you question the price points.

What is more striking is their payment plans.

Let’s use the two-bedroom apartment as an example. LaRose requires a 30% initial deposit for any apartment you want, which is higher than the 15% we see from other high-end developers. Yes, you read that right. With LaRose Royal Apartments, the deposit needed is 30% for any apartment you book, whether it is the highly expensive three-bedroom apartment for UGX 2 billion or the cheaper two-bedroom apartment for UGX 1.4 billion. You have to pay a 30% deposit and then pay the rest of the money in five-year equal monthly installments.

However, what is striking is the assessment of the rental revenue they estimate from these apartments. After the first two years of construction, during the last three years of your ownership, they take the revenue from the rental income, and you just pay off the top-up.

For someone who takes on the cheapest two-bedroom apartment at $388,000, you would have to pay around UGX 16,000,000 per month for five years, totaling close to UGX 1 billion. However, you can pay UGX 16,000,000 per month for 24 months, which is around UGX 380 million, and then they collect the rental income from your apartment and retain it.

You just top up the extra $1,100 or UGX 4 million per month. This assessment assumes your apartment is rented out at $3,500 per month. Otherwise, if it is not rented out, you still have to continue paying the extra money. The assessment is that a two-bedroom apartment should be making around $3,500 per month before any other costs.

But a two-bedroom apartment at UGX 1.4 billion, even if the target market for such apartments is not the majority of us, is what is making the prices of Kampala apartments and real estate extremely expensive and locking us out. Part of our engagement is to offer alternatives for those who have this kind of money.

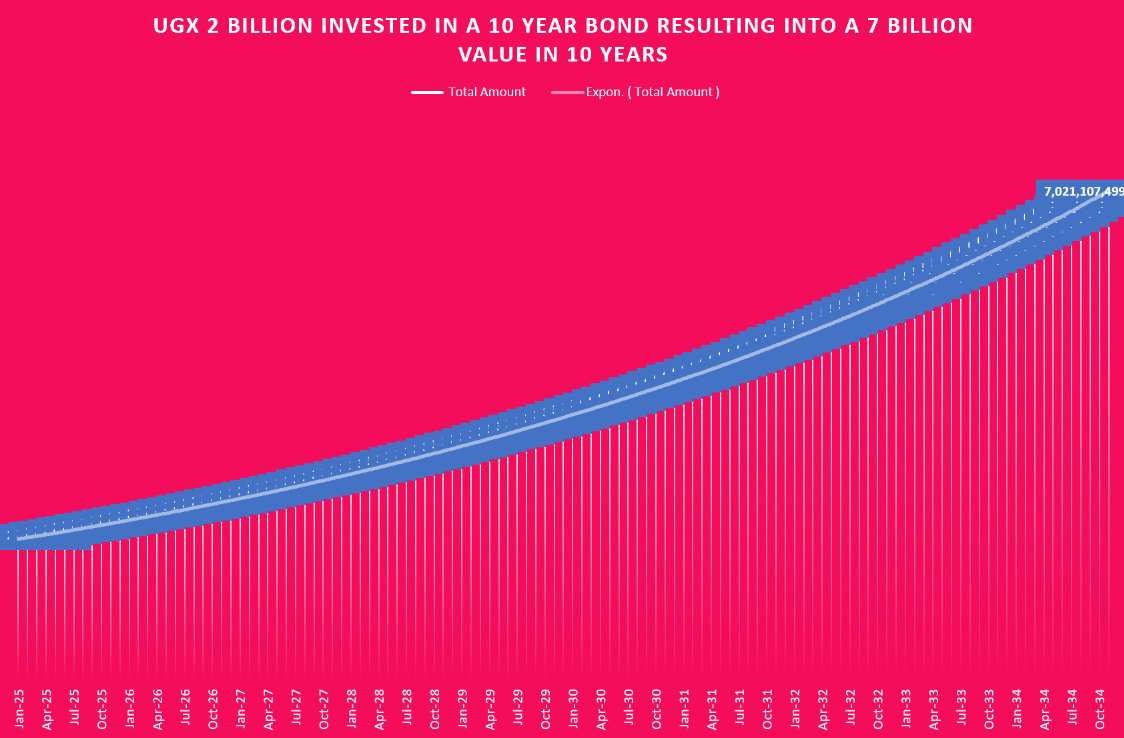

For example, investing UGX 1.4 billion in a two-bedroom apartment, if you instead buy a 10-year treasury bond, it will give you an income of $60,000 guaranteed after tax. That is almost $18,000 more than what you would make from renting out the apartment, before repairs, maintenance costs, and other expenses.

On the higher end, the two-bedroom apartments costing $458,000, or UGX 1.7 billion, are priced to bring in $4,000 per month before costs. That is an average of $48,000 per year before expenses. The same amount of money deployed in a 10-year or 15-year treasury bond would give you $70,000, almost $20,000 more than what you would make from the apartment if you are not staying in it and are renting it out.

While LaRose Royal Apartments offer luxurious living spaces, the pricing and payment plans make them accessible only to a select few. For those with the financial means, it is worth considering alternative investments that may offer better returns with less risk.

Even if you must buy a Residential House in Kampala, The cheapest Unit at LaRose is more expensive ($388,000) than this Modern 5 Bedroom 5 Bathroom House in Bukoto that’s going for $380,000.

This kind of pricing is for money laundering.

LaRose is probably targeting regional and the international market not merely the Ugandan market. There are some that own active gold mines and other precious minerals in the region. I think such people could easily afford this.