Land vs. Unit Trust vs. Treasury Bond: The Best Long-Term Investment in Uganda?

October 27, 2023

Dear Ugandans,

Yesterday's discussion on the long-term capital appreciation of land/RE was truly valuable. In Uganda, many of us have invested heavily in real estate because we believe it is the best low-risk, low-activity investment. But what does the data say?

In this series of articles, we will focus on a particular class of Ugandans with ready cash to buy everything and particular locations. Prime locations like Kyanja, Kungu, and Kira are some of the best places to buy land for capital appreciation.

Case 1:

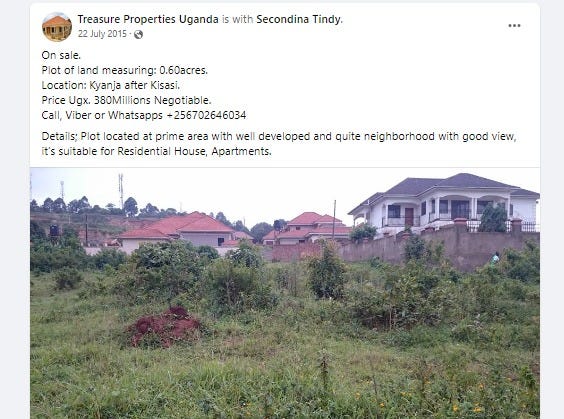

In July 2015, a plot of land in Kyanja was selling for 380 million shillings. This is the quoted public price, but My research indicates that such a plot sold for between UGX 300 million and UGX 350 million. For this discussion, let's assume the price was UGX 300 million.

Quoted price of 60 decimal plot in Kyanja

From an online survey and in some groups I’m in, I asked how much would this plot of land go for right now, 9 years later, and answers ranged from 500 Million to 700 Million.

My closest estimate of the current sale price might be around 600 million shillings at the lowest and 750 million shillings on highest. This means that a plot of land that cost 300 million shillings in 2015 (as above in picture) is now worth at least 600 million shillings, doubling in value. At best, it is worth 750 million shillings, a significant increase.

What if you had invested this money in other products? What would have been the return?

Unit Trust: If you had invested 300 million shillings in a unit trust with the lowest return over the same 9 years, you would now have 780 million shillings with an average return of 10.5% per annum. With an average return of 11.5% per annum, you would have 870 million shillings.

Treasury Bond:

If you had invested 300 million shillings in a treasury bond in 2015 (the comparable bond at the time, UG0000001517, had a coupon of 17% for a 10-year treasury bond issued in 2015), you would now have around 1.7 billion shillings in total bond value with compounded coupon investment.

Now the goal is yours: Where do you want to invest next if you have cash at hand and your goal is to invest for the long term (over 10 years)? Buy land, invest in a unit trust, or invest in bonds?

If you enjoyed this letter, please consider sharing it with your friends and families,

I hope you have a great weekend and potentially invest in Uganda’s Capital Markets.

Alex Kakande

This is so insightful, could please refer me to a good MMF in uganda. Appreciate.

Forever Grateful!, thanks Mr Alex for this Analysis.