Investment Analysis: Why We Are Not Moving Forward with the Apartment Complex Purchase

The Challenges of High Valuations and Low Returns in Real Estate.

It’s not entirely the fault of the housing market players (though to a large extent they are inflating the quoted prices for lack of tracked databases of closed deals).

It's just that the alternative right now, especially the liquid, low risk returns offered by unit trusts and Treasury bonds Investments, are much better when you factor in all conditions at play for the majority of people starting their investment journey.

Courtesy photo of the Apartment we intended to acquire.

Three weeks ago, I published an investment opportunity in an apartment that was being sold for UGX 3.3 billion, calling on interested parties to join hands as investors in an equity LLC with a minimum investment of 30 million per person.

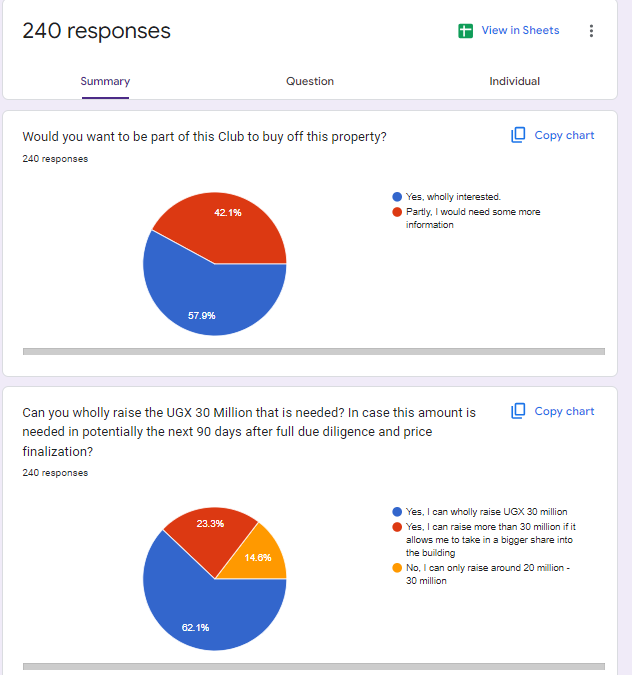

I received interest from a total of 240 people, with some willing to contribute as much as UGX 78 million to secure a higher percentage. Since then, we have been conducting our due diligence to ensure everything is in place before executing the transaction.

That was a commitment of UGX 7.2 billion (USD 2 Million). This was beyond what I had, even personally anticipated and I plan to reach out to each and find a way forward beyond this property and how we can harness the power of this collective effort to make tangible investments.

The Graph below indicates the total number who formally expressed interest in investing in the Property through an LLC Equity contribution

However, since we published the invitation for capital, a few issues have come to light during our due diligence and valuation of the property, leading to the transaction falling through. We will not be moving forward with the purchase of the complex, and in this email, I will detail the reasons why.

Valuation of Income generating Properties in Uganda

Consensus 10 Year payback period method of valuing Real Estate Income property.

When it comes to real estate valuation in Kampala, there seems to be now a standard practice and valuation methodology where developers or agents of cash flow-generating properties have adopted a straightforward method of using the payback period with an estimated time of 10 years based on the maximum achievable revenue of the property can generate before expenses or taxes. This means if a developer is selling a property, they will assume the current income potential.

To demonstrate the point above, consider 4 income generating rentals/apartments below. (The Revenue per month, assumes full occupancy and full payment of rent)

For example, if the property can generate UGX 10 million a month (Property 2), which is UGX 120 million a year, they would value the property at UGX 1.2 billion. This valuation method is commonly used in the Kampala real estate market.

However, this method assumes three things:

that the property is fully rented out for the entire year, that all units are occupied, and that the maximum income is achieved. If some units are not rented out, the maximum income is not realized, and this would make the 10-year payback period to be over-estimated and the sale value would be high.

Kiwatule Apartment consideration

For the apartment complex we wanted to buy, the maximum allowable income was around 30 million which would bring to a total of around 360 million a year which explains why it was first listed at 3.6 billion 4 months ago. But our due diligence from the rental rolls revealed that on a good month, the income was around UGX 23 - UGX 24 million, which is UGX 6 million short of the maximum. If we averaged this to 24 million, then the actual revenue in a year would be 280 million and potential Acquistion price of 2.8 billion.

If however, you end up considering UGX 30 million per month in Acquistion valuation yet in reality you only get UGX 24 million, and the UGX6 million per month shortfall continues, it could result in a loss of UGX 60 million over a year or UGX 120 million over two years to a maximum of 600 million in lost revenue in a period of 10 years in worst case scenario, which is rarely factored in by developers or sales agents, making the valuation expensive.

Additionally, when valuing properties, developers often consider only the revenue and not the expenses such as management fees, taxes, and maintenance costs. For instance, taxes must be paid objectively every year.

Kiwatule considerations.

Because the property would have ended being acquired through an LLC, the current tax regime allows you 50% of revenue as allowable expenses and paying tax of 30% as property tax. This high tax regime on rental income for properties owned by entities would lead to Taxes of around 50 million plus per year with an assumption that all apartments are rented out plus other Management fees and occasional repair and maintenance costs to running such a good and big apartment complex.

Rental increases, which are typically around 10% every three years, should also be factored in. This is a positive factor that would need to be factored in every time you are making an assessment for Rental income you can make from a property.

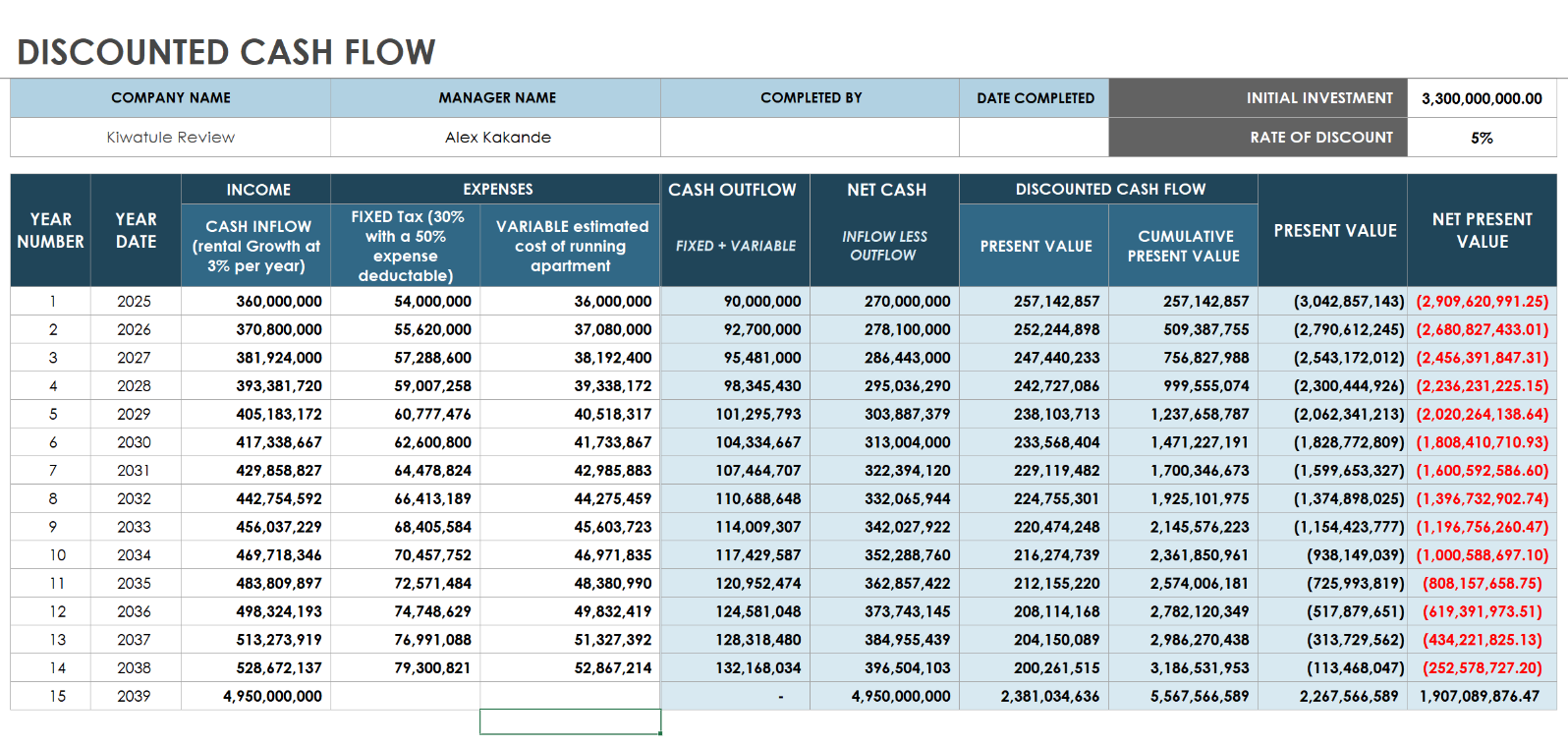

Discounted Cashflow tracking of the Rental Apartment project.

Even if we took the UGX 3.3 billion valuation with the assumption that the property would generate 30 million per month (UGX 360 million per year), after considering a 30% tax on income, management fees, and other related costs up to 10%, the payback period would be 12 years and the total income earned in year one would have been 270 million which would have brought the valuation of the property to around 2.7 billion (considering the 10 year payback period that has been widely adopted)

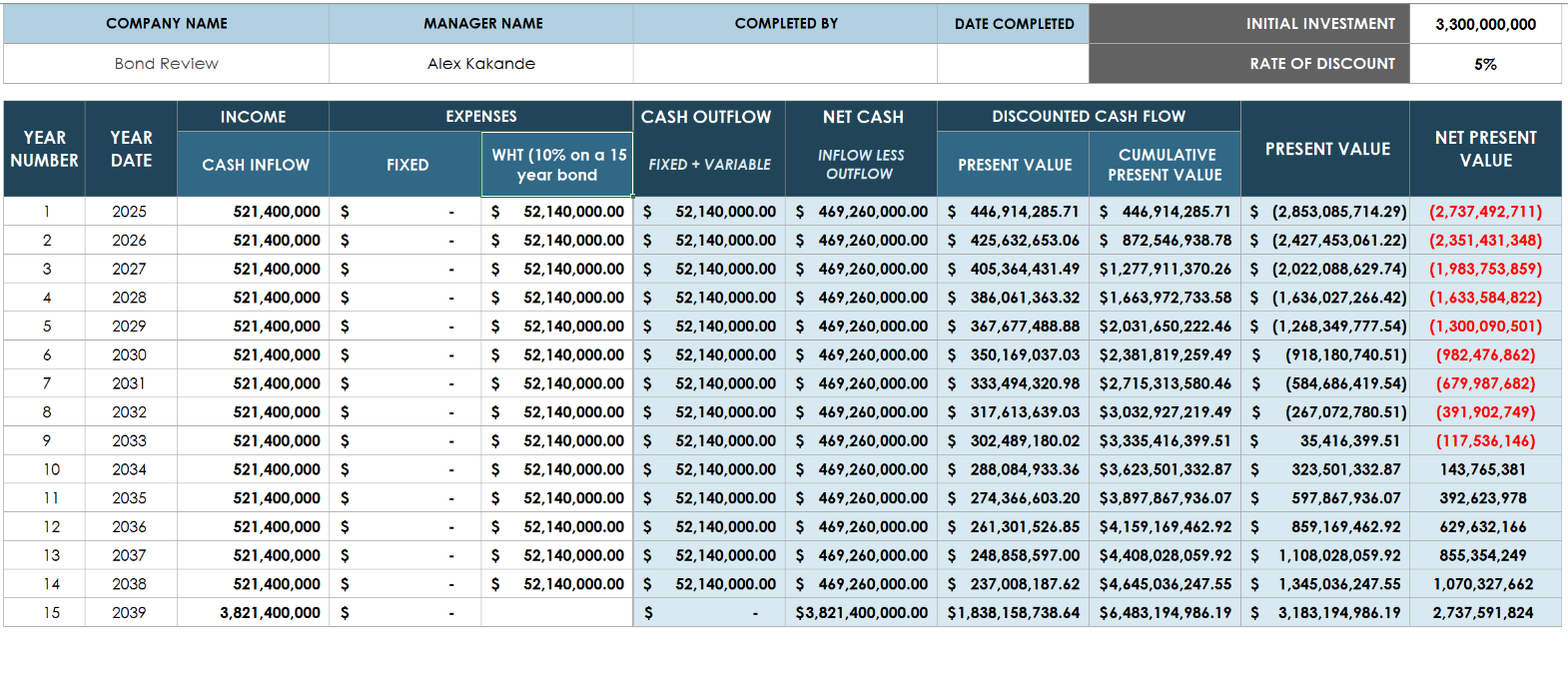

This is a long period compared to the current market alternatives like unit trusts with a payback period of around 7.5 years and treasury bonds with a risk-free rate of 5.5 to 6 years.

When considering the present value of money, factoring in an average inflation rate of 5% as our discounting factor, it would take 14 years to recover the initial investment of UGX 3.3 billion. This is significantly longer compared to an 8-year payback for a treasury bond and around 9.5 years for a unit trust. The valuation method that caps the return at 10% results in a longer recovery time than desired.

Discounted cashflow tracker of the A 15-year treasury bond investment

Exit Strategy

The exit strategy for the investment would have been viable if we could factor in selling the property after 15 years. Assuming a 10% rental increase every three years, the property would generate around UGX 450 million in rental income in its 14th year, and could be valued at around UGX 5 billion. However, this is debatable, and the actual valuation could be higher or lower. If sold for UGX 5 billion, the profit would be UGX 1.9 billion in present value terms, which is still less attractive compared to other market alternatives.

The Underlying Challenge with expensive and Over-valued rental properties in Kampala

The issue starts in the valuation of rental properties in Uganda, which generate low cash inflows and when considering repair costs, management fees, and taxes. From the return perspective for Investors, this makes it an unattractive business venture compared to other risk-free options on the market right now especially for majority of us who are just starting off the investment journey and our goal is to grow our investment net.

To make property investment viable, the initial valuation should match future cash flows in a more realistic manner. The return from this property is around 9% before tax and management fees, while unit trusts offer 11% (net of Management fees) and long-term treasury bonds offer 14% after tax.

For such a property to be competitive with unit trusts and treasury bonds, it should be valued at around UGX 2.2 to UGX 2.4 billion. However, the seller was not willing to sell at that price, which is understandable given the high construction and borrowing costs. This made the property expensive and unattainable for investors.