Our Anniversary. - It’s now a year since I officially started this Newsletter, Over 200 Articles published, and I want to extend a sincere Thank You to each and everyone of you that has read, shared and contributed to the Growth of this platform.

Friends,

A real estate opportunity has recently emerged in the Buwate neighborhood of Kampala, Uganda. The property listed states a monthly rental income of UGX 12 Million, While the property's initial value of UGX 1.5 Billion. The Property is 12 Units Apartment Block each unit bringing in Rent of UGX 1 Million.

The property Ad as seen on X.

In Kampala, truly many of us know, Real estate investment can be a great way to build wealth over time, but it is important to understand the risks involved.

One of the biggest risks is using debt (Bank Loans to finance your investment especially Purchase of properties).

In this article, we will assess a real estate investment opportunity in Naguru, Uganda, and explain why it is risky to invest in this property using debt.

Assumptions.

The following assumptions are made in this assessment:

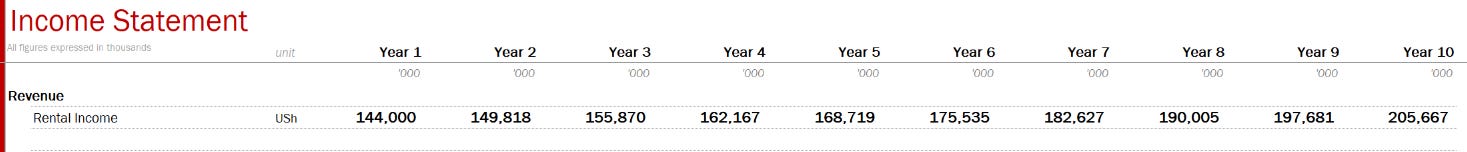

The property has a revenue income of 12 million per month, or UGX 144 million as stated in the advert.

The property has an initial value of UGX 1.5 Billion.

The investor borrows 75% of the money (UGX 1.1 billion) for 10 years at an interest rate of 18%. (this would be a generous offer in Kampala currently if you can obtain a 10 year loan at 18%) But for this article, we are going to do it from a business perspective and see what your profit/loss account would look like if you are to borrow this and track it from a business perspective.

Rental tax is 12% on total revenue.

The property appreciates in value by 8% per year which would ideally make the value to double in around 10 years.

The following are the key findings of the assessment:

Over the first 6 years, the investor would operate at a loss due to the high interest payments on the loan of 18%. With a projected rental income increase of 2-3% per year. The total income in the 10 years would be 1.7 billion Uganda shilling yet total interest expense would be 1.3 Billion Uganda Shilling.

Screen below shows the projected Income statement of such a project.

In the period of 10 years, you would have to pay back a total of UGX 2.4 Billion (Loan of UGX 1.1 Billion and UGX 1.3 Billion in interest payments) to the bank assuming your 18% interest rate is on reducing balance, else if it’s on fixed rate. This could go even up.

The property would appreciate in value over the 10 years, but the investor would need to get money from other projects to finance the loan each year. This would eat away at the total value of the investment, so that in year 10, the investment would be worth less than 10% of what the investor bought it. The property would put you in so much debt that by 10 years, the value of the property would be around 8 billion while your value of debt would be around 7 billion. Why?

The interest expenses to pay off the loan are higher than rental revenue and this would make you borrow from your other sources just to finance this project, whether that borrowing is from your own other projects or from other sources like salaries.

Screenshot below showing the Financial Position of the Investment. Property would double in value, but other parameters would get hit.

By the 10th Year, the property would be around UGX 2.6 billion by this estimation or much more but after paying a liability of around UGX 2.4 billion in Liabilities and UGX 400 millions of your own money at initial Acquistion (So paying a total of UGX 2.8 billion).

Cashflow statement of the project. Because the Revenue generated is not enough to pay off all expenses (interest expenses), you would have to finance the project by borrowing/using funds from other sources leading to negative cashflows of the project for 10 years.

Real Estate Leverage.

In order to understand why this investment is risky, it is important to understand the concept of leverage. Leverage is when you use debt to finance your investment. This can amplify your returns if the investment is successful, but it can also worsen your losses if the investment is unsuccessful.

In the case of this investment, the investor is using a lot of leverage (75% of the value of the property).

They are borrowing half the money to finance the investment. This means that even a small decline in the value of the property could result in a large loss for the investor.

The investor in this example is paying an interest rate of 18%. This is a very high interest rate. It means that the investor will have to pay a lot of money in interest each year which cant be matched by the corresponding Revenue from the property. And it’s this point that is causing a lot of Bank Foreclosures on Rental properties in Uganda. The interest expenses that people are paying is extremely high compared to the Revenue the end up generating from the property especially for the fist 5-10 years.

Finally, it is important to consider the capital gains tax on the property. When the investor eventually sells the property, they will have to pay capital gains tax on any profits they make. This tax can be significant, especially for high-value properties.

If you enjoyed this letter, please consider sharing it with your friends and families,

I hope you have a great week and potentially invest in Uganda’s Capital Markets.

You are correct that financed deals need more scrutiny than cash deal.

Generally, they offer more opportunity for gains if evaluated properly.

The best rule I have found is:

"Be cash-flow positive from day 1!"

As you said this is not the case here.

A few things anybody considering a deal like this also needs to consider that is not shown in the calculations presented:

• The property needs management - a property of this size should be calculated with about 8% of rent income in management fees

• The property will require maintenance and repairs - 5% of rent should be calculated

• The property will need CAPEX, not in the first 5-8 years but at some point, latest hitting 10 years, so 5% of rent income should calculated to accumulate sufficient funds for CAPEX, things like new roof, new air conditioning, new water heater, new floors ...

• The property is probably not always fully occupied, so you want to calculate 3-5% of rent for vacancy periods as the payments to the loan have to happen regardless of occupancy

This means 20%-25% of rent should be set aside for all these needs.

A good deal is found when you still have at least $1 or UBX1 positive cash flow after loan cost, taxes, plus the items listed above have been included in the calculation.

Otherwise I would stay away.

Thank you Alex for this piece of information. I have also factored in the vacancy rate. Normally, when the project is complete, it doesn't attract a 100% occupancy on its launch. The rate gradually increases as the place gets known and attracts potential tenants.