Friends,

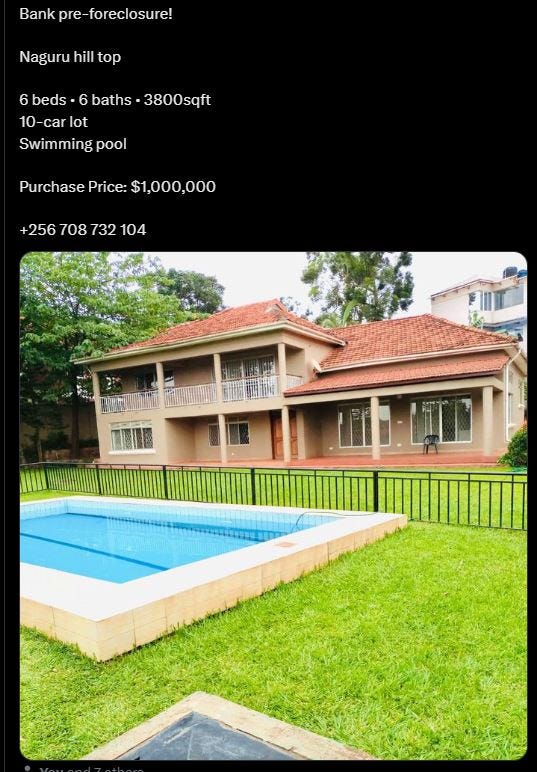

A real estate opportunity has recently emerged in the Naguru neighborhood of Kampala, Uganda. The property boasts a monthly rental income of $3,000, equivalent to approximately UGX 11 million at the current exchange rate. While the property's initial value of 1 million USD (UGX 3.7 billion)

The property Ad as seen on X.

Real estate investment can be a great way to build wealth over time, but it is important to understand the risks involved. One of the biggest risks is using debt to finance your investment. In this article, we will assess a real estate investment opportunity in Naguru, Uganda, and explain why it is risky to invest in this property using debt.

Assumptions.

The following assumptions are made in this assessment:

The property has a revenue income of $3000 per month, or UGX 11 million as stated in the advert.

The property has an initial value of 1 million USD, or UGX 3.7 billion as stated in the advert.

The investor borrows half the money (UGX 1.8 billion) for 10 years at an interest rate of 18%. (this would be a generous offer in Kampala currently if you can obtain a 10 year loan at 18%)

Rental tax is 12% on total revenue.

The property appreciates in value by 8% per year which would ideally make the value to double in around 10 years.

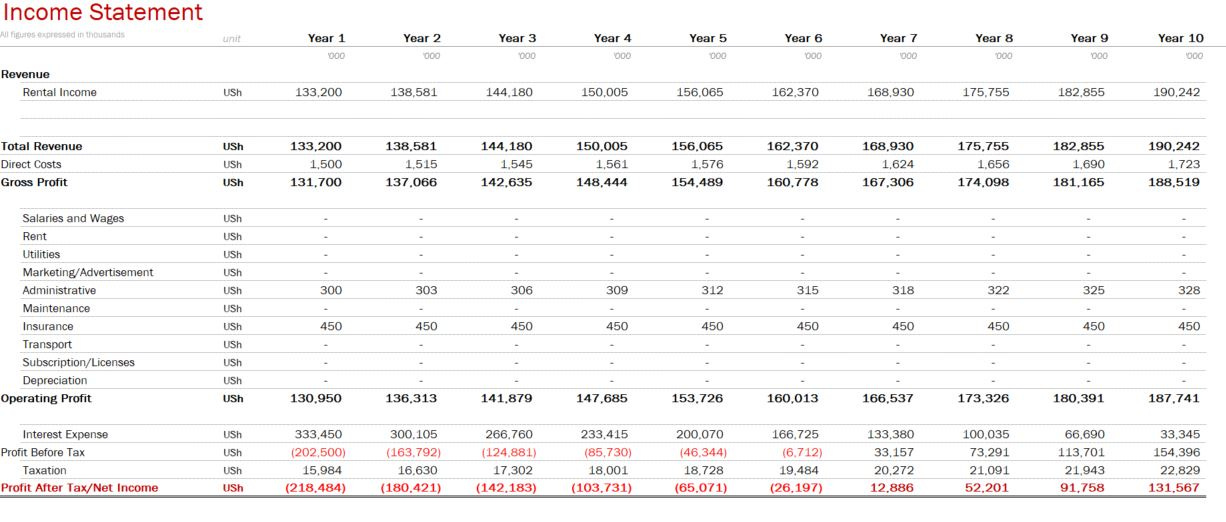

The following are the key findings of the assessment:

Over the first 10 years, the investor would operate at a loss due to the high interest payments on the loan. With a projected rental income increase of 2-3% per year. The total income in the 10 years would be 1.6 billion Uganda shilling yet total interest expense would be 1.8 Billion Uganda Shilling.

Screen below shows the projected Income statement of such a project.

In the period of 10 years, you would have to pay back a total of 3.7 Billion to the bank assuming your 18% interest rate is on reducing balance, else if it’s on fixed rate. This could go even up.

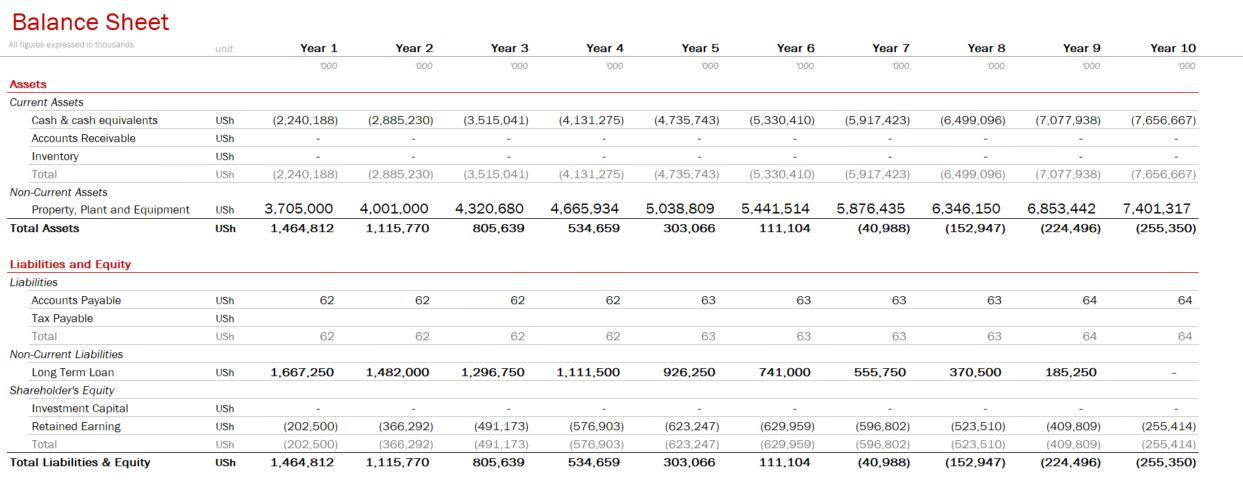

The property would appreciate in value over the 10 years, but the investor would need to get money from other projects to finance the loan each year. This would eat away at the total value of the investment, so that in year 10, the investment would be worth less than 10% of what the investor bought it. The property would put you in so much debt that by 10 years, the value of the property would be around 8 billion while your value of debt would be around 7 billion. Why?

The interest expenses to pay off the loan are higher than rental revenue and this would make you borrow from your other sources just to finance this project, whether that borrowing is from your own other projects or from other sources like salaries.

Screenshot below showing the Financial Position of the Investment. Property would double in value, but other parameters would get hit.

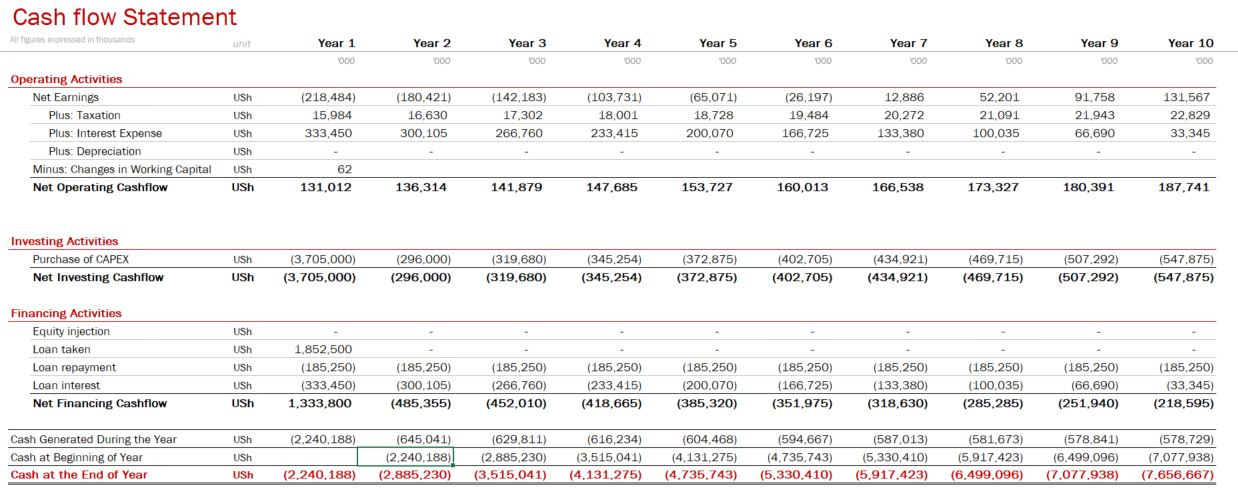

Cashflow statement of the project. Because the Revenue generated is not enough to pay off all expenses (interest expenses), you would have to finance the project by borrowing from other sources leading to negative cashflows of the project for 10 years.

Real Estate Leverage.

In order to understand why this investment is risky, it is important to understand the concept of leverage. Leverage is when you use debt to finance your investment. This can amplify your returns if the investment is successful, but it can also amplify your losses if the investment is unsuccessful.

In the case of this investment, the investor is using a lot of leverage (50% of the value of the property).

They are borrowing half the money to finance the investment. This means that even a small decline in the value of the property could result in a large loss for the investor.

The investor in this example is paying an interest rate of 18%. This is a very high interest rate. It means that the investor will have to pay a lot of money in interest each year which cant be matched by the corresponding Revenue from the property. And it’s this point that is causing a lot of Bank Foreclosures on Rental properties in Uganda. The interest expenses that people are paying is extremely high compared to the Revenue the end up generating from the property especially for the fist 5-10 years.

Finally, it is important to consider the capital gains tax on the property. When the investor eventually sells the property, they will have to pay capital gains tax on any profits they make. This tax can be significant, especially for high-value properties.

If you enjoyed this letter, please consider sharing it with your friends and families,

I hope you have a great week and potentially invest in Uganda’s Capital Markets.

Alex Kakande

Great insights Alex. You're actually being generous with the likely increments in rental prices because as one who operates in the Real estate market in Naguru, i know for a fact that house is unlikely to fetch more than $3000 in the foreseeable future owing to diff dynamics in our market. In any case, it was fetching about $4000 a couple years back. The Kampala high end market is already inflated as it stands, so expectations must be managed when it comes to rental appreciation. The sales do suffer the same fate actually....capital/land appreciation isn't guaranteed except with massive investment in upgrading the property. This effectively amplifies your opinion that borrowing to finance such investments here is in utter bad taste!! Thank you.