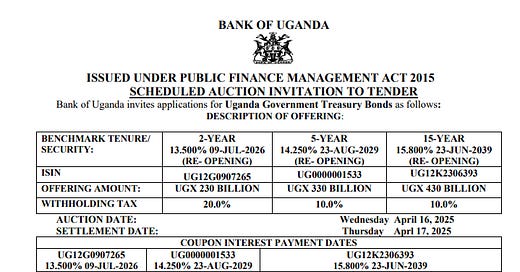

On April 16th, 2025, the Bank of Uganda will be auctioning off a 2-year bond with a coupon rate of 13.5% and a withholding tax element of 20%, maturing in July 2026. With around 15 months left until maturity, it's almost akin to a treasury bill at this point.

5 Year Bond with a 10% WHT

In the same auction, there will be a 5-year treasury bond, one of the most sought-after options, maturing in 2029 with a coupon rate of 14.25% and a withholding tax of 10%. What makes this 5-year treasury bond interesting is that it is a medium-term bond; being a 5 year bond means it has, on average, four years to go.

Additionally, the tax on it is low at 10%, whereas five-year bonds usually have around a 20% withholding tax. It also pays a coupon in August and February, making it an attractive option for anyone looking to ladder their bonds, especially if they already have either the 15-year bond or the 20-year bond. This bond is one of the first you'd want to consider.

The last time the 5-year bond was auctioned off in February, it came out at a 16.25%, even though the cutoff price was at a premium. This was because it was about to pay a coupon just six days after it was auctioned off. Therefore, if we see an interest rate of 16% and above, like we did in the last auction, it will likely be at a significant cutoff price discount, given that its coupon rate is 14.25%. Anything above 15.5% would bring it in at a discount, allowing anyone investing right now, when it has not accrued much interest, to benefit from a good discount on that investment.

15 YEAR BOND

In the same auction, the Bank of Uganda will also be auctioning off one of the people's favorites: the long-term 15-year treasury bond with a coupon rate of 15.8%, maturing in June 2039, and a withholding tax of 10%. For those of us looking to invest for the long term, this is the bond to look out for.

The last time it was auctioned off in February 2025, it came out at an interest rate of 17%, resulting in a cutoff discount of around 5%. However, since we are now in April, we are well over halfway through the journey to its next coupon payment in July 2025. This means it has accumulated some good accrued interest, so it might come in at a discount, but it won't be significant because it's about to pay coupons. For those of us investing while targeting cash flows in the short to medium term, this is an interesting bond because you are investing now, and in 2.5 months, you'll be receiving your first coupon—an appealing perspective for treasury bonds.

The outlook on this 15-year bond is promising; it might follow in the footsteps of its counterpart, the 20-year treasury bond, potentially offering another yield to maturity of 17%, or at a bare minimum, around 16.5%. This is a really good interest rate, even as we look ahead to the new calendar year and consider the government's consolidation of the current treasury budget, which is starting to take shape and factor into the interest rates the market is beginning to see.

In the secondary market, it's averaging around 16.4% to 16.6%, which you would expect to be reflected in the auction in two weeks. Therefore, for anyone trying to buy the cheapest bond while simultaneously earning a bit more from the coupon income, the 15-year bond should be your best bet in this upcoming auction.

I didn't study economics anywhere but you have strengthened my financial literacy from your YouTube channel. Thanks alot brother

I need to know more about t.bills&bonds