Dear Mr. Rugaba,

I know it has been a while, and I've taken almost 3 months since you last sent me an open letter on the investment of treasury bonds.

Firstly, like many of my new readers, investing in treasury bonds is a first-time experience for many, even those investing in capital markets. This includes buying stocks and equities on the Ugandan Stock Exchange or even opening a collective investment account with one of the unit trust fund managers.

It's their first time, so there are a few things that can easily go wrong, but that doesn't mean they are wrong; there is a learning curve for almost everything. But for this letter, we are going to focus on investing in treasury bonds, especially breaking down some of the items and parameters you highlighted that led you to make a loss in your investment. Maybe we can learn one or two things from each other that can help those who might be in the same situation to learn and do better or avoid certain mistakes.

While going through how your activities unfolded over 9 months, one question I asked myself at the beginning was: why? Why did you start buying treasury bonds? Why did you start investing in treasury bonds?

Now, that question might seem simple, but it forms the whole basis of our discussion going forward. It matters not how much money you have; whether you have a small amount or more, if you can't easily articulate the reason you are investing in anything, sometimes you might easily make losses. And the question of why is not just answered by the sheer direction of making money.

There are so many things we look at, which you might remember we talked about when we discussed developing an investment strategy. As individuals, we do not live in our own world; there are so many things we can learn from the corporate worlds we work with, the companies and corporate entities we admire, and the brands we admire. You are closely associated with one of the insurance entities; you might want to look at their financial statements and their balance sheet and total assets. You will see how they categorize some of their investments. It's not because they are just following certain rules for the sake of following rules; it's because management has developed an investment strategy that guides them to the certain rules they have to follow.

Some of these investment strategies are easy; they come naturally. When you are 25 and have limited resources, your investment strategy is to grow your resources, your net worth, and double your investments. If you are earning, it is to make sure it brings in money. But how often do we sit back and say, "Is what I'm doing leading to that?"

Without an investment strategy, an investment goal, something you are aiming towards, and crafting out what you need to do to achieve it, then you might do things and later say, "How well did I do this?" because you did not take time at the beginning to craft out a roadmap that you must follow. Investment is not something we just fall into; we work towards it. And it's at this premise of the roadmap that I'm going to break down a few things which I think you should have done at the beginning to achieve a different result, even with the smallest amount of money possible, or for someone who is out there listening to me and might be reading this, to take advantage of our tested steps to ensure that the risks and concerns you raised in your letter do not appear again.

Treasury bonds, like any other investment, can be bought for three major reasons. Allow me to introduce a language that we use so much in our accounting world when we are accounting for all investments, especially financial investments.

Trading Investments: (For Stanbic Holdings above, highlighted in Blue). These are investments you buy knowing you are going to sell right away.

For those who deal in real estate, they know that they are buying that plot of land as cheaply as possible and want to sell it in the next 3 to 12 months to get their money back and make a profit. You are literally trading in this particular asset, and the plan is that you are buying the treasury bonds to flip them and sell them in the next 12 months.

You must be critical, knowing that treasury bonds are impacted by what we call market factors, and the prices change. If you were to look at all the different banks and insurance companies, NSF, they all have a line called trading investments (Investments categorized as FVTPL). These are, for example, treasury bonds they buy and then want to sell to someone else. They buy them from the primary market cheaply and sell them at a profit.

Now, for you, Mr. Rugaba, when you bought your investments, when you bought your treasury bonds and sold them in the first 9 months, you were at that point trading. But did you buy them to trade? Was your plan at the beginning to buy and trade in treasury bonds? Did you sit down and say, "I'm buying these treasury bonds to sell them in 6 months and make a profit?" And if the answer was yes, did you understand what it takes, how you should price the treasury bonds you are buying right now, and how the price might be in 6 months?

Most entities dealing in trading securities have specialized knowledge to understand and predict the prices of treasury bonds between 3 to 6 months. They know if they buy right now, they can make a profit in 6 months.

For anyone, especially if your goal is to grow your net worth, especially if you have a small amount of money, never go into the trading category. If your investment goal is to grow and accumulate your income, you should not be in a position to buy treasury bonds today and want to sell them in 3 months, except in an emergency.

But if it's not an emergency, then taking on activities that would categorize your investment as a trading investment will likely result in losses. You are most likely going to lose money because if you buy a bond today and in 6 months it has dropped in price, you already have a small amount invested. By trying to sell them in 6 months, the person you are selling to or the bank in the secondary market has billions of that bond. For you trying to sell UGX 1,000,000 worth of a treasury bond, they are not going to make even UGX 50,000 profit, so they cannot give you a price that would make you recover your money. This means for anyone, and for you specifically at that point, you should not have gone through what we call trading investment.

Hold and Sale Investments: (For Stanbic Holdings above, highlighted in Green) Even those who invest in real estate understand this. There are plots of land you are going to buy, knowing you will have to sell them in a few years, maybe two or three years, but you know the value of that property or plot of land can best be realized when you hold on to it for a few years and then sell it.

This suits someone who can predict some market trends but also has adequate resources to protect against certain losses. When you buy a treasury bond, it pays a coupon every 6 months. If you categorize your investment strategy to always buy a treasury bond, especially long-term treasury bonds like the 20-year bond, and hold it for three to five years, after five years you have recovered almost all the principal investments. Now you want to sell it, and whatever you get is profit to reinvest in something else.

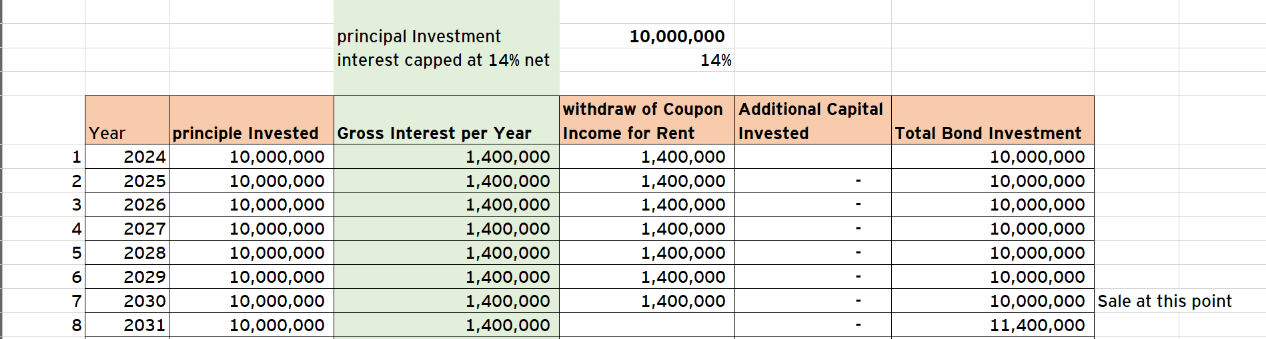

This is a good strategy to double your money. Very few people take it, but it's a good strategy. For example, imagine you have UGX 10 million. You buy a bond of 10 million, and let's assume you bought it at par, so you paid UGX 10 million, and it's a 20-year bond. As we see in the breakdown, that bond would give you 1.4 million per year, which means in six years you would have close to 10 million. Even if you sell it at that point, you would have recovered the money you invested in this bond. Even if you go to the market and they give you UGX 9 million out of your UGX 10 million bond, it means the UGX 9 million is profit.

This is a strategy I would recommend, especially for those who have medium-term investment goals. You know in five years you might want to do something, or in seven years you might want to channel your investments into another product or project. You buy long-term bonds; they offer you a good return at the lowest tax possible. After 5-6 years of recovering your money, you can sell it, and whatever you get is profit. You have not made any loss. But that depends on understanding that this is what you want to do. If you are long-term into this kind of investment, investing in the treasury bond, the question becomes why would you sell at that point, especially knowing that maybe you might sell and get that exact amount and put it in another treasury bond, which brings us to the third category.

Hold to Maturity Investments: (For Stanbic Holdings above, highlighted in Red).

This is the best category for the majority of us who are just starting off. You are 25, investing for the longest term possible. You are 35, you still have 30 years to go before you retire. You are 45, you still have 15 years to go before you retire. Your goals are long-term. Chances are the money you are investing is for the longest period possible. You have no rush to cash it out; your immediate liquid challenges can be taken care of by maybe your salary or other businesses.

In designing your investment strategy and goal, your horizon coincides with the kind of bond you are buying. You are 25, you buy the 20-year bond, the 15-year bond, and see it through. Every single year it will be paying a coupon to you for the next 20 years. The coupon it gives you, you use to buy more bonds. Every time you get more money, you buy more bonds long-term. You do not care what the price is because you know either way you are going to double that money every 5-6 years in our country, given the rates we have of 15-16%.

You start with just UGX 500,000 and consistently buy per month (even if buying from the secondary market), for years that in 20 years you wake up with total value of over UGX 500 million. To Hold, to Maturity. To be patient.

UGX 500,000 invested per month for 20 years growing into a UGX 500 million portfolio.

This is the category where I would expect you to have the patience to see it through. Even the immediate costs you might incur at the beginning when buying a treasury bond can easily be recouped in one year and forgotten about.

For anyone below 40 years trying to enter into the investments of treasury bonds and realizing that their goals are long-term, more than 10 years, continue buying your bonds. Even if you have only UGX 300,000, keep buying long-term bonds. Do not sell. Every single month you have UGX 300,000, buy.

Whether you are buying from the primary market or the secondary market, it won't matter. Just keep buying and buying and buying and do not sell. Let those bonds go to the full length until they mature. The amount of liquidity you will get when the bonds have matured is incomparable to what you would get if you try to play the game and the system of trying to buy and sell.

Now, Mr. Rugaba, as you have seen, the question is: what was your strategy at the beginning when you decided to start investing in treasury bonds?

Were you buying to trade? If so, did you have the expertise, knowledge, and resilience to withstand the changes in prices in the treasury bond market? To trade in the treasury bond market, prices change every single day, almost every three to four hours. You can buy a bond right now at UGX 100, and the next day it's trading at UGX 97. If you do not have that in your investment structure, never play the trading game.

Do not buy to sell in the next 3 months; you are going to make losses, you are playing a game that isn't yours. You are going to sell at a loss, not because the bonds haven't made money, but because you cashed out quickly. If it's an emergency, please cash out by all means. You will understand if it's an emergency; you need liquidity and cannot wait to profit off your investment because you have an emergency. It happens even in real estate when someone is selling a property worth UGX 40 million at UGX 25 million because they need the money in the shortest time possible.

But if you want to invest in treasury bonds for emergencies, you might be better off investing that money in unit trusts, where you can get all your money as quickly as possible without any loss. But you know the cost of investing in a unit trust is getting 11% versus getting 14% in a treasury bond per year. That difference of 3% is the access to liquidity versus the long-term investment strategy that collective investment fund managers take the risk to always provide you with liquidity. That risk is why you get 11% even when they invest in treasury bonds that offer them 14% to manage the liquidity and smooth it out.

But if your goal was to invest in treasury bonds to ensure the money you are investing grows, then you should have taken the second route or the third route: keep buying, keep holding onto that, keep receiving the cash flows from the treasury, and keep reinvesting it for five, ten, or fifteen years. The majority of us who are starting to enter the treasury bond market are still categorically young people, which means we have many years to go before we start thinking of liquidating, especially if you are still employed and have some access to money from somewhere. You can still play the long-term game. It's the system in almost all investments.

This means that for investing in treasury bonds, you should have taken the second route, which we call the hold and sell. You want to hold your treasury bonds for maybe 5 or 6 years, make some money from the treasury, then sell it on the open market. The timing also matters; you do not just sell for the sake of selling. Or you take route #3, which is to hold to maturity. This allows you to get all the cash flows out of the treasury bond, meaning you get the coupons every 6 months and wait until maturity to get back the principal. That is the maximum level of profitability you could achieve. It allows you time for your treasury bond to mature, make profits, and recover the expenses you have incurred in such a way that it makes sense for you to invest.

Now, if that was the goal, then you have to sit back and ask yourself, "Did I do it right? Did my actions reflect my investment strategy and goal?" By buying four treasury bonds in 4 months and selling them all at once in the 9th month, did it reflect my investment goal? Was I quick to sell it off? I believe you quickly sold off the treasury bond, and that's why it reflected the losses to you.

Cost of Investing in Treasury Bonds. - UGX 23,000 Primary Market cost

Like any other trading or business, the facilitators of business will make money. Banks are here to make money. The system so far allows that the majority of us can only buy treasury bonds through banks, whether we are buying from primary markets or secondary markets. This brings me to the cost of the primary market.

Every time you buy a treasury bond from the primary market, every time you participate in an auction, the majority of banks charge a facilitation fee, which on average, I believe is around UGX 23,000.

Now, ask yourself, how much am I buying from the primary market? If you are buying 200,000 from the primary market and they charge you UGX 23,000, that is already 10% of what you are trying to buy. Then you have to sit back and ask yourself, does it make sense for me to buy from the primary market? Because they are going to charge you 23,000 to buy for 200,000, it's going to take you more than a year before you recover the expenses you have incurred during that investment. It's a numbers game.

If you are buying a treasury bond of UGX 500,000, they are still going to charge you 23,000, which is 5% of what you are trying to buy. Does it make sense for you to buy in the primary market? No. Does it mean you shouldn't invest in treasury bonds? Not at all.

When you buy a treasury bond from the secondary market, especially when you are buying it from that particular bank that is your custody bank, they are not going to charge you the UGX 23,000. They are going to just mark up the treasury bond they are selling to you, and that will be it.

Like you remember in your article, your first bond you bought at UGX 195,000, which was at a premium, but they didn't charge you 23,000 compared to someone who is going to buy a bond of UGX 200,000 from the Bank of Uganda only to be charged UGX 23,000. So you have to sometimes think about it and say, what makes sense?

The UGX 23,000 is a funny number. If you are buying a bond of 200 million, you are going to pay UGX 23,000.

I actually believe anyone who is buying a bond of 10 million and above should buy from the primary market because the cost of buying from the primary market is so cheap that it's a net benefit.

But anyone who is buying a treasury bond of UGX 5 million and below, it's okay to buy from the secondary market from your custody bank because the markup they might put on that treasury bond might be too small, but it won't surpass the 23,000. So the question is, you have to sit back and ask yourself, how much am I trying to invest? Does it make sense for me to buy from the primary market or the secondary market? Now, for me, the last two transactions that you made, you bought from the Bank of Uganda, the amount you were investing was too small. You should not have bought from the primary market; you should have bought from the secondary market to avoid the 23,000, which would have reduced your cost of doing business and allowed you to maximize profit.

Nice one sir. Indepth analysis indeed. Thank you. For the bank charges I once said and can repeat that ABSA bank, maybe being a primary dealer, it charges me nothing when I buy in the primary auction.

A great article. Thank you Alex. Happy weekend all.