How the Unlikely Partnership Between Sanlam Investments and Standard Chartered Bank Has Propelled the Fund Manager into the Top 3 Ranking in Uganda

December 2, 2024

“Standard Chartered Bank shillingi Investment. The Trustee and custody businesses of Standard Chartered bank especially those who have been investing in their shillingi Unit trust which it has it’s Sanlam Investments will stay fully operational as these are part of their corporate Banking which Standard Chartered Bank has indicated is staying Uganda”

Friends,

In October 2020, Sanlam Investments launched its fund unit trust management, and for the greater part of the year, it seemed improbable that within three years, it would ascend to the top three fund Managers in Uganda. Now, within striking distance of the number two rank, Sanlam has experienced one of its most successful years in asset mobilization, nearly doubling its assets every six months to a year. This remarkable growth is for a great part attributed to its partnership with Standard Chartered Bank Uganda.

Many people are aware of the Standard Chartered Bankers shilling Fund. Even those who bank with Standard Chartered and are members of the Shilling Fund may not realize that Standard Chartered is not a licensed fund manager.

This means that the Shilingi Trust Fund is not directly managed by Standard Chartered Bank but is central to the offerings of Sanlam Investments the licensed Fund Manager. This partnership, which began one and half years ago, is proving to be one of the most successful in wealth building, wealth management, and asset mobilization for any fund manager that has helped the Fund Manager triple their Assets under Management in a space of 1 year.

In 2022, Sanlam had approximately UGX 20 billion in assets under management. By June 2024, their total assets had soared to around UGX 240 billion. Within just the last three months, they grew their assets by over UGX 30 billion, and by the 30th of September, their total assets under management had reached 270 billion with their eyes in sight of closing in UGX 300 Billion.

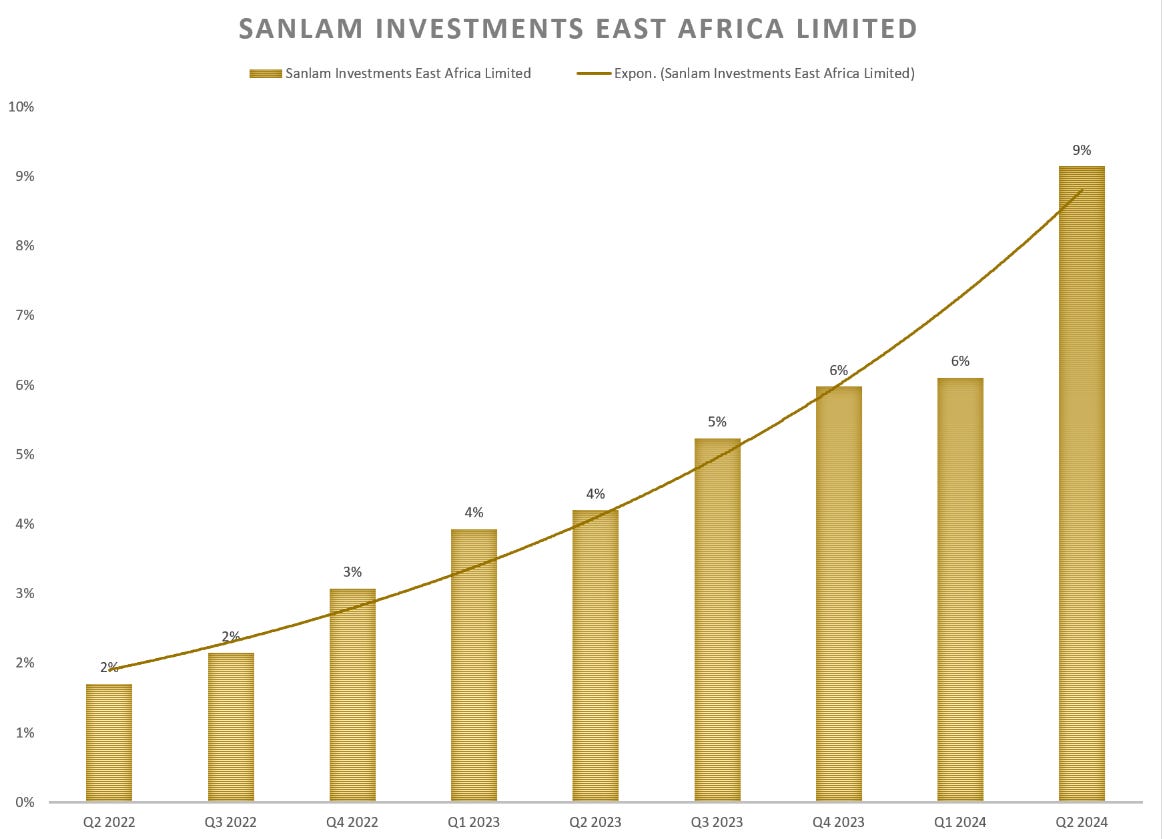

Their Market share has grown from as low as 2% to currently 9% in a market that is largely dominated by Old Mutual Investment Group.

This surge has enabled them to surpass Britam, which was at one point was the second biggest Fund Manager then to the third-largest fund manager, and they are now close to overtaking ICEA, which sits at around UGX 400 billion in total assets.

At the current growth rate, it is plausible that within the next one to two years, Sanlam Investments could achieve this milestone, especially since they have recently launched their dollar trust fund.

The Withholding Tax on Investment Income Dilemma.

Sanlam Investments have overcome one of the most challenging episodes concerning their license, where they were collecting withholding tax on Investment Incomes and what was a cause of concern for many investors.

In 2023, many potential investors were hesitant about investing with Sanlam due to the withholding tax on investment income. This was a concern because the other five fund managers in the country were not collecting withholding tax.

Collective investment funds are generally not subject to withholding tax, but at the time, Sanlam had not yet received a withholding tax exemption from the Uganda Revenue Authority.

The leadership at Sanlam Uganda worked diligently to resolve this issue, and by early this year, they successfully obtained the withholding tax exemption certificate. This development puts Sanlam Investments on equal footing with its competitors, potentially enhancing its success and appeal to the Market even further.

Beyond the growth of their total assets, it is essential to consider the increase in income they distribute to investors. For instance, in Q2 2024 alone, they distributed more income to their investors than in the entire year of 2020, indicating that they have almost tripled their assets in the last three years.

This success can be traced back to the great stewardship and the performance of the Fund Manager as seen in their performance, but beyond it all, their partnership with Standard Chartered Bank.

For those banking with Standard Chartered and interested in investing in a unit trust, Sanlam offers the most convenient option. The ease of transferring funds, withdrawing, and maintaining the same relationship managers simplifies the investment process significantly.

The leadership at Sanlam Investments led by the Managing Director, Mr. Mugalya Mubbale, CFA, and the Head of Business Development, Ms. Peace Gakwaya, have been instrumental in this accelerated success.

Their achievements in the last two and a half years are noteworthy, and it is essential to recognize the individuals steering these companies, as their vision and execution inspire confidence in their direction and future prospects.