It was a Bonanza for the Who is Who of our Financial Sector.

Friends,

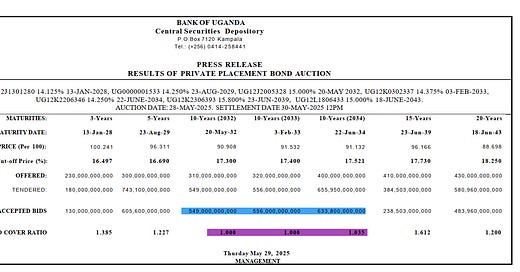

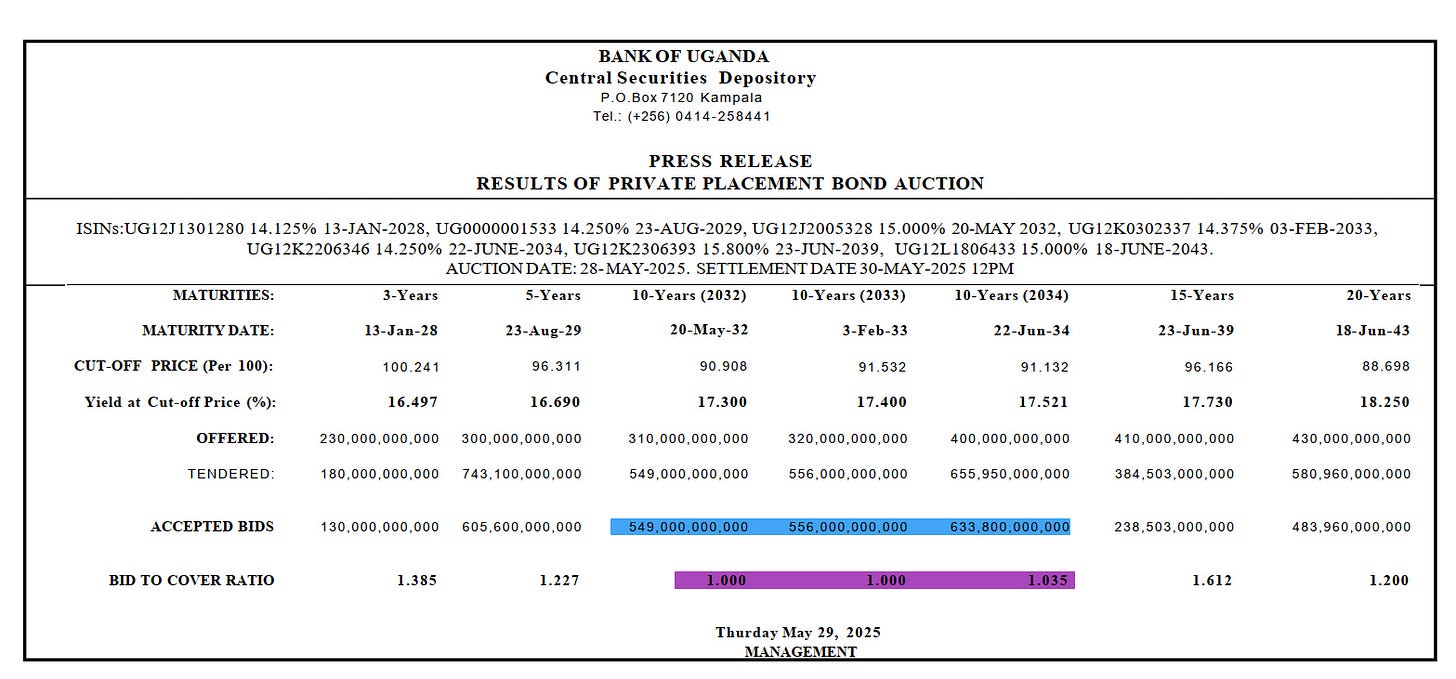

In an unprecedented move, the Government of Uganda and the Bank of Uganda have raised over UGX 3.19 trillion from yesterday’s private offering to the primary bank dealers through the 7 different bonds that were put on the market and announced last week.

This marks one of the largest treasury bond raises in a single offering from the domestic market in recent times, comparable only to the nearly UGX 1.8 trillion raised in a private offering in October 2023.

The rates announced today are among the highest seen, significantly pushing the yield curve across all tenors of the treasury bonds. This situation raises many questions for investors regarding what to expect in the coming months, especially with speculation that this move was strategically designed for the government to raise funds in a single private offering while potentially reducing reliance on public auctions in the near future.

Notably, the yield on the 20-year treasury bond has now surpassed 18%, with a cut-off yield of 18.25% in this private offering, which was exclusive to primary dealer banks and NSSF.

This indicates that the government has borrowed at a very high cost, particularly for a bond that is set to pay a coupon in less than 45 days, specifically on July 10th. Similarly, the 15-year bond had a yield of 17.73% in this private offering, which is a significant increase from the cut-off yield of 17.1% during its last auction in April.

At that time, the government and the Bank of Uganda rejected a substantial number of bids for the 15-year bond. This raises the question: why did they reject bids two months ago but now accept nearly all the money offered at a higher cost?

It is also worth noting that nearly all the 10-year bonds, including the 2032, 2033, and 2034 bonds, were fully accepted by the government. This means that if a bank bid 18% for the 2034 bond, that amount was accepted. If another entity bid 19%, it was also accepted.

This trend is consistent across all tenors of the treasury bonds in this primary private offering. With an average coverage ratio of 1.14, it indicates that the government accepted nearly every single coin put in front of it, resulting in a total borrowing of 3.19 trillion UGX from primary dealer banks and NSSF alone.

What does this mean for your investment timelines? We are yet to see how the primary dealer banks will react in the secondary market. Will they sell off these bonds at better yields to make a profit right away?

We are also uncertain if the upcoming auction will experience lower participation rates and yields in June. Given that the government has raised over 700 billion UGX beyond what was initially offered, it may not require as much funding in the upcoming public auction, especially if it is indeed winding down the financial year.

The Private Euro 500 Million private Loan from Eco-Bank and Afriexim Bank

This news comes at a time when the Minister of Finance and Planning Hon Kasaija informed Parliament that the government has borrowed close to 500 million Euros from three international banks.

In just one month, the government has raised and borrowed over 6 trillion UGX from both international and domestic markets.

Happy Investing Everyone

Alex Kakande