Friends

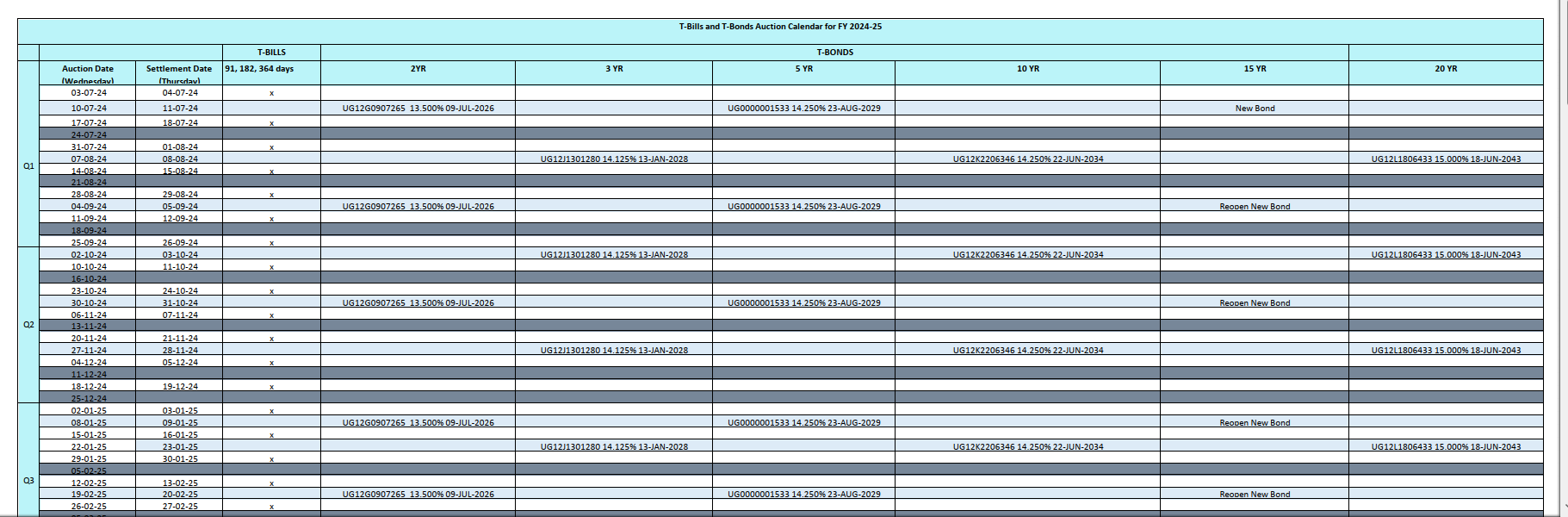

Officially, the FY 2024-2025 Treasury Bond Auction Calendar has been released by Bank of Uganda. Link to the 2024-2025 Treasury Bond

Updates made to the FY 2024-2025 Auction Calendar Treasury bond coupon rates:

the 2-year Treasury bond rate has been lowered by 50 basis points from 14% to 13.5%,

the 3-year Treasury bond is the previous 5-year treasury bond, with it’s rate increasing by 62.5 basis points,

The 5-year Treasury bond rate has been raised by 12.5 basis points from 14.125% to 14.25%, and

The 10-year Treasury bond rate has been reduced by 12.5 basis points from 14.375% to 14.25%.

The 20-Year Treasury bond coupon rate will remain steady at 15% for the bond maturing in 2043.

The Treasury Department and the Bank of Uganda have released the FY 2024-2025 Treasury bond and Treasury bills calendar, introducing several key changes that will guide investors in the forthcoming financial Treasury bond market. Notably, a new 15-year Treasury bond will be launched in July 2024, though its coupon rate has yet to be announced. The rate will be revealed when the bond is advertised and the auction is called.

Investors interested in participating in the upcoming auction should mark July 10th, 2024, on their calendars. Although the exact coupon rate for the 15-year Treasury bond is currently unknown, the expectation is that the interest rate will be highly competitive, as evidenced by recent trends where rates for 10-year, 20-year, and 15-year Treasury bonds hovered around 16%. The secondary market in Uganda continues to price long-term bonds above 16%, suggesting that the 15-year Treasury bond could be an attractive investment opportunity, potentially offering interest rates as high as 16%.

Another important update is that the 20-year Treasury bond's coupon rate will be maintained at 15%, with the Treasury opting to reopen the 2043 20-year bond rather than issuing a new 20-year treasury bond. This strategy by the Bank of Uganda and the Treasury Department is a prudent measure to manage the interest rates paid on Treasury bonds, thereby controlling the government's domestic borrowing costs.

Additional noteworthy changes include the unchanged withholding tax rates for various bond tenors and the consistent timing of bond and bill sales. Treasury bond sales will continue monthly, and Treasury bill sales will occur biweekly through the Bank of Uganda.

For those looking to invest, now is the time to plan and prepare. With two weeks until the July 10th auction, prospective investors should begin organizing their finances, completing necessary forms, and positioning themselves to participate in this investment opportunity.