From as little as UGX 10 million to a UGX 600 million bond portfolio

Patrick's plan.

For a moment, I truly agree with you. I've seen the numbers from other people's perspectives, and I would like you to run the numbers for me. This was Patrick's text in my DM, and I've decided to use his example to analyze how someone can utilize unit trusts and treasury bonds under similar circumstances to grow their wealth using these two amazing products.

Patrick is 36 years old and has three kids. From our discussions, he has managed to set aside 1,000,000 UGX per month to invest in either a unit trust or a treasury bond. Currently, he has 10 million UGX saved up, which he wants to start with. His plan is to figure out how he can use treasury bonds, treasury bills, and unit trusts to grow his wealth.

Planned Structure of His Investments.

The solution we have decided on starts with the 10 million UGX he has. He can deposit it to buy a treasury bond. Since Patrick is 36, we have capped it at a 15-year treasury bond to allow him to develop a strategy for when he turns 50 in the next 15 years.

The current market for 15-year or 20-year treasury bonds is at a discount, so he will receive a very good rate. At the same time, we have capped the interest rate at 13% per annum on the treasury bond side to account for the possibility that interest rates might drop in the future, which could happen in the next five to six years. While the rates may not remain at the current 16%, they could change.

The second act is that for every 1,000,000 UGX he receives, he will deposit on a unit trust account with one of the unit trust managers. He will have to religiously deposit 1,000,000 UGX every single month.

Why are we shifting the 1,000,000 UGX to the unit trust? Every six months, or whenever the treasury bond pays a coupon from the original 10 million UGX bond, he will move the 6,000,000 UGX in the unit trust, which would have earned income over those six months, to buy another treasury bond.

Every six months, he will accumulate 6,000,000 UGX in the unit trust from his monthly savings of 1,000,000 UGX. Additionally, the treasury bond he bought with the initial 10 million UGX will provide a coupon of around 700,000 UGX.

His plan is to consistently align these two cash flows: moving the 6 million UGX from the unit trust, adding it to the coupon income, and purchasing another treasury bond. This means that every year, he will need to buy two treasury bonds, as treasury bonds pay coupons twice a year.

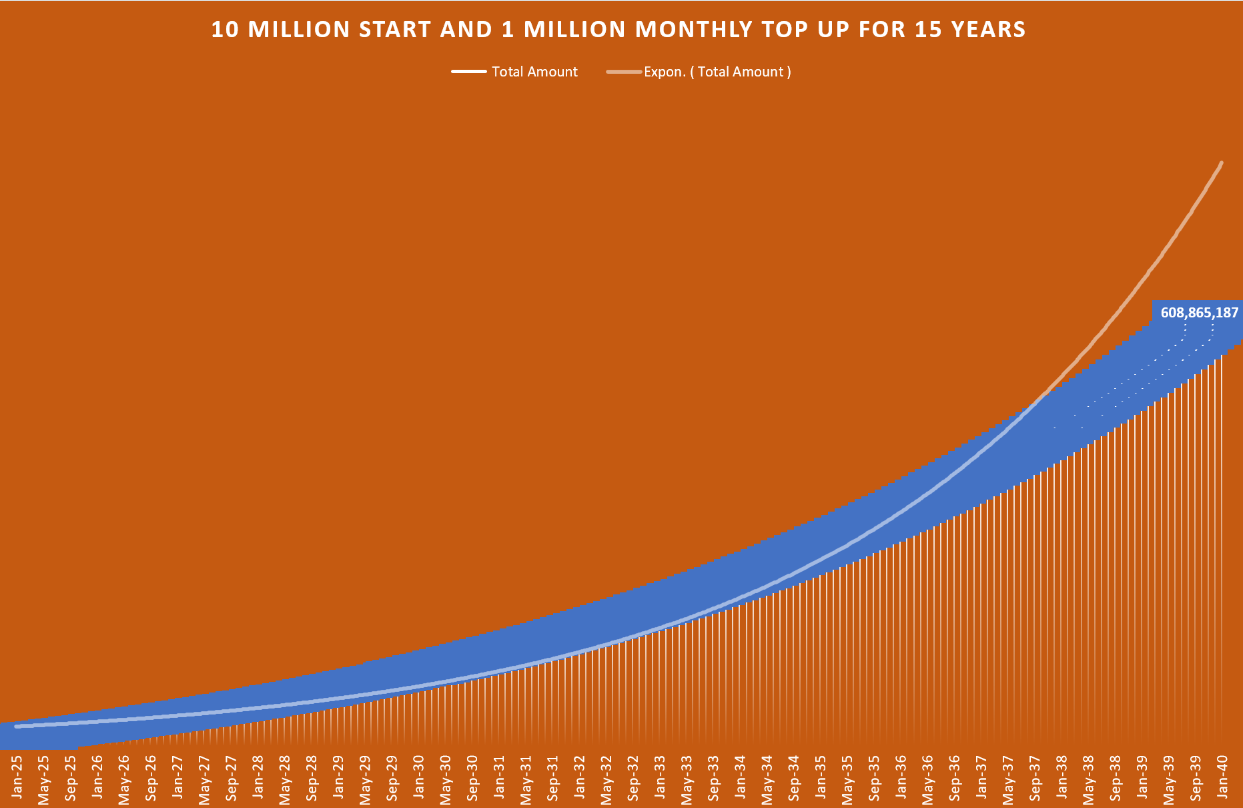

As the years pass, the interest income will increase. With this strategy, consistently building from a 10 million UGX bond and saving 1,000,000 UGX per month in a unit trust—which is then shifted into treasury bonds every time they pay a coupon—will yield significant growth. By the time Patrick turns 50, he could have around 600 million UGX in treasury bonds and more.

From this work, in the first year, he is averaging just 100,000 UGX in income per month. In the second year, he averages 200,000 UGX per month, and in the third year, he averages around 300,000 UGX per month, as long as he continues to deposit 6,000,000 UGX and invest it in a treasury bond every six months.

The beauty of treasury bonds and unit trusts is that you can easily predict the growth trajectory if you stay on course. By December 2030, which is six years from now, he would be earning around 1.3 million UGX per month. By December 2031, which will be seven years from now, he would be earning around 1.7 million UGX, and by December 2032, he should be earning 2,000,000 UGX per month. At that point, he would be earning more in interest income than what he is saving. This is where compounding takes place: when your interest income exceeds the amount you are saving and investing, allowing your bond portfolio to keep growing.

In 2032 alone, he will make a profit of around 26,000,000 UGX in one year, which is more than he would have saved that particular year. For as long as he continues to save and invest, he would have saved and invested 12 million UGX, but he would still make a profit of 26,000,000 UGX. At that point, he will be just 44—mature enough but still young enough to continue this journey, with eight years to go before the entire plan comes to fruition. By 2032, his bond portfolio will be around 200 million UGX but growing steadily.

By December 2035, he would be earning around 3.4 million UGX per month, which averages to 40 million UGX a year, and his total bond portfolio would have grown to 324 million UGX. At that point, he will be making three times more in interest income than he is saving, effectively doubling his current salary. By 2035, he will be 47 years old, with four years to go.

By December 2039, his total bond portfolio would have grown to 600 million UGX, earning around 6.3 million UGX per month, totaling close to 75 million UGX in a year. Even if he does not deposit any additional money at this point, he would have reached his 50s, earning close to 70 million UGX in income alone from treasury bonds, treasury bills, and unit trust investments, making nearly 6,000,000 UGX per month

One of the critical elements of investing in treasury bonds and unit trusts is the behavioral aspect: the willingness to let money grow and to invest for the long term. Without this willingness and the ability to endure the challenges of investing for 10 to 15 years at a minimum, achieving the numbers we have discussed will be impossible. Patrick must be prepared to allow his money to grow

Happy Investing

Alex Kakande

I think, Patrick's plan is quite good since depositing and withdrawing funds from a unit trust only requires an email or direct withdraw for those with Apps, unlike the bonds which still require one to fill out forms and take to the bank. But I learned from a recent masterclass with Alex, that you can request your bank to buy the bonds via email.

Is this the same when one uses 20M at inception and 500k monthly in the Unit trust ?