From 34 billion sale to 1.6 Trillion Company.: The Meteoric Rise of Stanbic Bank Uganda

December 17, 2023

No wonder President Museveni Regrets the selling of Uganda Commercial Bank 22 years ago for just 34 Billion. The powerful story of Stanbic Bank Uganda transformation.

The journey of the Stanbic Bank came to life when the Ugandan government made a move to sell the then “Uganda Commercial Bank” to a prominent South African Bank for a seemingly modest sum of UGX 34 billion in 2001 (UGX 434 billion in today’s money). This exchange now appears minuscule compared to the trillions of Shillings it generates today, and the government, having not retained a single share, remains bereft of its share in it, wondering who advised them on this deal.

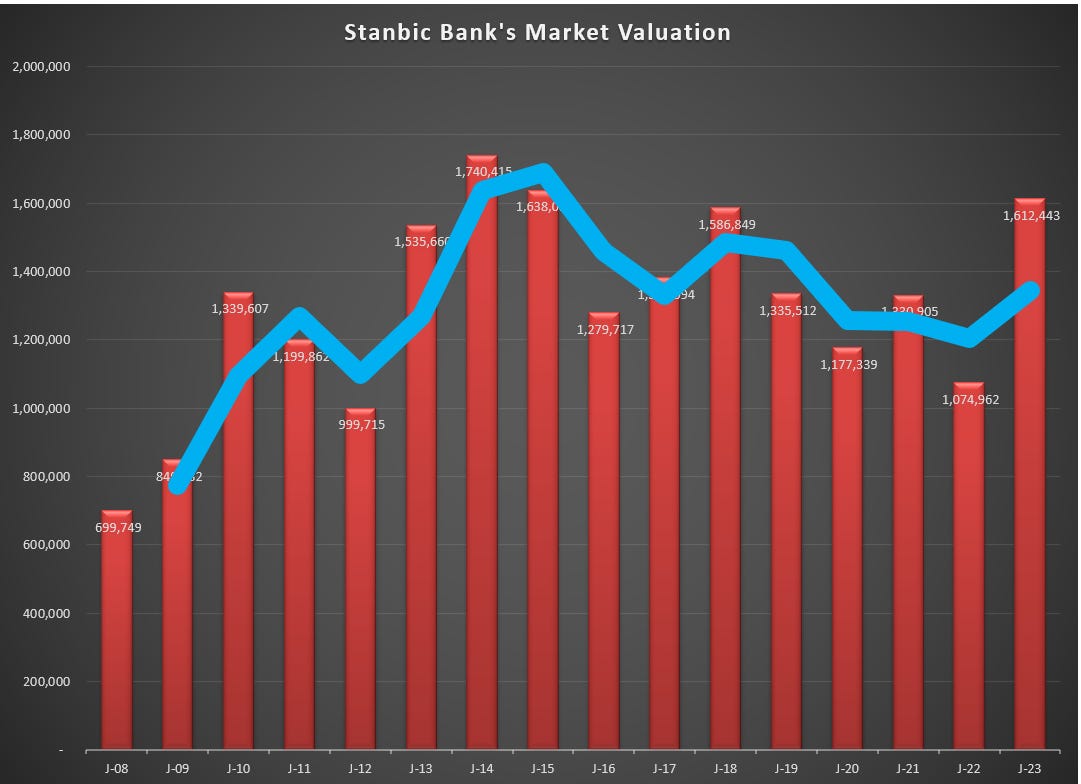

Embracing its transformation from a national bank into a systematically essential financial pillar, Stanbic Bank has victoriously written its story of success over the years. Its growth story sees an income exceeding a trillion in level and a yearly profit surge of over UGX 300 billion. Given its sizeable market presence, it contributes significantly to shareholder value thanks to outstanding leadership witnessed from Ugandan captains steering its helm with great determination and focus.

Take for instance Anne Jjuko, who has been at the forefront since 2020, after succeeding Patrick Meheirwe. She, in her very first three years, catapulted the company's Market Cap from UGX 1.3 trillion at the initial part of 2020 to an impressive UGX 1.6 trillion by the end of November 2023.

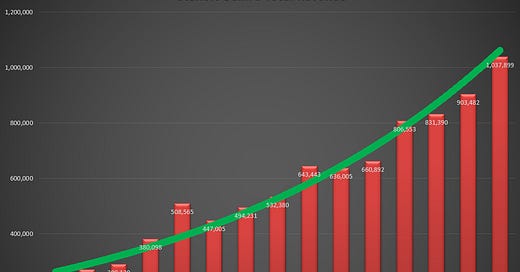

One cannot underestimate the rise of Stanbic Bank Uganda into an indomitable powerhouse. Within just a 15-year span, it multiplied its total revenue over 364 times! In 2008, the bank made a total revenue of around UGX 223 Billion. Fast forward to 2022, the figure hit an astonishing UGX 1 trillion, projecting the revenue to surpass UGX 1.2 trillion in 2023 alone – a proclamation of the invincibility of the bank's efficiency. No other Bank is coming close.

What can I say?, Stanbic Bank is akin to a perpetual money-making machine. Over the past six years, it has consistently amassed profits averaging more than UGX 250 billion after taxes. Taking 2022 alone as an example, the bank generated an astounding UGX 357 billion in profits. This level of financial triumph isn't just a one-off event. They aim to replicate, if not surpass, this success in 2023. The continuous value generation of this magnitude makes Stanbic Bank a stalwart force that powerfully impacts the Uganda Securities Exchange and makes a desired stock for every investor on the Stock Market.

When it comes to pleasing shareholders, the tale of Stanbic Bank is inspiring. It has paid dividends in 13 out of the last 15 years, with 2022 seeing a dividend payment of over 184 billion UGX (3.6 UGX per share), which is a remarkable feat. Its retained earnings of over UGX 1.5 trillion crowns it as a leading player on the Uganda Stock Market.

Stanbic Bank doesn't merely excel at generating profits, it has shown an eminent proficiency in creating substantial wealth for its shareholders. One key indicator of this is the surge in Earnings Per Share (EPS). The EPS, which reflects the portion of a company's profit allocated to each share of common stock, has catapulted from a humble UGX 1.53 in 2008 to a staggering UGX 6.98 in 2022.

This remarkable increase in the EPS bears testimony not only to the bank's profitability but also renders each stock more valuable, thereby rewarding shareholders. The EPS is a critical metric for investors as it provides direct insight into the profitability of an organisation and can significantly influence their investment decisions.

Furthermore, the bank's Return on Equity (ROE) in 2022 was an impressive 21.6%, marking an upsurge of more than 100 basis points from the previous year. This is yet another critical financial indicator that measures the ability of a company to generate profits from its shareholders' equity investments, thus highlighting Stanbic Bank's potent capacity to deliver superior returns and value to its investors.

The transformation of Stanbic Bank into a mega cash cow is a testament to prudence and strategic planning and a true loss to the Ugandan Government and it’s old advisors. It has now become the jewel in the crown for its investors and a dream investment for potential investors desiring a slice of this prosperous entity. Interested to learn further about this successful turnaround? Stay tuned for Part-2!

Happy Sunday!!

Alex Kakande

But UGX 34 billion in 2001 (UGX 434 billion in today’s money). - What inflation rate is that Alex??