Friends

Last week, The Observer published an FUD article titled “High returns or hidden costs? The complex reality of Ugandan bonds” that I have decided to respond to and clarify the many misstatements made in that article regarding the now worthy investments by retail investors in Government Treasury Bonds.

The writer, Mr. Mark Kidamba, a business journalist, dedicated a greater part of the article to highlighting the other side of investing in Treasury bonds, which he says the crusaders conveniently choose to leave out the disadvantages. Here, I will break down point by point what he raised and my reply to each of them and what he got wrong.

Statements in Headlines are what Mr Kidamba wrote in The Observer and I’m reply to reply to them follows.

ST.1 - “To begin with, bonds are an ideal investment for investors whose priority is safety, and not large returns.”

Mr. Kidamba opens up with the statement that Treasury Bond Investments are much more for safety or capital preservation than for large returns. What he doesn’t highlight, however, is large returns compared to what? Business investments? Entrepreneurship? Real estate investments?

Currently, medium to long-term treasury investments are returning a profit of around UGX 14% after tax, and it can go higher if the investor keeps compounding their initial investments and strategically timing their investments. A 14% net return indicates that every 5 years, you double your initial capital investments.

Graph showing the average return of 10 year and 20-year Ugandan treasury bonds.

Compare this to real estate investments like rental investments, which are mostly known to return around UGX 5-7% per annum, and it can take you almost 14 years before you recover your initial investment. Compare that with real estate of buying demarcated plots of land in estates; on average, in most outskirt towns, the invested amounts double between 7-10 years (if you bought a plot of land at UGX 30 million, it might reach UGX 60 million in, say, 7 years), and if you somehow invest in plots of land in places that have matured like Kyanja, the time it might take you might be even longer, yet you need more capital to buy such a plot.

(These apartments are going for USD 345K and their monthly income is $3,100, before any cost like tax, repair and vacancy, their yield is just 10%).

Does Mr. Kidamba compare the 14% return on bond investments with businesses? A return of 14% per year after tax in a bond is the final profit after all costs (WHT and bank charges) have been taken care of. With UGX 100 million, it means every single year I get around UGX 14 million per year, and if I compound it, it can grow to as much as UGX 20 million in 3 years or UGX 30 million in 5 years.

How many formal businesses can give you that profit? If you invested UGX 100 million in a downtown business, after every payment is made, do you have UGX 15 million in profit? Or let’s compare it to agriculture. How many projects could return a net profit of that? I’m talking about profits here, not revenue, because we must compare like with like.

This goes to show you that for a country like Uganda, the Treasury bonds return of 14% is competitive with many options someone might deploy their money in. Is it the best? No, many businesses might give you more money and more profits, but you are wrong to call bond returns “not large.”

ST - 2 “Secondly, rising interest rates and bonds have an inverse relationship: when interest rates rise, bond yields fall and vice versa. This means that when new bonds are issued with high interest rates, automatically, the value of the old bonds drops, indicating that their holders sell them at a loss — discount.

More times than not, this has been the case in the Ugandan bond market. Since January 2022, the central bank rate [CBR] has risen by 3.75 per cent from 6.5 per cent to 10.25 per cent in June 2024. This reveals that bond yields have been dropping in the last couple of years as Bank of Uganda [BoU] raises the CBR.”

Mr. Kidamba highlights a true statement but misses a critical component. Many people now “investing” in Treasury bonds are here to invest, not to trade. The key word is to invest.

They are playing a term period commensurate with their goals, not to trade in a way that is to buy and sell tomorrow. The price changes in the market that happen so often affect mostly those in the trading business (big banks and institutional investors) who mark to market their investments to prices.

To many new retail investors, who I talk to daily, their plan is to invest and deploy their small resources monthly for the longest period of time, so whether the price of the old bond falls, they didn’t enter to sell.

But like any investment, emergencies might come in, and you need to cash out, which would then mean the market price will determine what you get paid. However, we can’t ignore that if you bought a bond for 10 years (UGX 10 million) and you sell it after 4 years, you have already got back around 70% of its value (UGX 7 million), so even if after 4 years you sell it at a discount and get back UGX 9 million of the bond, the total amount obtained is UGX 16 million, and a profit of UGX 6 million is made. So where is the loss?

Mr. Kidamba continues to take a comparative period of 2022 to 2024, stating that because of the CBR increase from 2022 to 2024, the bonds sold in 2022 would fall in price. If he had done more research, he would have noted that bonds sold in 2021, 2022, and 2023 had some of the highest interest rates and coupons that up to now are unrivaled, and their prices continue to go up even as the quoted CBR goes down.

In 2022, the government issued a 20-year bond with an 18.5% coupon; in 2021, they issued one with a 17.75% coupon; and early in 2023, they issued one with a 17.5% coupon. Those bonds are trading at premiums, and those who bought those bonds then are making money.

The reality is different. But true to the statement that rising interest rates affect old bond prices, for most new investors who are in for the long term, the plan and game is “time in the market is better than timing the market,” which is a statement for them to keep investing monthly or quarterly every time the government is selling, and they will take advantage of high rates and also earn some money for lower-rate bonds. Either way, in any business, you win some, you lose some.

ST - 3 “Likewise, bonds issued by BoU aren’t inflation-protected, and their yields are lower than the increasing price levels in the economy. When bonds are inflation-protected, the prevailing rate of inflation is added to the yield, thereby protecting the bondholder from rising prices.

This is not the case for Ugandan bonds. Inflation weakens the shilling; as per BoU, in the last five years, currency circulation has gone up on average by 12.6 per cent. Economists have come to associate increased money circulation with the level of inflation. In FY 2022/2023, headline inflation hit 8.8 per cent, and core inflation was 7.4 per cent.”

I’m not so sure which data Mr. Kidamba is quoting; however, official statistics show our inflation in the country has been averaging around 5%, with the highest rates in late 2022. Bonds offer nominal yields of an average of UGX 14% gross, which would mean the net yield return is an average of UGX 9%-10%.

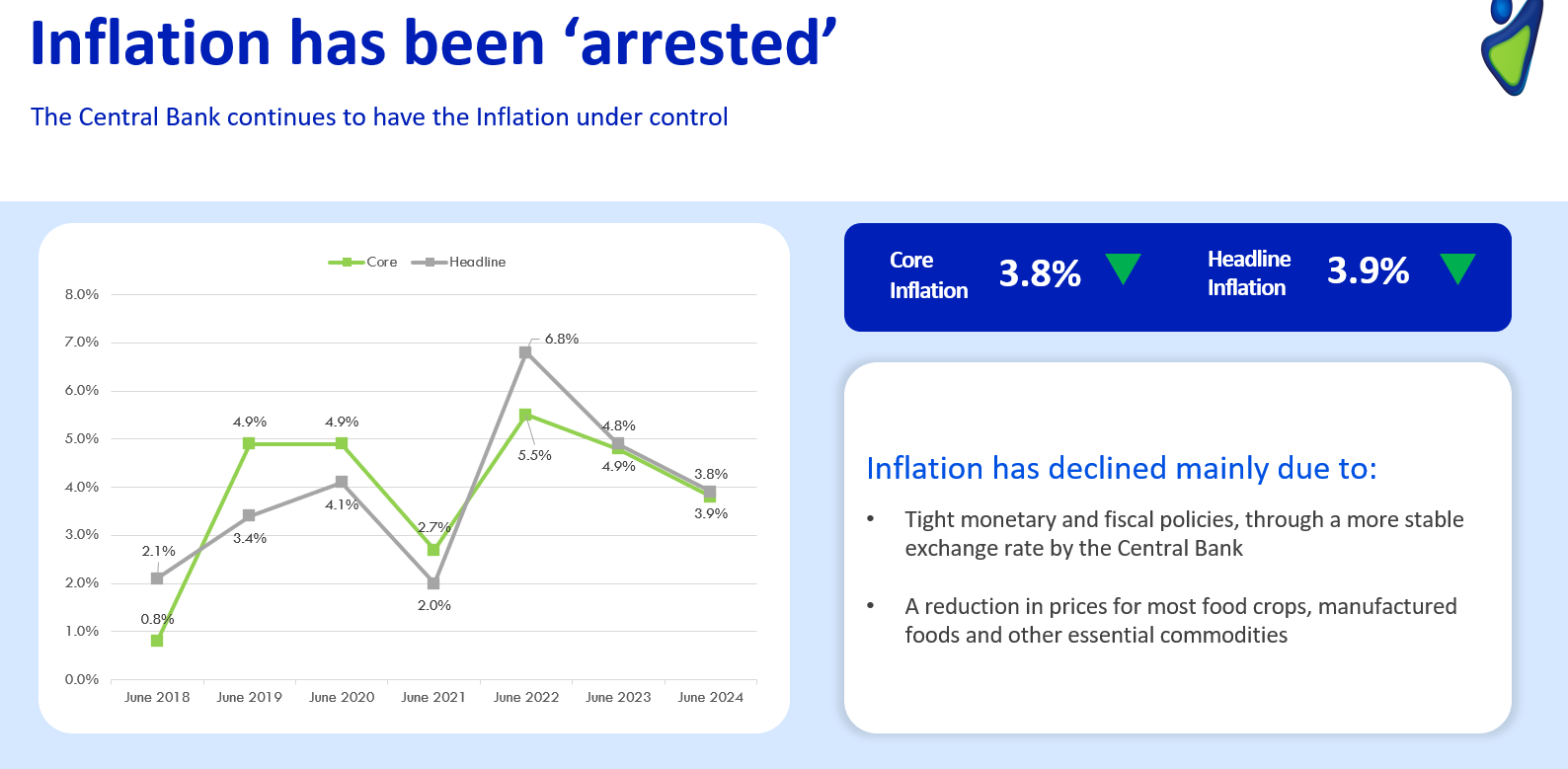

Graph showing Uganda’s core and headline inflation over the last 9 years.

Even in 2022, when inflation was so high, the bonds that were offered in that year had an 18% yield, which meant that the return protected the investor against inflation as their net real return was 10%, and now that inflation has cooled, they locked in a good rate for the long term, and they are celebrating to the bank. A real return of 10% per annum is incredible.

What is Inflation indeed?

Also, inflation is a misunderstood item. Person A has UGX 10 million to invest. They can invest it in any sector in Uganda. That investment product will be impacted by inflation. Whether you invest in land, rentals, business, or treasury bonds, inflation impacts us all the same.

As an investor, you have to make sure your return from that investment is higher than inflation by a big margin to be inflation-protected, something the bonds have and continue to do. With your rental return of UGX 8% when inflation is 5%, it means you get a real return of 3%.

ST - 4 “Then there are the various costs associated with bonds. For instance, they attract commission fees and a withholding tax; and because of the always-rising interest rates, bond investors oftentimes buy them at a premium: that is, above their face value. Besides, the bond market in Uganda is designed for the bondholder to benefit only when the bond market is soaring.”

True to the position he states, but which investment in Uganda doesn’t have associated costs, and where don’t you pay tax? Commission fees are as low as UGX 23,000 per bond auction for most banks; whether you are buying a bond of UGX 10 million or UGX 100 million, you just pay UGX 23,000 for the services the banks offer. Of withholding tax, which is a final tax to the investor, the treasury bonds have a final tax of 20% for bonds below 5 years and those of 10 years and above a final tax of 10%.

Real estate attracts around 12% tax on average, which means I’m paying less tax on bonds. Businesses even pay more tax than bond investors.

Of the premium payments, in the last 18 months, all bonds bought at the primary market have been at a clean price discount, not a premium, even with increasing interest rates. It’s in the secondary market that clients sometimes pay a premium, but even this, we are advising more investors to get advisors who can easily help them negotiate better deals to avoid paying unnecessary premiums.

ST -5 “On buying bonds, businesswoman and investment enthusiast Moreen Oyulu had this to say, “With bonds, once you invest money in them, you’ll not see that money until the maturity date; all you’ll get is the coupon, which is the interest you’ll have earned from the bond. In other words, if you needed that money for an emergency, you’ll not have access to it until the bond matures.”

This is a fully contradictory statement by the writer himself. At the top, he talked about the ability to sell the bond on the secondary market. Actually, the turnaround time for selling a bond on the secondary market and getting your money in the account is now just 24 hours. Even with an emergency, you can still sell. And the beautiful thing is, you don’t need to sell all of it. If you have a total bond portfolio of UGX 30 million and your emergency is UGX 2 million, you can just sell off only UGX 2 million and get your money in 24 hours, and the remaining UGX 28 million continues to make money for you.

Thank you for your explanations, you are a genius, your explanation silenses Kidamba. I totally agree with your explanations/writeups, experience and your smartness in this value investment. You have taught me alot on how to invest more and more in T-Bonds

God bless you Kakande

Thanks Alex.