CBR Rise Rocks Kenyan Economy: Bond Yields Surge, Lending Rates Soar, Investment Opportunities Arise

Kenyan Edition. December 11, 2023

For Kenyans with disposable funds, this is an opportune time to invest. With the attractive returns and yields on 1-year treasury bills and 2-year bonds exceeding 15%, it's worth considering allocating a larger portion of your investments towards government bonds.

Friends,

Last week, the Central Bank of Kenya (CBK) raised its Central Bank Rate (CBR) by 200 basis points to 12.5%. This move, taken against the backdrop of a significant depreciation of the Kenyan shilling against the US dollar, has far-reaching implications for the Kenyan economy and financial markets. In contrast, Uganda's stable CBR of 9.5% stands as a noteworthy comparison.

Impact on Bond Yields

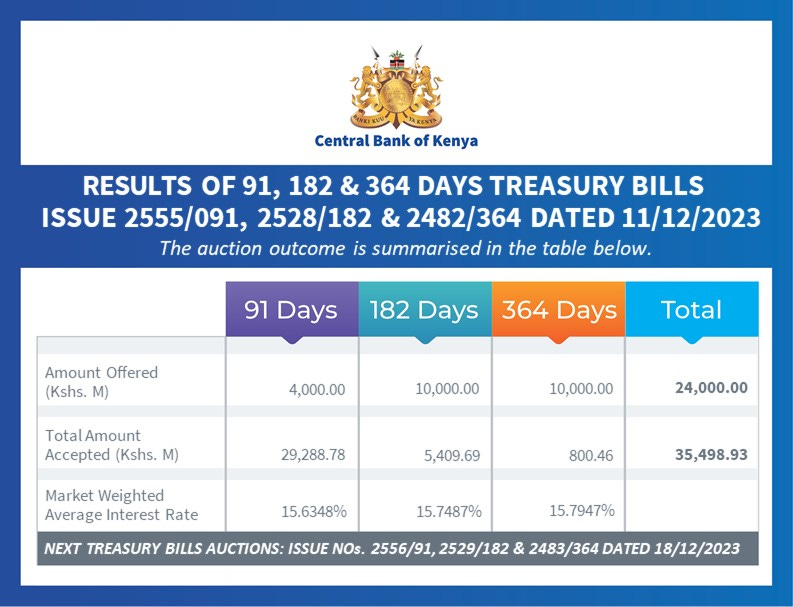

The CBR increase will directly impact Treasury bond yields in Kenya, making government bonds and treasury bills more attractive to investors. As of last week, the 364-day treasury bill yield has already reached around 15% and still expected to continue to rise in the near term. This rise in interest rates is causing the value of existing bonds to fall, a term known as mark-to-market adjustment.

Investors are likely to shift significant portions of their investable funds towards government bonds and bills, withdrawing them from other investments like the stock market. This could destabilize the stock market in the short term, as evidenced by the significant decline in stock prices of companies like KCB and Safaricom over the past year.

SAFARICOM PLC Market price per share over the last 2 years.

For my Ugandan Audience, Whereas the Kenyan Bonds are giving higher yields than Ugandan Bonds, consider the FX losses/gains at transaction period before you make that final decision to invest in Kenyan Bonds, especially if you earn and spend in Ugandan Shillings

Impact on Lending Rates

The CBR increase is bound to translate into higher lending rates for both individuals and businesses. This will make borrowing more expensive, potentially hindering investment and consumption activities. Leading banks like Equity Bank Kenya have already announced that their prime lending rates will rise to over 17.56%.

Furthermore, with the higher returns on government bonds, banks may be inclined to lend to the government rather than to consumers or businesses, significantly limiting private sector credit growth. This will be a challenging time for businesses in Kenya, as their cost of capital, particularly for those relying on debt, will increase significantly, particularly in the context of a dollar shortage.

An Investment Opportunity

For Kenyans with disposable funds, this is an opportune time to invest. With the attractive returns and yields on 1-year treasury bills and 2-year bonds exceeding 15%, it's worth considering allocating a larger portion of your investments towards government bonds. These bonds are currently offering some of the highest returns in the economy. This level of returns was last seen in Kenyan bonds over 10 years ago.

The 10 Year Kenyan Treasury Bond Yield currently at 17.88%

If you enjoyed this letter, please consider sharing it with your friends and families,

I hope you have a great week and potentially invest in Uganda’s Capital Markets

Alex Kakande

+256 771 404 377

How can a private Ugandan investor participate in the Kenyan bond market?