Friends,

If you are not currently invested in the treasury bond market, especially if you have liquidity and cash either in the bank or on hand, you are missing out on a rare opportunity that occurs once every three years. Treasury bonds are extremely cheap right now, and every purchase you make is almost guaranteed to be at a discount.

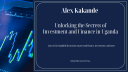

With interest rates rising steadily, those who are fully invested are making money. Today's auction has been no exception, as evidenced by the results. Most notably, the three-year treasury bond has crossed 16.5% for the first time in over four years, the ten-year bond has crossed 17%, and the twenty-year bond has crossed 17.8% for the first time in over three years.

To illustrate, Uganda’s 20-year Treasury bond yield development over the last two years has shown significant movement. Rates kicked off around 16% two and a half years ago, rising to around 17% before dropping back to 16.5%. now, it’s showing signs of reaching 18% on the horizon.

This is a prime time for Ugandans to invest in bonds, especially given the high interest rates. Learning from Kenya's recent experience can provide valuable insights.

To illustrate, Kenya’s 20-year Treasury bond has shown a significant curve over the last year. Rates increased from 14% to touch 17.5% before dropping in the last four months to the current 14.5%.

A year ago, the Kenyan economy was undergoing a severe crisis that experts say began to manifest in early 2023. The government was financially strained, revenue targets were not being met, and the new Presidency was mired in corruption scandals that eroded public confidence.

Additionally, the Euro Bond due in June 2024 was approaching with no realistic repayment plan in sight. The IMF was still negotiating debt relief, and the exchange rate of KES to USD was depreciating at an unprecedented rate. The economy was struggling, prompting the Central Bank of Kenya to increase its CBR rate by over 200 basis points—a move not seen since the early 2010s—which caused borrowing costs to skyrocket.

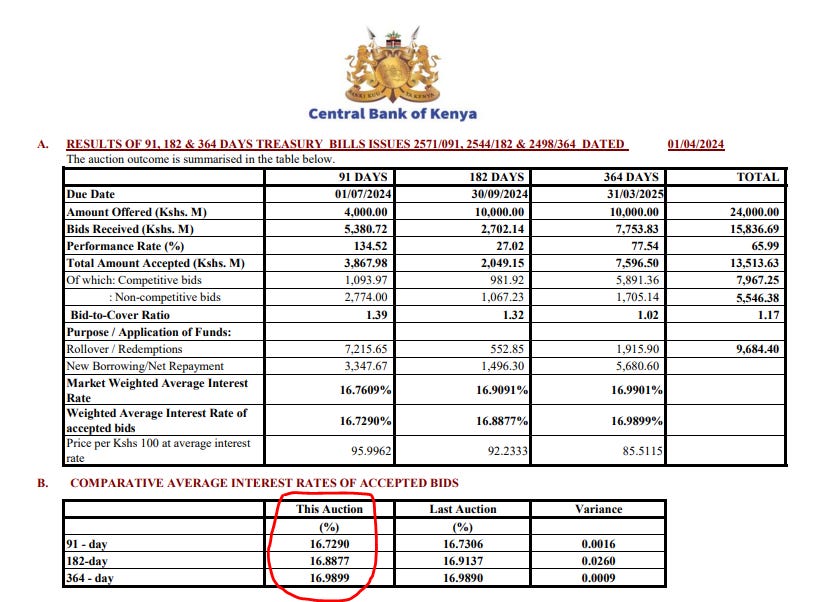

However, investors in the fixed income markets were reaping significant benefits as bond market yields soared to as high as 18%. In January 2024, the government issued an infrastructure bond, exempt from tax, at a market-weighted rate of 17.5%. Those who bet on the government's ability to navigate the crisis and invested in government securities were making substantial gains.

Treasury bills with a one-year maturity were yielding up to 16%, and the cost of short-term borrowing for the government reached an all-time high. Money Market funds in Kenya were posting annualized yields as high as 17%, attracting more customers to the Kenyan investment markets.

Between January and May, it was an opportune time to be an investor in the Kenyan fixed income market. These high returns left many Ugandans envious, as their yields of 15-16% seemed comparatively small. Many Ugandan investors sought to enter the Kenyan market, often without fully assessing the FX risks associated with cross-border investments. Kenya’s treasury bonds and bills were exceptionally attractive, comparable to a rare, beautiful flower.

Auction yield in January 2024 showing an 18.3% yield on Kenya’s Treasury Bond

In February 2024, the Kenyan government issued a new long-term Dollar Euro Bond that was oversubscribed, indicating renewed investor confidence and reduced fears of a sovereign default. The proceeds from the new bond were used to pay off some of the expiring Euro Bond. As the country's exchange rate began to stabilize, the IMF sent a substantial cheque in June 2024 to help settle the remaining expiring debt, despite ongoing GenZ demonstrations due to political pressures.

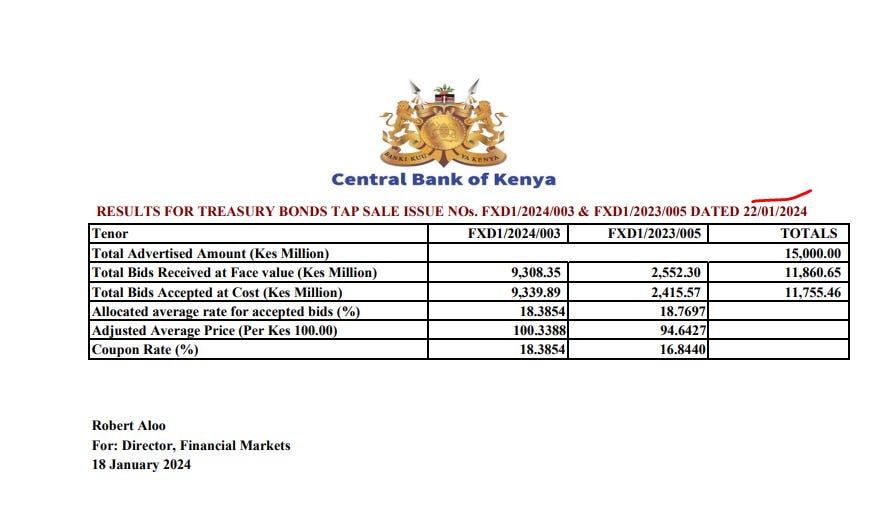

Investors tracking the fixed income markets began to notice a cooling trend, realizing that the government had avoided a sovereign default. David Ndii was publicly boasting, perhaps aware of the significant achievement. By July 2024, the Central Bank of Kenya started cutting the central bank rate, and bond yields began to fall, though not as quickly as the government had hoped due to high political risk not accounted for in their calculations.

Fast forward to December, the CBR had been cut by 75 basis points in the latest monetary policy statement.

Monetary policy statement issued on December 5, 2024 by Central Bank of Kenya.

Observers noted that bond yields had decreased from highs of 18% to the current 15% for long-term bonds, and from 16% to 10%-11% for short-term bills. It is expected that rate cuts and market cooling will continue in the coming months. Those entering the market now might not achieve the same high returns as those who invested during the peak of the crisis. As the saying goes, "time in the market is better than timing the market." Investors who took the risk between November and May 2024 have seen substantial rewards.

Comparatively, in Uganda, the yield curves have inverted by January, with Kenyan long-term bond yields decreasing to potentially 14%, while Ugandan yields are rising. With political pressures anticipated in 2025, Ugandan yields might surpass the recent 17.5%. This presents a unique opportunity for Ugandan investors to capitalize on the high yields in their own market, without the risks associated with cross-border investments. Investing in Ugandan treasury bonds now could lead to substantial returns, similar to the gains seen by Kenyan investors during their economic crisis.

Ugandan 10 year treasury bond - trading at 17% and shooting for the moon.

While the Kenyan 10 year bond takes a nosedive.

Very insightful. How can i learn more about investments and the capital market