Building Dreams: Assessing Loan and Save & Build Options for Future Homeowners

Nest Uganda

Friends,

Despite the growing inclusivity in the real estate industry in Uganda, it is still largely favored by men compared to women. Today, I am proud to share the planning journey of Ms. Pumla Nabachwa for a construction project.

Inspired by a friend who constructed their home through NEST Uganda’s Save & Build program, she reached out during the planning stage of her journey, seeking a company that could assist with supervision, given her 9-to-5 job, which makes time availability challenging. She was also informed that she could access a flexible payment plan if she opted for a loan.

Budgeting Process

Estimated cost from the NEST Uganda architectural team:

Budget: UGX 210 million

Assessing Financial Options

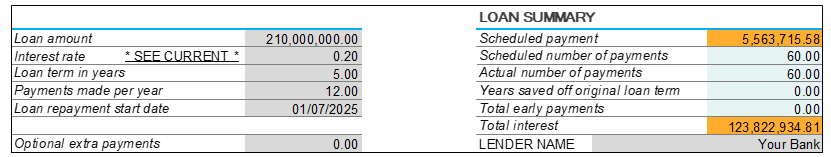

Construction Loan (Mortgage) Payment Period: 5 Years

To meet the cost with a bank loan, there are several factors to consider. First, the monthly payment would be approximately UGX 5.5 million. If she is eligible, we then look at the interest rate, which totals UGX 123 million over the loan period. For those taking out mortgages, I hope the banks are sharing these figures before issuing the loan. In this case, the loan interest is fixed; however, most banks offer floating rates on mortgages (construction loans), meaning the interest rate will increase if the market rate rises.Save & Build Plan - 5 Years

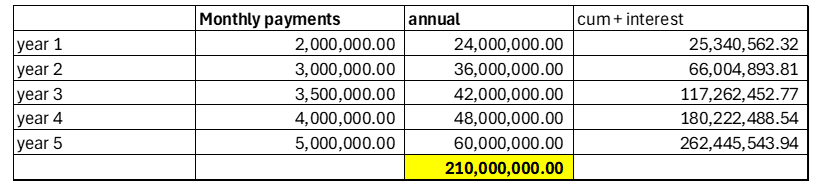

With a Save & Build plan, the budget is divided into monthly payments, and each payment earns interest from a unit trust account, helping to grow her building fund. This specific plan is structured to allow for incremental payments over time. This creates flexibility, enabling one to start with whatever portion of their income they can afford and increase installments as their income grows.

My Professional Opinion

Loans are not inherently negative, as they are often the most accessible option for acquiring important assets such as real estate property. However, the interest charged due to current loan rates and the length of repayment can make them unrealistically expensive. In this case, the interest of UGX 123 million represents over 50% of the loan amount borrowed.

The second, and perhaps most overlooked, risk is the potential loss of property due to layoffs. Recent layoffs from USAID and other donor-funded programs have painfully illustrated how unreliable employment income can be. Now, imagine having paid millions in interest for your property, only to have the bank foreclose on it due to a loss of employment.

My advice is to consider acquiring a home only if you can secure a subsidized loan rate (10%) or if you can afford to repay it within a period of less than two years (24 months); otherwise, it may not make financial sense. Alternatively, you can plan your payments and invest in a unit trust account to generate interest, allowing you to build stress-free with the Save & Build option provided by NEST Uganda.

If you want to learn more about the Save & Build option, I have attached a link to a video that further explains this option: Save & Build Video. Otherwise, you can reach out directly on WhatsApp at 0709757168 for more information.