Friends.

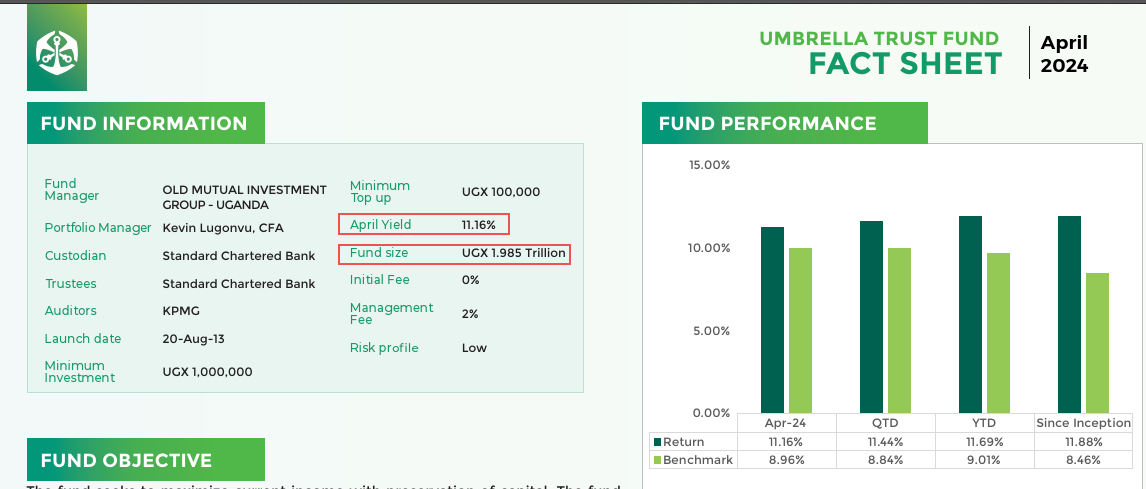

Old Mutual's total investments have soared beyond the 2 trillion Ugandan Shilling (UGX) milestone. This remarkable achievement is attributed to an exceptional month of April, during which the company added over 200 billion UGX in new investment funds from both new and existing clients.

The driving force behind this success is primarily the UGX umbrella Unit Trust fund, which experienced a surge of approximately 140 billion UGX in April 2024 alone. Additionally, there was a notable increase in investments within the dollar fund.

The impressive performance of these funds is largely due to the attractive yields they offer to investors.

For instance, the umbrella Unit Trust fund provided an annualized yield of 11.16% for the UGX Investors, while the dollar Unit Trust fund offered a yield of 5.08%.

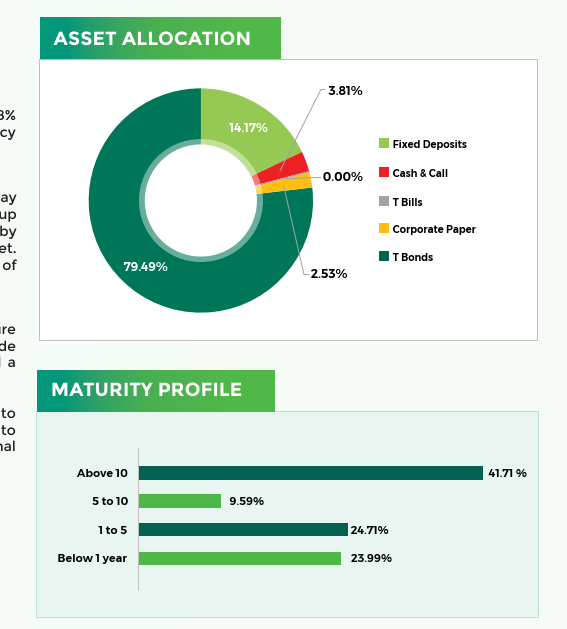

Old Mutual, as the preeminent fund manager, continues to dominate the market, achieving unparalleled milestones and delivering robust returns to its investors. The company prudently invests its funds, particularly in long-term treasury bonds, to maximize financial returns for its members.

Other funds have also shown significant growth; the money market fund reported an annualized yield of 11%, which propelled its growth to 8 billion UGX. Similarly, the balanced fund increased to 4.6 billion UGX.

This accomplishment is a testament to the vitality of the entire capital markets industry and the collective investment sector. It also marks a triumph for all those with an interest in investments, as one of the most influential entities in collective investment surpasses the 2 trillion UGX threshold.

Should Old Mutual manage to sustain this growth rate, adding over 200 billion UGX monthly until December, it is poised to become the first fund manager to reach the 3 trillion UGX mark in assets and investments.

This would significantly propel the collective investment market toward even greater milestones, such as the 3 trillion and 4 trillion UGX marks, setting the stage for more ambitious achievements in the forthcoming months.

Congratulations are in order for the entire Old Mutual Investments team, including the finance sales staff, marketing personnel, and top leadership, for their exceptional performance in recent months and especially in April.

This year alone, the unbeatable returns, averaging 11%, are a clear indication of the growing confidence in the market, the company, and its leadership.

I remember you sharing about the 1.8Trn and clearly saying 2Trn mark would soon be hit.

This is testament to the fact that people are embracing alternative investments like Unit Trust funds.

The key drivers are:

1. Continuous financial education.

2. UTs are tax-exempt.

3. UTs offer liquidity.

4. UTs are flexible.

CMA and many other people pushing this financial education including yourself continue to do a good job. This is a combined effort and the 121,000 people that CMA CEO said are investing will also increase since she said, we have barely scratched the surface.

Owning appreciating assets like this is a sure win in a tight economy where inflation is now at 10.25% and with an 11% return UTs still offer way better than savings accounts whose money value get's eroded by inflation.

"If you don't find a way to make money while you sleep," says Warren Bufffet, "You will work until you die."

This also reminds of a saying from a man called cheruiyotkb says, "You can be fired from you job but you can't be fired from your assets."

Keep investing in appreciating assets.

Thank you Alex for this message.

Blessings