Treasury Bond Investments. Understanding the scope, especially the primary and secondary markets, is essential. The Bank of Uganda conducts auctions on these markets, and being conversant with how it operates can maximize yields on your investments.

This article will help show the differences between the primary and secondary markets and educate you on the proper forms to fill, either CDS form 2 or 4.

Primary Market Auction by Bank Of Uganda

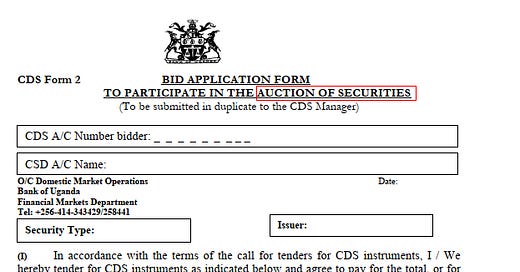

The primary market is where new securities are issued for the first time or existing securities are re-opened by Bank of Uganda. The Bank of Uganda (BOU), once every month, conducts auctions in this marketplace. Here, you get to purchase government bonds directly from the BOU. However, investors should keep in mind that to participate in the primary market auctions held by the BOU, one must fill out CDS Form 2.

CDS Form 2 is exclusive to the primary market, and it should only be filled by those planning to directly invest in this market. Paying attention to this detail can help investors avoid unnecessary complications during the investment process.

Secondary Market

On the other hand, the secondary market allows you to purchase bonds from sellers who initially bought them in the primary market. This involves primarily commercial banks or other sellers. These transactions occur daily, so investors have the freedom to engage in bond transactions whenever they wish.

Now, just as CDS Form 2 is for the primary market, CDS Form 4 is meant for the secondary market. This form allows investors to conduct safe and secure purchase transactions, ensuring that they adhere to the rules and regulations governing the secondary bond market.

Understanding The Difference

It's crucial for every investor to understand that each form (CDS Form 2 and CDS Form 4) is tailored to serve its designated market. Misusing these forms can lead to confusion, errors, and unnecessary delays in your investment journey.

Conclusion

As an investor in Uganda, understanding the difference between these two forms and when to fill each is an essential part of your investment journey. Filling in the correct form can, without a doubt, save you from a lot of headaches involved in misunderstanding which part of the market you are venturing into.

Happy Investing and a Happy 2024 to everyone.

Kakande Alex.

Thank you so much for this. It answered a question I asked under a previous article concerning how one can know when bonds are on sale.

Thanks.

Would love to know more about the pros and cons of each market, the conditions, the cost comparisons, investment limits if any. That would be helpful