Friends,

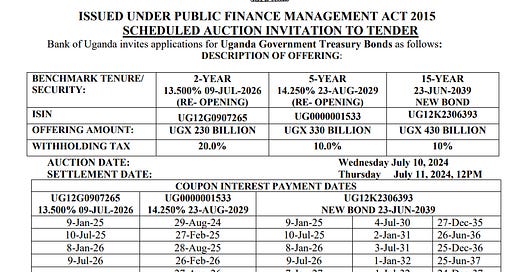

The Bank of Uganda has announced the call for bid applications for next week's treasury bond auction. The upcoming bid notification includes three bonds: the 2-year bond with CUSIP UG12G0907265, the 5-year bond with CUSIP UG0000001533, and the newly launched 15-year Treasury Bond with CUSIP UG12K2306393.

In contrast, in previous years, the Bank of Uganda primarily auctioned two tenors of treasury bonds: one for the medium term (2, 3, and 5-year bonds) and one for the long term (10, 15, 20-year bonds). In the next week's auction, they will offer three tenor treasury bonds: two for the medium term (2 and 5-year treasury bonds) and one for the long term (15-year bond).

Another notable difference from the previous month's auction is the amount the Bank of Uganda (Government of Uganda) aims to raise. Previously, when calling for two bonds, the goal was to raise a total of UGX 550 billion in applications. In this round, with three bonds, the Bank of Uganda is looking to raise approximately UGX 990 billion or close to one trillion UGX.

This raises the question: Is this the new trend where the Government of Uganda aims to raise nearly 1 trillion UGX from the primary market in almost every auction? This is only for the July auction, and if 1 trillion UGX becomes the norm, we are yet to see how this will affect interest rates. This becomes a significant amount of money that the government will attempt to raise each month from domestic bond auctions.

It is crucial to remember and understand the implications of what we observed in June 2024 when the Uganda National budget was released. It was noted that the government plans to borrow up to 28 trillion UGX from the domestic market, either through new financing or the redemption of bonds and bills.

This July auction will provide an indication of the government's appetite and how much they are willing to raise to fund the Ugandan budget from the Domestic Market. This is significant because, in this week alone, the government has already raised close to 800 billion UGX in the treasury bill auction that occurred yesterday on July 3rd.

If they plan to raise nearly 1 trillion UGX in treasury bonds next week and another 500 billion UGX in treasury bills in two weeks, we are looking at the government raising close to 2.5 trillion UGX from domestic market alone in the Month of July alone. With such a high appetite, we can only wait to see the impact on interest rates, both for investors and borrowing rates. This means that banks, especially the primary dealer banks tasked with raising as much money as possible for the government, will have to lend to the government, potentially diverting funds from the private market.

This month marks the beginning of how the approved 72 trillion UGX budget will be funded. At 2.5 trillion UGX per month, this aligns with the government's indication that it may need to raise through domestic financing mechanisms. It's going to be an interesting year for investors and borrowers alike.

Our focus is on the new 15-year treasury bond maturing in 2039, which will be introduced to the market next week with the CUSIP UG12K2306393. Unfortunately, for those interested in investing in this bond, the Bank of Uganda has not yet disclosed its coupon rate in the bid application notification.

We will have to wait until after next week's auction results to learn its coupon rate and indicative interest rate. However, based on previous experience with 10, 15, and 20-year treasury bonds, where interest rates were 16% and above in the primary market, we can project that the interest rates on the new 15-year treasury bond will likely be within the current range of 16% to 16.5%.

for those planning to invest, it is crucial to fill out the correct CSD forms (CSD Form 2) to ensure that the banks submit your bids in time for next week's auction.