To what extent will the aggressive tightening of the monetary policy help address the UGX/USD FX Challenges and slow down inflation?

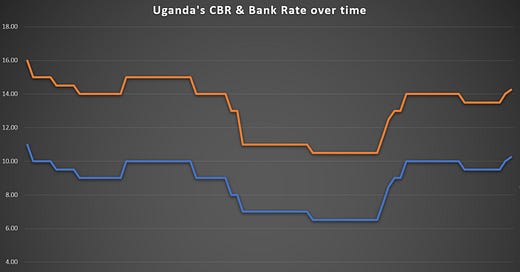

Yesterday, the Bank of Uganda announced an increase in the Central Bank Rate (CBR) to 10.25%. This surge will subsequently result in the Bank Rate climbing to around 14.25% - the second monthly rise in a row. The bank's tactics to control inflation while stabilizing the suddenly depreciating Ugandan Shilling against the US Dollar are evident.

Two years ago, in April 2022, the CBR stood at 6.5%, with the Bank Rate around 10.5%. This indicates an increment of over 57% in the CBR within 24 months, signifying the highest rate since May 2017 - a peak unseen in over six years.

This rate increase adversely impacts borrowers from commercial banks who can expect lending rates to escalate. For instance, in March 2024, when the Bank of Uganda declared an increase from 9.5% to 10% (50 basis point), the average prime lending rate rose from 17.32% to roughly 18.09% (77 Basis points), raising the question of what the lending rate will be at the end of April 2024, moving into May 2024.

For those already with floating interest rate bank loans, you may soon receive a notice from your bank repricing your outstanding amount and potentially updating your payment amount for each term.

The growing concern is how businesses can sustain themselves in an environment where credit capital is escalating to as high as 20%.

If borrowing isn't urgently required or an absolute necessity, my advice would be to delay that borrowing plan until the economy eases up.

At the same time, this period, which is likely to result in costly borrowing, demands a revisit to your saving strategies. Particularly for those who are storing money in a bank account that yields merely 2%-3%. Notice the widening gap between the prime lending rates for commercial banks' loans versus the interest on deposit received from your savings. It's a perfect time to ensure that your money is working for you, not merely remaining idle, especially in these challenging times.

Does increasing CBR has any impact on treasury securities?

Thanks mr. Alex Kakande